The archive of CreditUnions.com is filled with stories about the different ways credit unions have met members where they are fulfilling needs and serving those left out or living on the periphery of the traditional financial system. These stories are inspiring and, at first glance, might appear unrelated. But they all underscore the efforts credit unions across the country are making to have a positive, demonstrable impact on the people and communities they serve.

When Callahan & Associates designed its 2020 Impact Framework, choosing which metrics to include to reflect member impact was by far the most challenging. We chose to focus on several key areas that impact how well members are able to live, including building savings, buying a home for the first time, living in environmentally impacted areas, and navigating life without a traditional social security number.

In addition to these metrics, we blended in data that focuses on the services credit unions provide all members regardless of circumstance.

Since rolling out the Impact Framework, we’ve discovered that although credit unions vary quite a bit on the types of products they offer to meet the needs of their members, as a group, the industry is prioritizing education around every type of need. This speaks to a powerful mission in the industry to serve as a guide while empowering members to take the reins of their own financial future.

Of the credit unions Callahan surveyed, financial literacy is a strong priority. In addition to offering general counseling in various areas of finance, these credit unions also offered a variety of topical education. This supports what we know: Credit unions meet their members where they are, taking action to educate and support them when they need it as well as how they need it.

The graphs below offer a snapshot into the insights Callahan gleaned from the 2020 Impact Framework. As we look forward to our 2021 data collection, however, 2020 results raise some questions. Are these the right metrics? How would you evolve the framework to provide more relevant trends? How would you evolve this dataset if you could? Would you measure differently?

As you review the results below, please consider joining the impact community and providing feedback. Every individual cooperative and the movement as a whole is stronger together.

Callahan’s impact initiative empowers credit unions to articulate their value through a mission-focused lens with the help of new metrics and best practices. The Impact Network is growing every day. Join the network today and help evolve the credit union story.

The majority of credit unions that participated in Callahan’s 2020 Impact Framework track and counsel first-time homebuyers.

The types of products credit unions offer vary based on distinct member needs. Credit unions that participated in Callahan’s 2020 Impact Framework reported a clear focus on building and maintaining credit within their membership.

Evidence of member-centric product design is clear in the specific types of accounts credit unions offer. Credit unions that participated in Callahan’s 2020 Impact Framework reported offering products such as overdraft protection, payday loans, and secured credit cards.

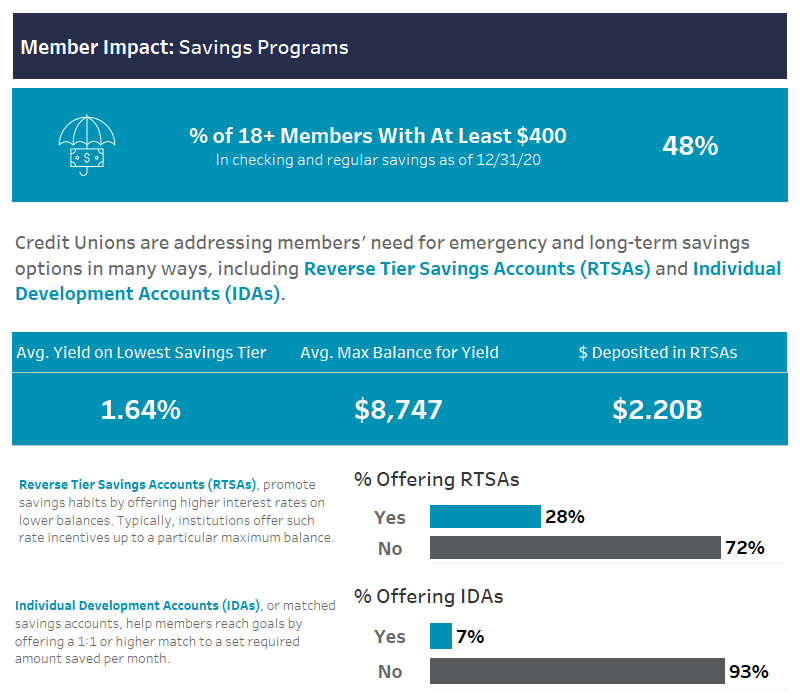

For the Impact Framework, Callahan asked about reverse-tier savings accounts and individual development accounts. Qualitative data received makes it clear credit unions do design products to serve members; however, the options included in the Impact Framework might not be universal.

When It Comes To Supporting Members, Education Is Key

The archive of CreditUnions.com is filled with stories about the different ways credit unions have met members where they are fulfilling needs and serving those left out or living on the periphery of the traditional financial system. These stories are inspiring and, at first glance, might appear unrelated. But they all underscore the efforts credit unions across the country are making to have a positive, demonstrable impact on the people and communities they serve.

When Callahan & Associates designed its 2020 Impact Framework, choosing which metrics to include to reflect member impact was by far the most challenging. We chose to focus on several key areas that impact how well members are able to live, including building savings, buying a home for the first time, living in environmentally impacted areas, and navigating life without a traditional social security number.

In addition to these metrics, we blended in data that focuses on the services credit unions provide all members regardless of circumstance.

Since rolling out the Impact Framework, we’ve discovered that although credit unions vary quite a bit on the types of products they offer to meet the needs of their members, as a group, the industry is prioritizing education around every type of need. This speaks to a powerful mission in the industry to serve as a guide while empowering members to take the reins of their own financial future.

Of the credit unions Callahan surveyed, financial literacy is a strong priority. In addition to offering general counseling in various areas of finance, these credit unions also offered a variety of topical education. This supports what we know: Credit unions meet their members where they are, taking action to educate and support them when they need it as well as how they need it.

The graphs below offer a snapshot into the insights Callahan gleaned from the 2020 Impact Framework. As we look forward to our 2021 data collection, however, 2020 results raise some questions. Are these the right metrics? How would you evolve the framework to provide more relevant trends? How would you evolve this dataset if you could? Would you measure differently?

As you review the results below, please consider joining the impact community and providing feedback. Every individual cooperative and the movement as a whole is stronger together.

Callahan’s impact initiative empowers credit unions to articulate their value through a mission-focused lens with the help of new metrics and best practices. The Impact Network is growing every day. Join the network today and help evolve the credit union story.

The majority of credit unions that participated in Callahan’s 2020 Impact Framework track and counsel first-time homebuyers.

The types of products credit unions offer vary based on distinct member needs. Credit unions that participated in Callahan’s 2020 Impact Framework reported a clear focus on building and maintaining credit within their membership.

Evidence of member-centric product design is clear in the specific types of accounts credit unions offer. Credit unions that participated in Callahan’s 2020 Impact Framework reported offering products such as overdraft protection, payday loans, and secured credit cards.

For the Impact Framework, Callahan asked about reverse-tier savings accounts and individual development accounts. Qualitative data received makes it clear credit unions do design products to serve members; however, the options included in the Impact Framework might not be universal.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Tech-Grown CEOs Share Fintech Partnership Strategies (Part Two)

Tech-Grown CEOs Share Fintech Partnership Strategies (Part One)

Virtual Cards: More Than Just A Trend

Keep Reading

Related Posts

Digital Wallet Usage Skews Younger, But Becoming More Ubiquitous

3 Ways The Balance Sheet Is Adjusting To New Borrowing Habits

Macroeconomics: First-Quarter Trends Or Headwinds?

Virtual Cards: More Than Just A Trend

Best Of 2025 (So Far): Building Vibrant Communities

Aaron PassmanBest Of 2025 (So Far): Supporting Member Financial Wellbeing

Aaron PassmanView all posts in:

More on: