OPPORTUNITY TO LEARN AND GROW AT WORK

ALL U.S. WORKERS| DATA AS OF 2024

© Callahan & Associates | CreditUnions.com

Source: GALLUP.COM.

- Credit unions have reported significant balance sheet growth the past several years — assets increased 4.4% in 2023 alone. If they want to continue on this growth trajectory, however, credit unions must keep providing superior service. To do that, credit union employees must learn and grow in their capacity to meet new member needs.

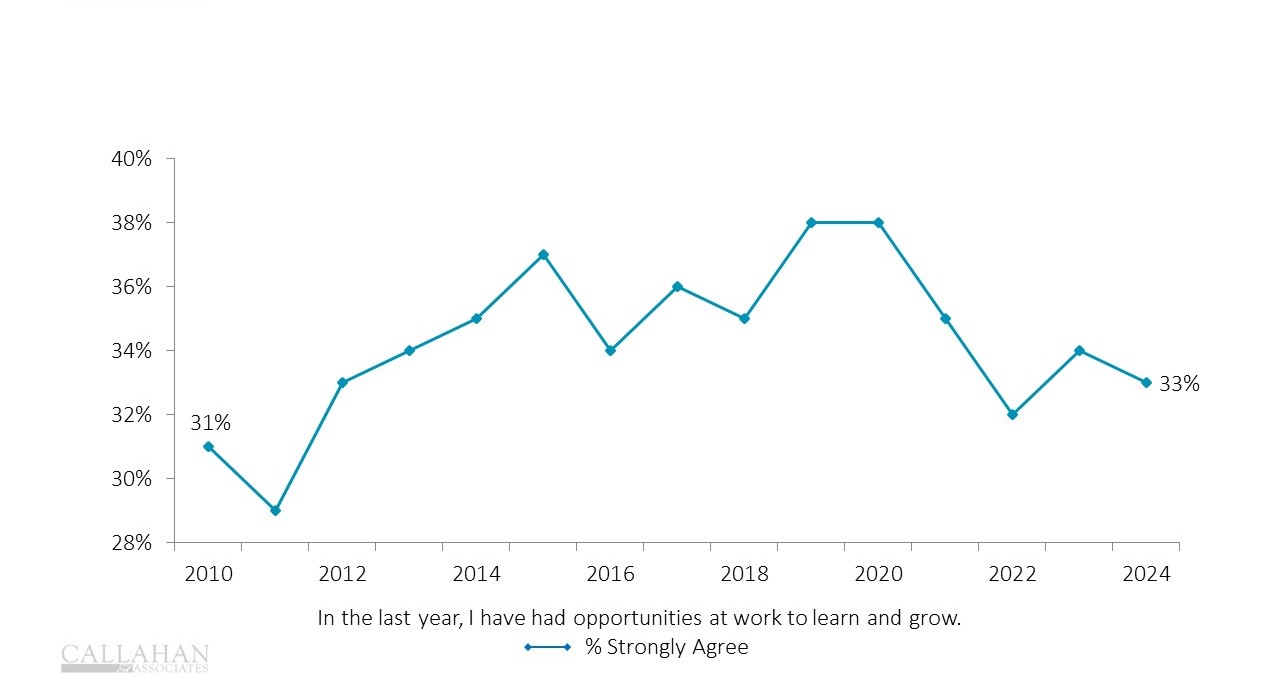

- Enabling employment growth is crucial for the overall success of any organization. According to a 2022 Gallup poll, only 33% of employees strongly agree that they have had ample opportunities to learn and grow (see graph above). This raises the question: What can credit unions do to better encourage the professional development of their employees?

- The same Gallup poll showed only 33% of U.S. employees strongly agreed that they feel connected to their job’s mission. As member-owned cooperatives, credit unions can put mission first and use that clarity of purpose to foster deeper connections with staff members.

- Plenty of credit unions understand that investing in their employees also benefits their members — take care of employees and they take care of members. Unfortunately, the 2022 Gallup study also found only 32% of U.S. employees feel supported in their professional development at work.

- Professional development is a crucial element in a credit union’s efforts to provide consistent, top-quality service even as membership grows. On average, every credit union employee serves 400 members. That’s a 15-member increase from five years ago. This growth presents the opportunity for credit union employees to learn and grow in their roles.

- Salary and benefits per full-time employee at U.S. credit unions increased 5.8% annually in 2023, outpacing the average rate of inflation. For some workers, this boost in pay offers sufficient validation and incentive to stay. For others, compensation might not be the primary driver of satisfaction. For these employees, credit unions must think strategically about benefits that address employee wants and how to partner with employees to meet common goals.

Transformative Strategies For Member Financial Wellbeing

Embark on a journey towards member empowerment and financial prosperity with an innovative program crafted by Callahan & Associates and Gallup. Discover how this dynamic program can drive meaningful engagement and elevate your credit union’s impact.

LEARN MORE