Changing interest rates in the past year have tilted share deposits in dramatic ways.

Share growth has essentially stalled at an industrywide level and has actually dropped at smaller institutions. Despite the decrease, smaller credit unions have been able to continue lending using available shares. At the nation’s largest credit unions, liquidity remains a top concern.

Still, share certificates offer a bright spot in the share portfolio. As members move their money from liquid deposits to share certificates in an effort to take advantage of rising rates and combat economic uncertainty, share certificate popularity has hit a 16-year high.

A look at total versus median share growth, changes in share balances by product, and certificate maturity trends highlight the ways deposits have changed in recent quarters and years.

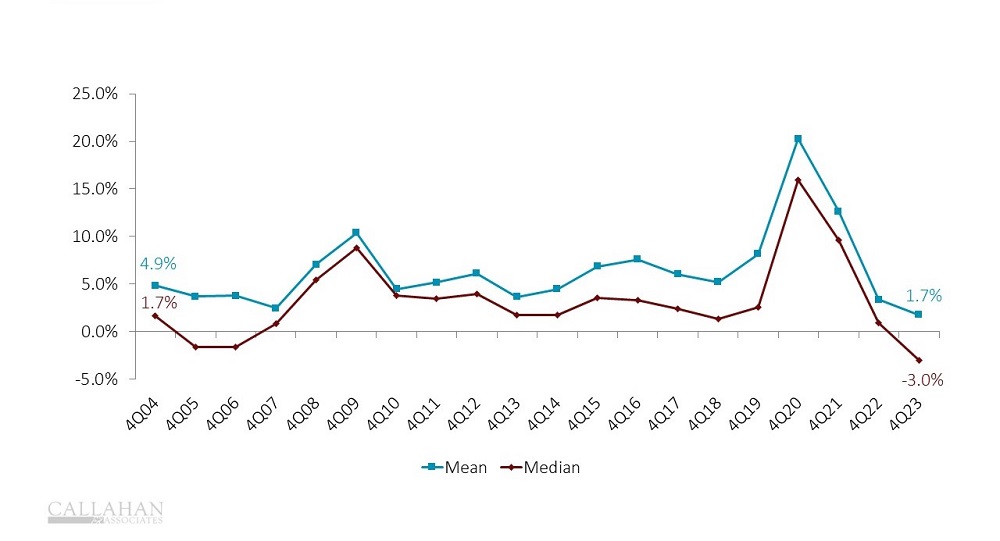

TOTAL VS. MEDIAN SHARE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- Shares grew 1.7% year-over-year across the credit union industry. That’s the weakest growth credit unions have reported in a decade. Unfortunately, even that positive growth at the industry level masks a startling trend: share growth declined 3.0% at the median credit union. Share balances actually decreased at two-thirds of credit unions.

- The decrease in share growth coupled with the continued increase in loan growth has pinched liquidity at America’s credit unions. With personal savings rates continuing to tick near record lows, this downward trend is likely to continue into 2024.

Are you using data to fuel strategic decisions? Callahan’s Peer Suite empowers credit union leaders to make informed, data-back decisions without wrestling with complex, manual processes. Benchmark against the peer groups your choose, automate your KPIs every quarter, and kickstart your journey to success. Request A Demo

3-MONTH SHARE CHANGE BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- Liquid deposits have flowed out of credit unions in the past year; share certificates, however, have grown. This is not surprising, considering share certificates yield higher interest and are a popular share type in high-rate environments. Currently, share certificates are the only share type offering significant net inflow.

- Share certificate popularity is at a 16-year high. With economic uncertainty and rising prices, credit union members view certificates as a way to make their dollar last longer. As such, they are moving their shares from liquid deposits to certificates.

- Credit unions also prefer share certificates. When they reprice core deposits, they have to reprice all core deposits. Higher priced certificates, however, mature and move off the balance sheet.

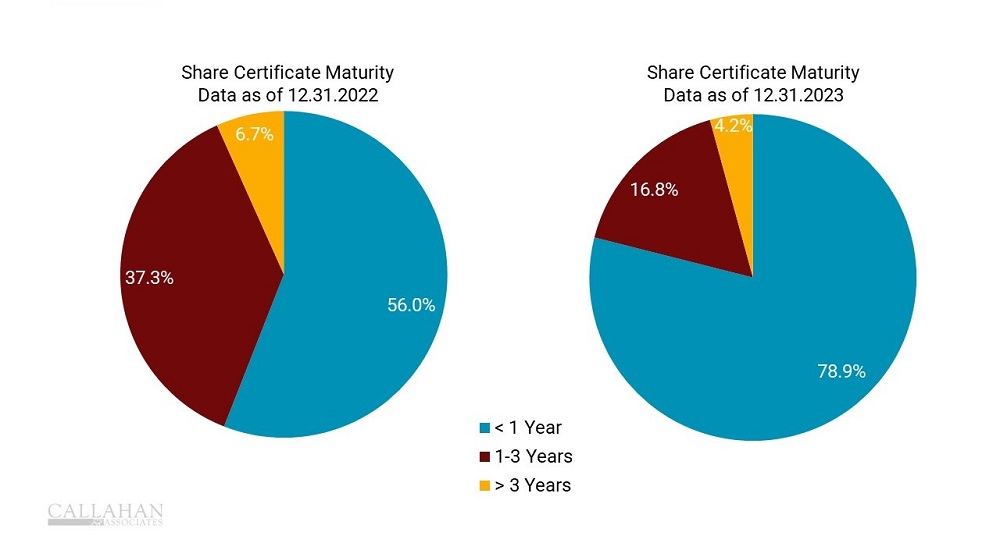

SHARE CERTIFICATE MATURITY

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- In response to share certificate growth, credit unions have tweaked the duration they offer. In the past, credit unions have sold longer-term share certificates to lock in liquidity. As interest rates increased, credit unions were incentivized to sell shorter duration certificates in anticipation of rate cuts. Shorter duration certificates reprice more quickly, offering more flexibility and leaving credit unions on the hook for the higher rate for only a limited time. This is especially desirable in a quickly changing rate environment.

Credit union performance data for this article comes from Callahan’s quarterly Trendwatch webinar, which includes Call Report data from 99% of all industry assets. Watch Trendwatch 2023 today on-demand.