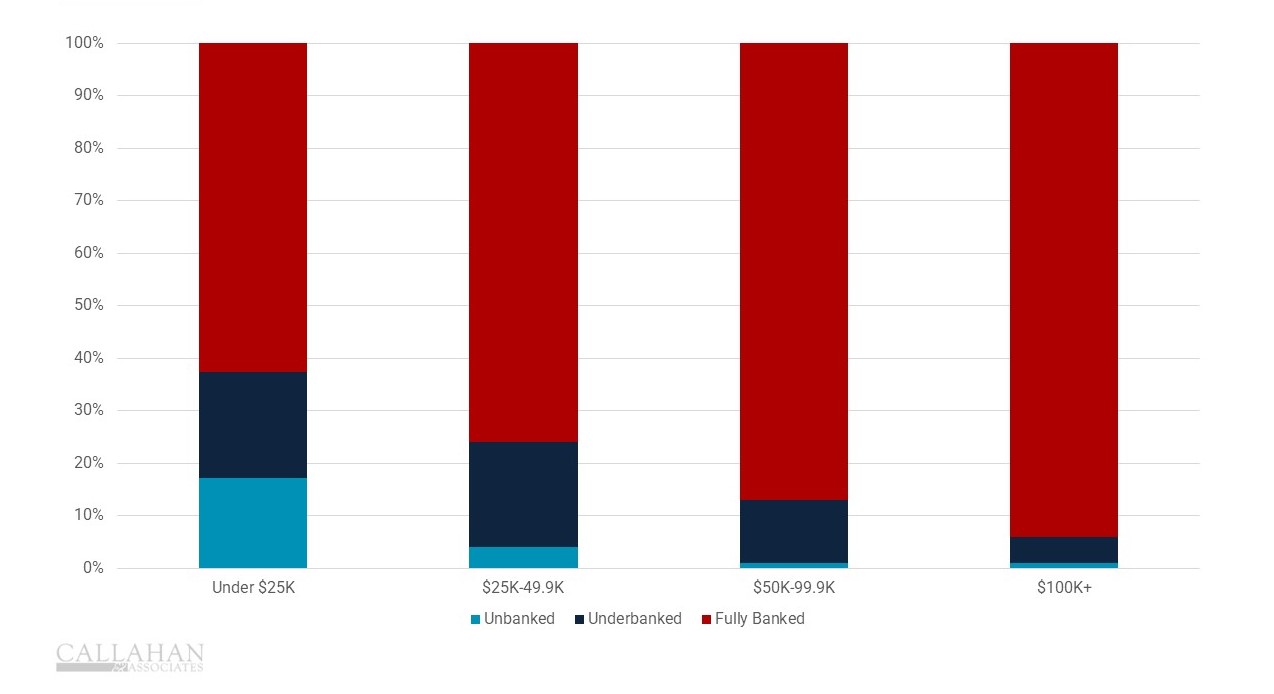

CONSUMER BANKING RELATIONSHIPS BY INCOME BRACKET

FOR 11,965 U.S. CONSUMERS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

- A report from the Federal Reserve shows credit unions and others are making progress in their efforts to reduce the number of un- and underbanked consumers. The report — dated 2022 but reflecting 2021 data — shows a clear correlation between income, education, and banking status. The overall figures are largely unchanged from 2020 and 2021, but the number of unbanked consumers has dropped by 7% since 2015.

- That seven-point decline does not reflect improvements in financial inclusion, the report notes. Rather, a decline in the usage of alternative financial services might have resulted in an uptick in usage of nonbank products that are more difficult to track, according to the Fed.

- For those with banking accounts, overdrafts remain a concern. Sixteen percent of consumers with incomes below $50,000 paid overdraft fees in 2021, along with 10% of those with incomes from $50,000 to $99,999, and 5% of those making $100,000 or more.

- Thirty-eight percent of adults applied for credit, but more than one-quarter of those applicants say they were either denied credit or approved for less than needed (although that figure is a three-point decline from one year prior). Applicants with lower incomes were denied credit more frequently than those bringing home $100,000 per year or more. Black consumers had the highest levels of decline, regardless of income.

How Do You Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

SCHEDULE YOUR PEER DEMO