What does community impact mean? After all, credit unions can’t effectively measure the movement’s impact on the communities it serves without first agreeing on a common definition.

Callahan & Associates is speaking with credit unions and asking that question. In our work collecting data for the 2020 Impact Framework, we’ve learned the answer is, on the surface, complicated.

But dig deeper, and we must ask: Is it really?

We hope there is consensus that measuring community impact involves measuring a credit union’s ability to execute on its mission or live its values. But how any one credit union does that can, and should, vary depending on the individual institution and the needs of the community it serves. Missions and values differ; therefore, so will their impact.

That’s why when Callahan selected community-oriented metrics for its inaugural impact measurement survey, we concentrated on process rather than focus.

Some credit unions donate directly to the community, others prefer to work through their charitable foundations. For the credit unions that participated in Callahan’s impact survey, priorities varied depending on each one’s distinct member-focused priorities.

Generally, larger credit unions tend to give back to their community through a foundation. Will a larger data set in 2021 tell a different story? Click to view larger size.

Questions as to what constitutes an underserved area or member tends to generate a lot of questions for and about guidance, especially when it comes to commercial lending.

According to the Consumer Financial Protection Bureau, underserved means a local community, neighborhood, or rural district that is an investment area and is underserved by other depository institutions. The CFPB provides a tool that allows credit unions to use an address to check the status of properties for loans extending back to 2014. Check that out here.

The NCUA provides application guidance for expanding service to an underserved area. Its guidance aligns with the CFPB and is available on the administration’s website. Check that out here.

As to how the CFPB identifies investment areas, its ultimate guidance can be found on the CFPB website under the final rule for Truth in Lending (Regulation Z); Determining Underserved Areas Using Home Mortgage Disclosure Act Data:

The Bureau produces annually a list of rural and underserved counties and areas that is used in applying various Regulation Z provisions, such as the exemption from the requirement to establish an escrow account for a higher-priced mortgage loan and the ability to originate balloon-payment qualified mortgages. Regulation Z states that an area is underserved during a calendar year if, according to Home Mortgage Disclosure Act (HMDA) data for the preceding calendar year, it is a county in which no more than two creditors extended covered transactions, as defined in Regulation Z, secured by first liens on properties in the county five or more times. The official commentary provides an interpretation relating to this standard that refers to certain data elements from the previous version of the Bureau’s Regulation C, which implements HMDA, that were modified or eliminated in the 2015 amendments to Regulation C. The Bureau is issuing this interpretive rule to supersede that now outdated interpretation, specifically by describing the HMDA data that will instead be used in determining that an area is underserved.

Also, per the NCUA, If your credit union makes at least one first-lien mortgage loan secured by a property located in a rural or underserved area during 2019, it qualifies as a creditor operating in a rural or underserved area during 2020, and for loan applications received before April 1, 2021.

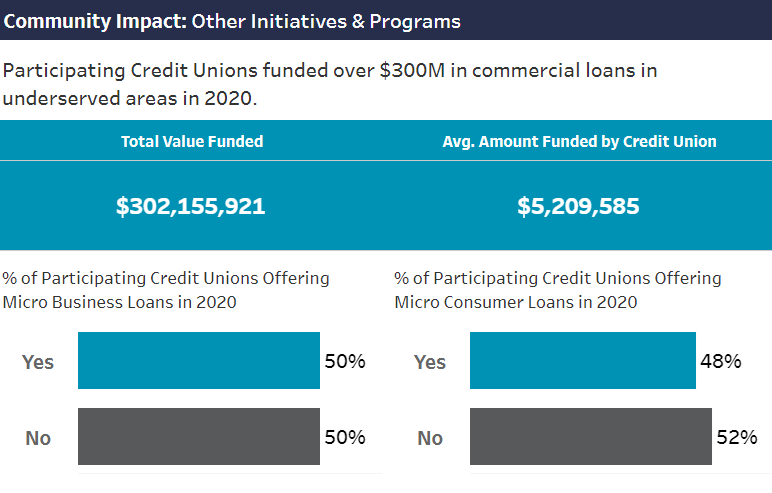

Callahan data shows lending to underserved communities is an area credit unions are exploring in their community impact journey.

As the movement looks forward to 2022 and Callahan prepares to launch its outreach soliciting data for the 2021 Impact Framework, it’s important to keep in mind the most important takeaway isn’t the findings themselves but the questions and conversations they inspire along the way.

