After nearly five years of economic disruptions courtesy of the COVID-19 pandemic, the economy has finally steadied. GDP has grown 3.0% in the past year, inflation has cooled, and unemployment is historically normal at 4.1%. For all intents and purposes, the economy has normalized.

Whether the current status quo is “good,” however, depends on perspective.

The University of Michigan’s Consumer Sentiment Index fell to 68.2 from 79.0 at the beginning of the year. Although the economy is improving on paper, pessimism abounds. This mismatch between the country’s economic performance and Americans’ outlook on it has even spawned a new term — the “vibe-cession.”

In the second quarter, the Consumer Price Index — a common measure of inflation based on the cost of a typical basket of goods — rose 3.0% year-over-year. Although this marked a general easing of inflation from nearly 9.0% in 2022, it still is a percentage point higher than the Federal Reserve’s target rate. For the American consumer, this means more expensive trips to the grocery store, higher prices at the gas pump, elevated housing costs, and a paycheck stretched paper-thin.

Since inflation started creeping up in 2021, so, too, have assistive loans such as credit cards and HELOCs at credit unions. Americans are relying on these revolving lines of credit to supplement income shortfalls and cover higher expenses. Credit card balances were up 7.1% annually at midyear and other real estate loans, mainly HELOCs, grew 20.8%.

These trends reflect the economic stress Americans are under, and responsible, non-predatory credit union products are helping members in need.

But it’s not just household products that are on the rise. Housing prices have increased, too.

HOUSING AFFORDABILITY

FOR U.S. HOMES | DATA AS OF 06.30.24

SOURCE: National Association of Realtors

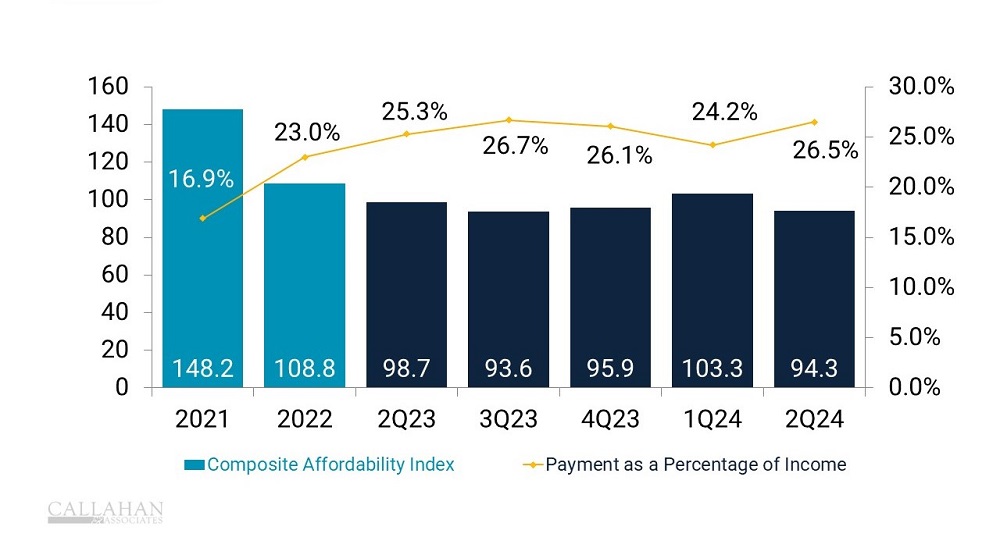

According to the National Association of Realtors, housing affordability has slumped to an indexed score of 94.3 at midyear. By comparison, the index stood at 148.2 when interest rates were near zero in 2021. Since then, the median price of a single-family home has grown from $357,100 to $422,100, and the average mortgage rate has shot up from 3.01% to 6.95%. Likewise, the qualifying income for a mortgage has grown from $57,888 to $108,600, dampening the dreams of hopeful homebuyers.

Unaffordable housing coupled with reduced supply and pinched liquidity has hollowed out the market for first mortgages. Owning a home is a key component of the American Dream, and current unaffordability is contributing to poor consumer sentiment.

