Deeper member relationships are a key component for credit union growth. The ability to grow from within is not only more efficient — as attracting new members typically comes at a relatively high cost — but also indicates the credit union is delivering real value to its members. Although credit unions use a range of options to expand their reach — such as field of membership changes, new branch locations, or mergers — the ability to expand existing member relationships is a strong foundation for any growth strategy.

The challenge today is meeting, if not anticipating, member expectations about service experience. A credit union CEO recently told Callahan & Associates, “We don’t have a member growth strategy, we have a member-service strategy.”

How Are You Performing Against Peers In Your Market? Callahan’s Peer software offers endless opportunities to pull custom research and comparative performance benchmarking to make strategic, member-driven decisions for your institution. Let us show you how it works with a free custom scorecard with metrics and peer groups of your choosing. Claim your custom scorecard today!

A clear service strategy encompassing all member touchpoints is fundamental to engaging members and developing deeper relationships. Consumer behaviors will continue to shift and service expectations will continue to rise. Will credit unions make the necessary investments in 2023 and beyond to ensure they meet the service expectations that will allow them to deepen member relationships?

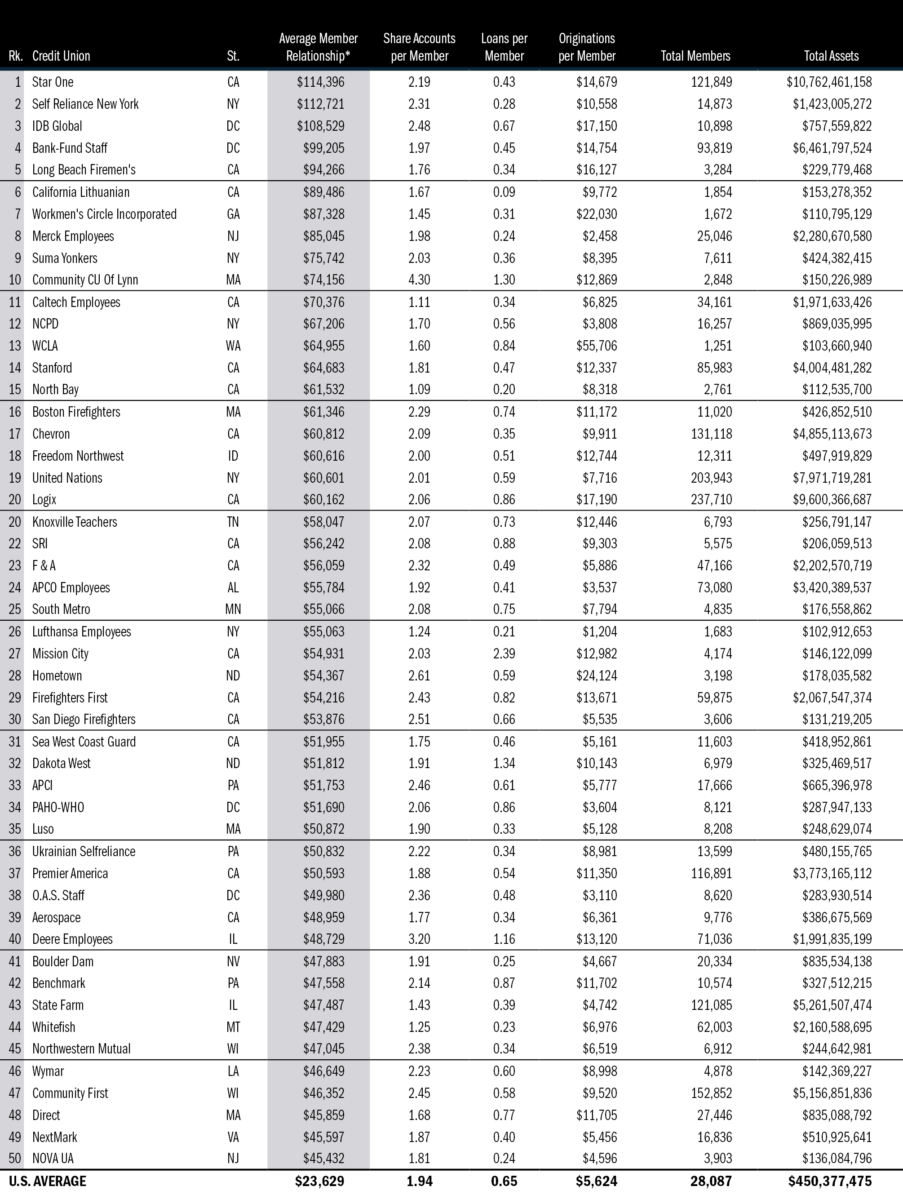

TOP 5O CREDIT UNIONS IN AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com