Top-Level Takeaways

-

In line with increases in the credit union workforce, both physical branches and digital touchpoints grew at financial cooperatives nationwide through 2019.

-

Operation models and efficiency will continue to change through 2020 as more employees adapt to remote work and brick-and-mortar branches face loss in foot traffic.

Retail banking across the world, including at credit unions, will see effects and changes brought about due to the coronavirus pandemic. With the loss in foot traffic to physical locations and increased remote work, institutions with well built-out digital channels can continue to provide value and financial resources to their membership.

At year-end 2019, before the pandemic hit, brick-and-mortar branches were continuing to grow at credit unions nationwide. Total branch counts increased by 113 over the past year to 21,225 as of December. Coinciding with branch growth, total employee counts also expanded. Total full-time equivalent employees (full-time + part-time) increased 3.6% year-over-year to 316,335. As of December, credit unions nationwide employed 304,247 full-time and 24,176 part-time employees.

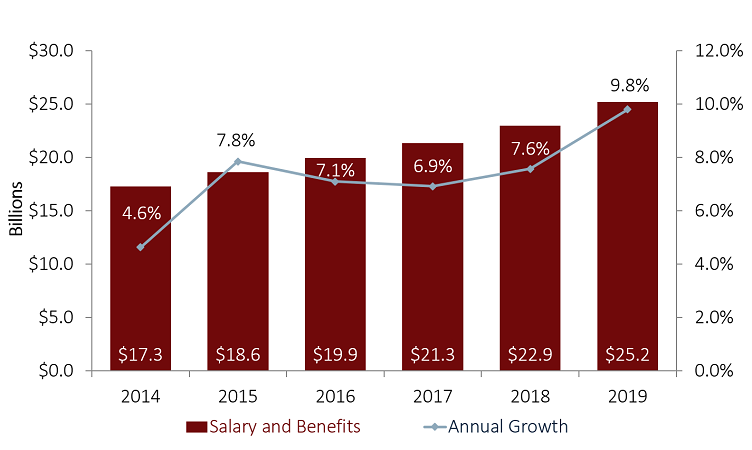

Growing branch and employee counts have resulted in increased operating expenses. Salary and benefits, which account for 51.4% of total operating expenses at credit unions nationwide, increased 9.8% year-over-year.

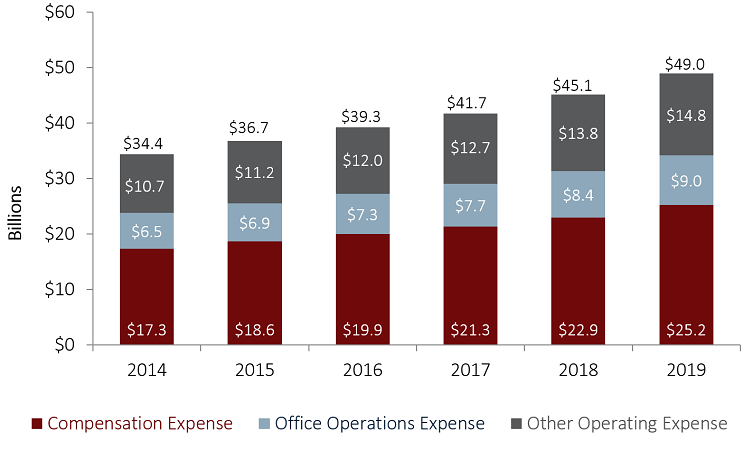

In line with increasing branch counts and growing technology offerings around the country, office operation expenses increased 7.7% annually to $9.0 billion at year-end 2019. These expenditures account for 18.4% of total operating expense, the second largest portion behind employee compensation.

Fewer Institutions, Increased Retail Delivery

Credit unions, like other financial institutions, have consolidated and used scale to offer membership increased resources. Despite fewer institutions, however, credit unions have grown membership touchpoints. Credit unions nationwide reported sustained growth in branches, employee counts, and electronic delivery channels.

Over the past five years, the number of credit unions operating in the U.S. was down from 6,402 at year-end 2014 to 5,349 at the end of the decade. Over the same period, credit union branch counts were up 460, employee counts were up 55,393, and total membership was up 21.3 million.

At the end of 2019, credit unions nationwide provided financial services for 121.8 million members. That’s just more than 21.1% above the 100.5 million members reported at year-end 2014. This growth in members, employees, and branches has coincided with increased digital channel offerings.

