Since March of 2021, inflation has consistently outpaced salary growth for most U.S. workers. That changed in March of 2023; however, it’s been difficult for many Americans to build a cushion of savings. According to data from the Federal Reserve, Americans saved just 4.8% of their income in the first quarter of 2023, well below historic norms. Financial institutions need deposits to fund lending programs, and interest paid on these deposits has increased as institutions compete for a limited amount of dollars. Those unable to attract enough deposits are borrowing funds from places such as the Federal Home Loan Bank, and the associated costs put further pressure on net interest margins.

Credit Union Key Points

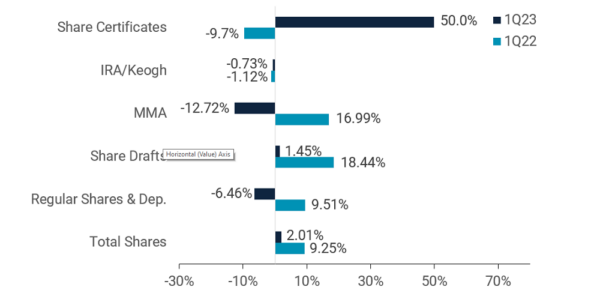

- Total share balances were up 2.0% since the first quarter of 2022, the lowest annual growth on record. Share certificates — up 50.0% annually — drove much of this growth. Core draft and savings balances declined 3.6%.

- Borrowings were also a popular path to source funds, with balances up 121.1% year-over-year. Borrowing liabilities now fund 4.7% of assets, the most since 2009.

- Members received $4.7 billion in dividends in the first quarter as credit unions used rate promotions to attract liquidity. Between dividends and borrowing, the cost of funds increased 60 basis points quarter-over-quarter to 1.17%.

- Uninsured deposits accounted for 8.5% of total credit union deposits, well below the value of 41.1% for banks. Members of credit unions are better protected than bank customers, an important psychological dynamic.

How Do Your Shares Compare?

Claim Your Custom Scorecard Today

Performance At-A-Glance

ANNUAL SHARE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

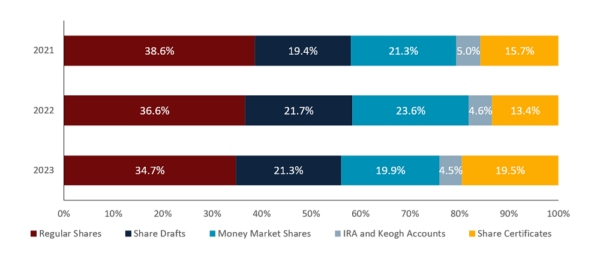

SHARE PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

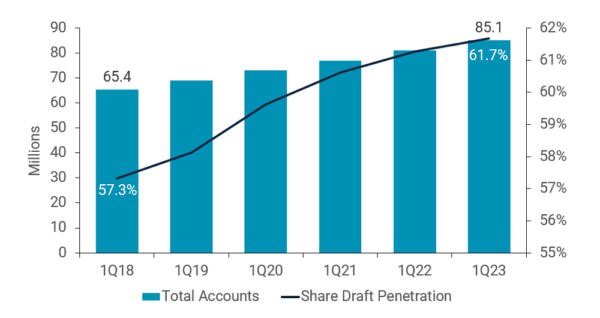

SHARE DRAFTS AND PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

The Bottom Line

Liquidity was the dominant storyline for financial institutions in early 2023, and credit unions were no exception. The industrywide loan-to-share ratio was higher than 80%, and credit unions are converting cash balances to loan balances at record rates, leaving a limited funding runway to cover future lending and withdrawals. Cooperatives are turning to creative avenues to source new funds — including certificate promotions and third-party borrowings — but these are expensive and often unreliable. As long as members struggle to save, liquidity challenges are likely to persist. With inflation still cutting into paychecks, financial education around budgeting is more important than ever for members as well as the cooperative.

This data originally appeared in Credit Union Strategy & Performance. Contact Callahan & Associates to learn how you can gain access today.