Data from the United Way provides further insight into the degradation of consumer outlook.

The United Way of Northern New Jersey started tracking ALICE data — the acronym stands for Asset Limited, Income Constrained, and Employed — in 2009 to better understand the struggles of families who work but are unable to afford basic necessities. Today, ALICE data is a key measure of economic vitality in the United States, offering insight into why consumer sentiment might be detached from top-level economic fundamentals.

Community financial institutions need an accurate understanding of financial hardships and local needs to develop effective solutions. Learn more in “What Can ALICE Do For You?”

In 2022, the United Way reported that of the 129 million households in the United States, 29% met ALICE criteria. That is more than 37 million households across the country struggling to make ends meet amid high prices at the supermarket and in the housing market.

U.S. economic data might look OK overall, but wealthier segments of the population skew these traditional indicators, which, in turn, fail to accurately reflect the fiscal reality many lower-income citizens face today.

ALICE ESSENTIALS VS. CPI

FOR U.S. CONSUMERS | DATA AS OF 06.30.24

SOURCE: United For ALICE

According to the United Way, ALICE data presents a comprehensive, unbiased picture of the financial hardship faced by many Americans who suffer a mismatch between what they earn and the cost of survival. ALICE serves as a useful proxy for the type of American credit unions serve, including working and middle-class individuals as well as low-income and underserved communities.

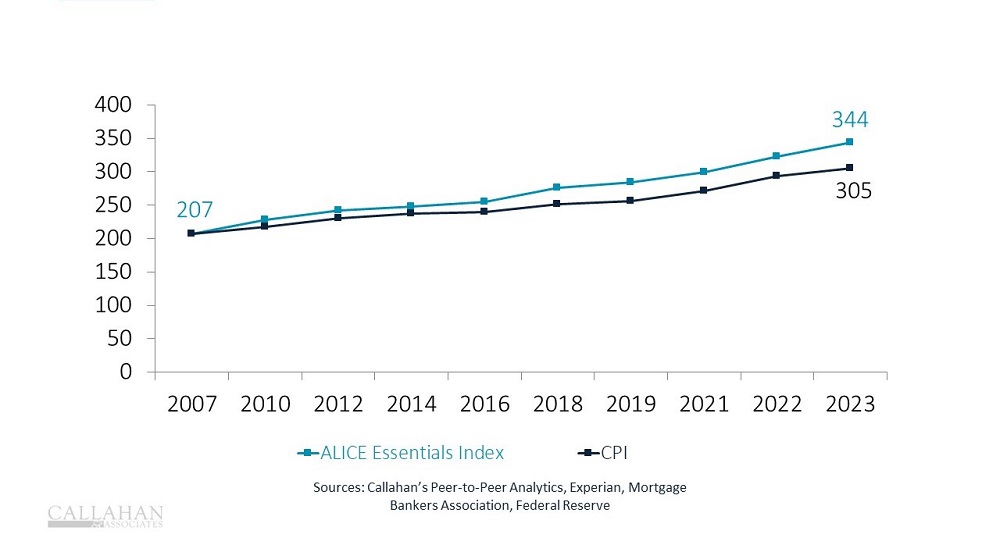

United Way’s ALICE Essentials Index calculates how the costs of household essentials vital to ALICE households have changed over time. Since the COVID-19 pandemic, and even before, the measure has outpaced standard CPI. In the past two years, inflation for ALICE households increased 7.3%, compared to the 6.1% felt by the average American.

Typical measures of inflation show even the average American has a pinched budget, but the impact is even more acute for folks lower on the socioeconomic spectrum.

Deepen Your Credit Union’s Impact With Help From Callahan The national economy might be strong, but members are still looking for ways to shore up their personal finances. Peer-based performance data from Callahan & Associates enables credit union leaders to identify new opportunities to support members and strengthen the institution. A free 1:1 performance analysis with Callahan helps leaders gain deeper insights into their credit union’s standings. Request a session today.