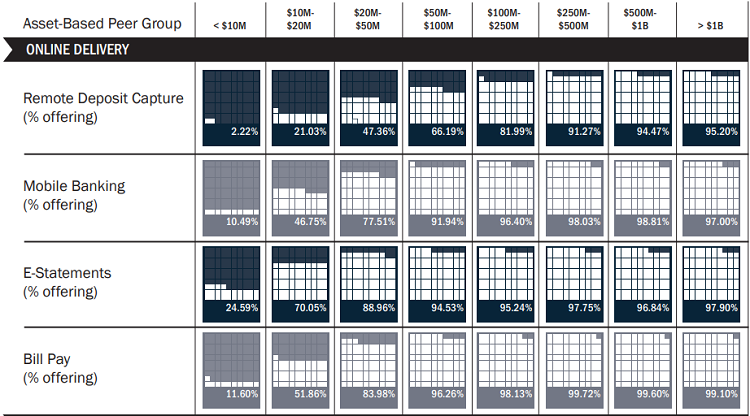

DELIVERY CHANNEL DEPLOYMENT BY ASSET CLASS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The large majority of credit unions over $20 million in assets offer mobile banking and remote check deposits.

In the fourth quarter of 2019, 2,552 credit unions, representing 47.7% of the industry, offered remote deposit capture (RDC). That’s up from 2,398 (43.7%) at year-end 2018. This is depressed by the large number of smaller credit unions that do not offer RDC. The proportion of credit unions offering the service is directly correlated their asset size.

Evidently, only 2.2% of the 1,354 cooperatives under $10 million and 21.0% of the 661 credit unions between $10 million and $20 million offer RDC services. Larger credit unions, like those above $1 billion in assets, however, are far more likely to offer RDC; 95.2% of credit unions in this asset band offer remote deposit capture.

Mobile banking and electronic bill pay also continue to grow as credit unions continue to expand their retail delivery offerings. In the fourth quarter of 2019, 1,730 credit unions offered both bill payment and mobile banking, up from 1,611 at the same time last year. Recent developments regarding the novel coronavirus will incentivize credit unions to implement and develop remote driven retail strategies to continue member engagement and support.

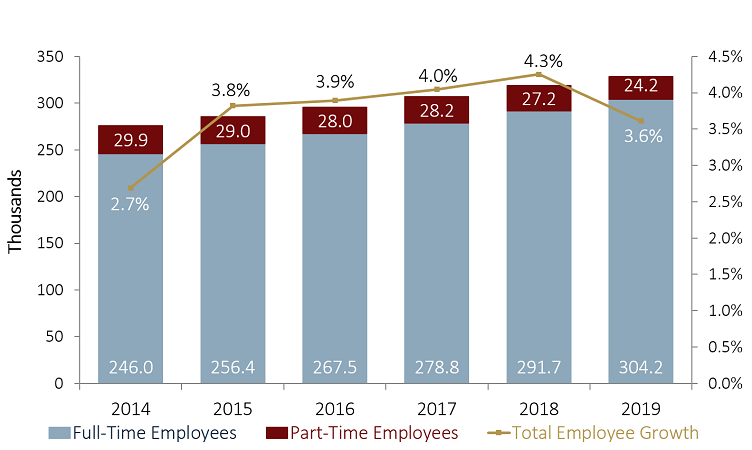

Operating Costs And Employee Counts

As of December 2019, FTE counts were 316,335 nationwide, up 3.6% year-over-year. Broken out, the number of part-time employees decreased 11.1% year-over-year while the number of full-time employees increased 4.3% as credit unions nationwide revise their staffing models and favor full-time employment in lieu of part-time.

Corresponding with gains in full-time equivalent employees, credit unions across the industry reported increased compensation, which makes up 51.4% of total operating expense as of the fourth quarter.

Total compensation rose 9.8% year-over-year to $25.2 billion through December 2019 resulting in total operating expense up 8.6% to $49.0 billion. On average, full-time equivalent (FTE) employees were paid $79,636 over the last 12 months, up 6.0% year-over-year.

TOTAL BRANCHES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The total number of credit union branches in the United States has grown by 460 over the past five years.

FT & PT EMPLOYEES AND ANNUAL TOTAL EMPLOYEE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

U.S. credit unions added 11,023 FTEs over the past year, a 3.6% growth rate. Broken out, full-time employment increased 4.3% year-over-year, while part-time employment decreased 11.1%.

TOTAL COMPENSATION AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Total salary and benefits rose nearly 10% in 2019, reaching $25.2 billion among the nation’s 5,349 credit unions at year-end.

TOTAL OPERATING EXPENSE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Office operating expenses were up 7.7% in 2019 but the impact of remote work as a result of COVID-19 may change that in the quarters ahead.

As credit unions invested in talent, employees returned more value to the credit union. The average revenue generated per dollar spent on salary and benefits increased 4 cents over the past 12 months to $3.28 at year-end. On average, every full-time equivalent employee generated $261,295 in annual revenue, up $17,587 year-over-year.

COVID-19 has forced a large portion of employees to work from remote locations in an effort to fight the spread of the infection. This may result in downward pressure on both employee growth and operating expenses. In the fourth quarter, office operating expenses accounted for 18.4% of total operating expense. At $9.0 billion as of the fourth quarter, these expenses increased 7.7% from the year prior.

As physical relationships grow distant, credit unions are further developing digital touchpoints to continue to provide financial solutions to their members beyond a brick-and-mortar experience. This, coupled with accumulated talent over the previous expansionary period, should position credit unions well in the current circumstances and beyond.