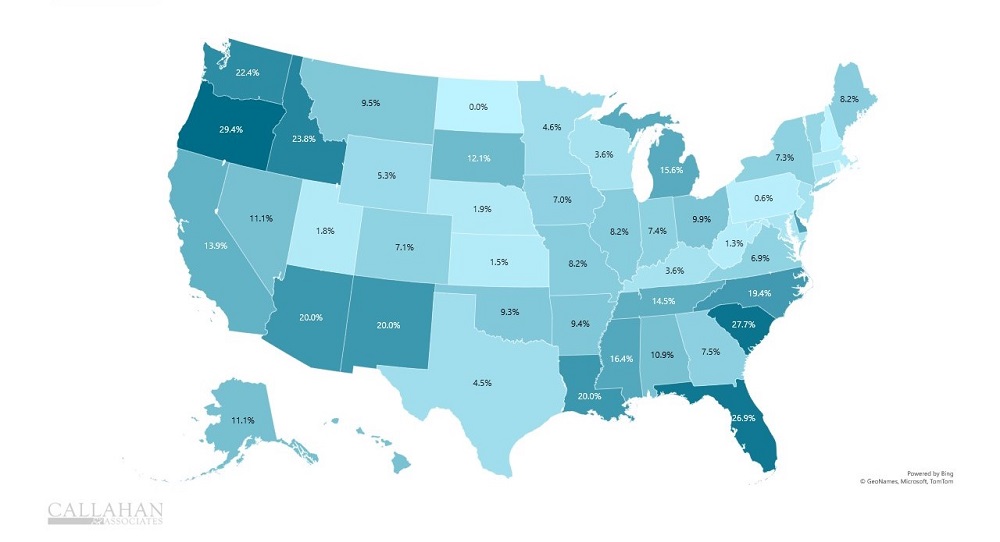

CDFI DESIGNATION BY PERCENTAGE OF CREDIT UNIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.23

© Callahan & Associates | CreditUnions.com

- Community Development Financial Institutions (CDFIs) provide financial services primarily to low-income communities and to people who lack access to financing. Institutions with a CDFI certification can access grant support for their operations, an important benefit in an expanding market.

- Credit unions with CDFI status tend to have larger memberships — 46,178 versus 30,257 for the average non-CDFI credit union. They also have slightly more loan accounts per member — 0.66 versus 0.64 — and lower average loan balances — $16,928 versus $17,917.

- The return on assets at CDFI credit unions is nearly identical to the industry average — 0.70% versus 0.68% — showing they’ve been able to target low-income communities without sacrificing earnings.

- CDFIs are most common in Oregon, South Carolina, and Florida. Oregon’s fellow Pacific Northwest states of Washington and Idaho also have a substantial number of CDFI credit unions. Nationwide, just 422 credit unions have CDFI status, down from a peak of 465 in the third quarter of 2014.

How Do You Compare To CDFIs?

Whether you’re already a CDFI and you’re looking to benchmark your performance against others, or you are scoping whether becoming a CDFI is the right choice for your credit union Callahan can help. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

Request A Demo