If you have thoughts on our next evolution of community impact measurement, please comment below or email impact@callahan.com.

Want more stories of credit union impact? CreditUnions.com has them! Click here to see a selection of stories that highlight strategies, initiatives, products, and services of credit unions making a positive impact for the members and communities they serve.

What Is Community Impact? Callahan Has The Data.

What does community impact mean? After all, credit unions can’t effectively measure the movement’s impact on the communities it serves without first agreeing on a common definition.

Callahan & Associates is speaking with credit unions and asking that question. In our work collecting data for the 2020 Impact Framework, we’ve learned the answer is, on the surface, complicated.

But dig deeper, and we must ask: Is it really?

We hope there is consensus that measuring community impact involves measuring a credit union’s ability to execute on its mission or live its values. But how any one credit union does that can, and should, vary depending on the individual institution and the needs of the community it serves. Missions and values differ; therefore, so will their impact.

That’s why when Callahan selected community-oriented metrics for its inaugural impact measurement survey, we concentrated on process rather than focus.

Some credit unions donate directly to the community, others prefer to work through their charitable foundations. For the credit unions that participated in Callahan’s impact survey, priorities varied depending on each one’s distinct member-focused priorities.

Generally, larger credit unions tend to give back to their community through a foundation. Will a larger data set in 2021 tell a different story? Click to view larger size.

Questions as to what constitutes an underserved area or member tends to generate a lot of questions for and about guidance, especially when it comes to commercial lending.

According to the Consumer Financial Protection Bureau, underserved means a local community, neighborhood, or rural district that is an investment area and is underserved by other depository institutions. The CFPB provides a tool that allows credit unions to use an address to check the status of properties for loans extending back to 2014. Check that out here.

The NCUA provides application guidance for expanding service to an underserved area. Its guidance aligns with the CFPB and is available on the administration’s website. Check that out here.

As to how the CFPB identifies investment areas, its ultimate guidance can be found on the CFPB website under the final rule for Truth in Lending (Regulation Z); Determining Underserved Areas Using Home Mortgage Disclosure Act Data:

The Bureau produces annually a list of rural and underserved counties and areas that is used in applying various Regulation Z provisions, such as the exemption from the requirement to establish an escrow account for a higher-priced mortgage loan and the ability to originate balloon-payment qualified mortgages. Regulation Z states that an area is underserved during a calendar year if, according to Home Mortgage Disclosure Act (HMDA) data for the preceding calendar year, it is a county in which no more than two creditors extended covered transactions, as defined in Regulation Z, secured by first liens on properties in the county five or more times. The official commentary provides an interpretation relating to this standard that refers to certain data elements from the previous version of the Bureau’s Regulation C, which implements HMDA, that were modified or eliminated in the 2015 amendments to Regulation C. The Bureau is issuing this interpretive rule to supersede that now outdated interpretation, specifically by describing the HMDA data that will instead be used in determining that an area is underserved.

Also, per the NCUA, If your credit union makes at least one first-lien mortgage loan secured by a property located in a rural or underserved area during 2019, it qualifies as a creditor operating in a rural or underserved area during 2020, and for loan applications received before April 1, 2021.

Callahan data shows lending to underserved communities is an area credit unions are exploring in their community impact journey.

As the movement looks forward to 2022 and Callahan prepares to launch its outreach soliciting data for the 2021 Impact Framework, it’s important to keep in mind the most important takeaway isn’t the findings themselves but the questions and conversations they inspire along the way.

If you have thoughts on our next evolution of community impact measurement, please comment below or email impact@callahan.com.

Want more stories of credit union impact? CreditUnions.com has them! Click here to see a selection of stories that highlight strategies, initiatives, products, and services of credit unions making a positive impact for the members and communities they serve.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

A New Product Playbook Is Driving Change At Premier Credit Union

Meet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Keep Reading

Related Posts

When Members Don’t Turn To FIs, They Turn To Friends And Family

Credit Union Data Predicts Who Will Win Super Bowl 2026

140 Million Reasons To Lend

Meet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Callahan & AssociatesWhen Members Don’t Turn To FIs, They Turn To Friends And Family

Andrew LepczykA Small Match Builds Big Emergency Savings At Lake Trust

Aaron PassmanView all posts in:

More on: