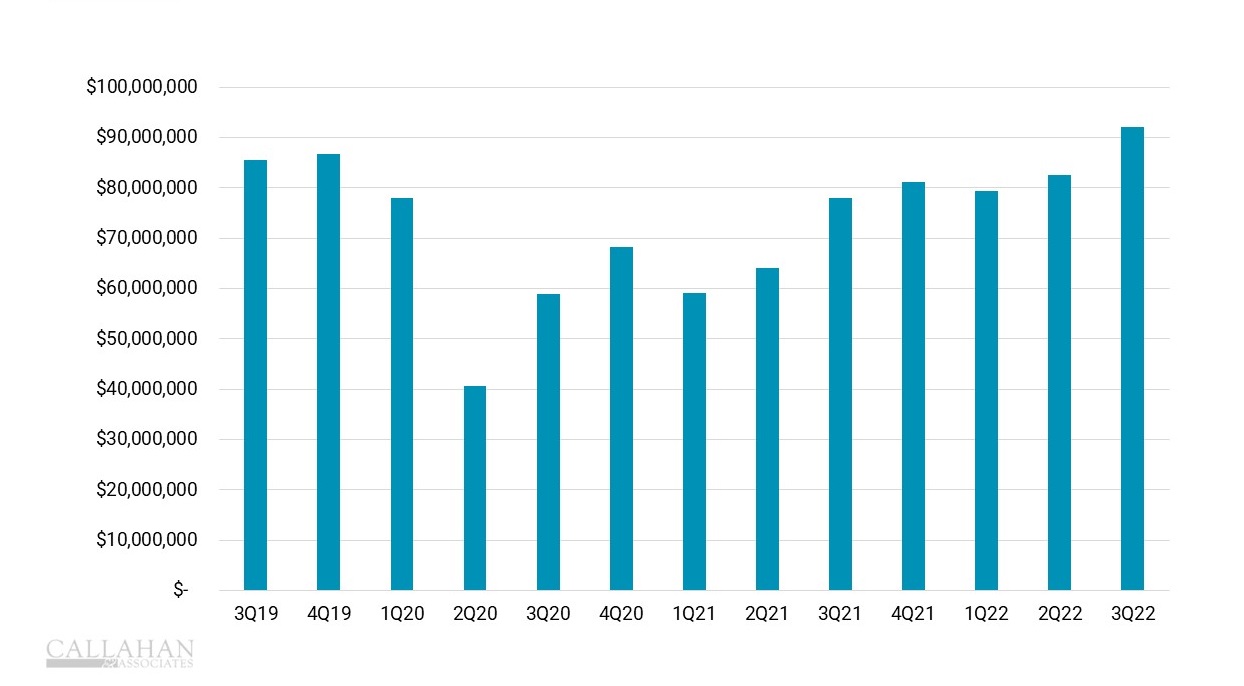

QUARTERLY NSF AND OVERDRAFT FEES

FOR NII-PARTICIPATING CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

- Credit union members overdrafted their accounts more frequently in the third quarter of 2022, as rising prices and tighter budgets made it more difficult to make ends meet. Overdrafts declined during the pandemic thanks to reduced consumer spending and government stimulus efforts that boosted account balances.

- Credit unions that participated in Callahan & Associates’ non-interest income study reported an 18.1% year-over-year increase in NSF and overdraft fees as of Sept. 30, 2022.

- Not surprisingly, the consumer savings rate also was lower in September, with Americans saving just 2.4% of their discretionary income. That’s down from 7.9% one year earlier.

- Members of credit unions in the Callahan study paid an average of $24 in NSF and overdraft fees year-to-date, up $4 from the same period the year prior.

- NSF and overdraft fees accounted for exactly half of fees collected through Sept. 30, 2022, making it the largest category of fees that members pay.

Want VIP Access To NII Data Sets?

Callahan & Associates’ non-interest income program allows credit unions to monitor industry trends, dive into historical data, anticipate future performance, compare performance against others, and develop informed strategies to improve revenue. Contact Callahan to learn more and ask how you can participate.