The adoption of online and app-based banking has resulted in less foot traffic and a reduced branch network for many financial institutions.

What Is A Bank Desert?

Any census tract without a branch within two miles for an urban area, five miles in the suburbs, and 10 miles for a rural community.

According to the Federal Reserve Bank of Atlanta, the rate of bank branch closures has doubled since 2020. According to a different Federal Reserve study, the rate of closures is faster for institutions with $10 billion and more in assets. Community banks, however, have increased their footprint, and the credit union industry has held relatively flat, with a slight decline.

The negative impact on communities abandoned by mainstream banking has become a significant issue in American financial policy.

Where Are Banking Deserts?

According to the Federal Reserve Bank of Atlanta, 66% of bank deserts are located in suburban areas, 20% in urban areas, and 14% in rural areas. Banking deserts are growing the fastest in suburban and urban areas, with branches falling 6% in suburban areas and 6.1% in urban areas compared to 4.2% in rural areas.

Banking deserts tend to fall along stark demographic lines. A full 46.4% of census tracts in majority American Indian or Alaska Native areas are banking deserts. And since 2017, the lion’s share of branch closings have occurred in nonwhite urban neighborhoods. Further, banking deserts are correlated with communities that have more elderly people and people with disabilities.

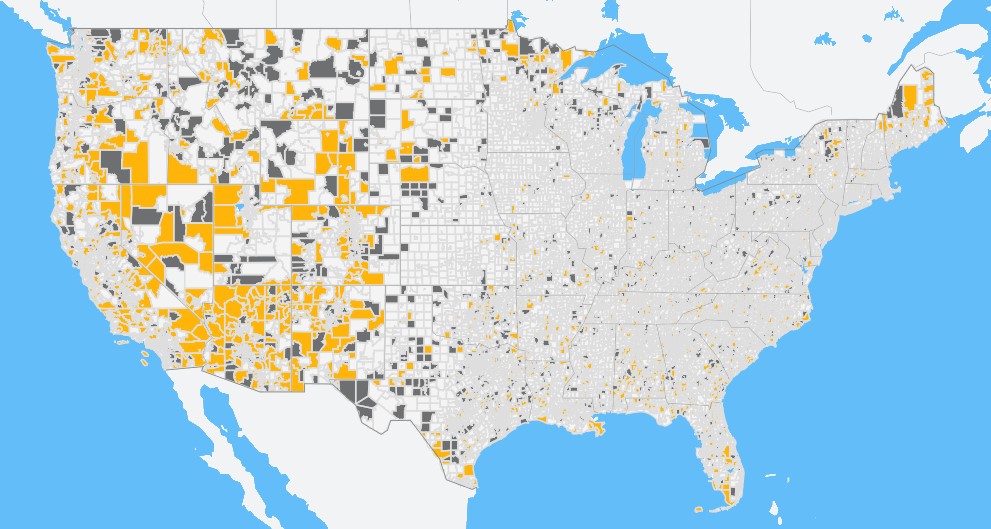

U.S. BANKING DESERTS

FOR U.S. FINANCIAL INSTITUTIONS

SOURCE: Fed Communities

A map shows which census tracts are banking deserts (YELLOW) or are at risk of becoming banking deserts (GRAY).Credit unions that wish to examine banking deserts across the country have an easy way to do so. The Market Reporting folder in Peer Plus from Callahan & Associates allows users to analyze markets and assess whether they are teetering on or full-on banking deserts.

Why Are Banking Deserts Bad?

What Happened?

2012: Bank branches peaked at 82,965 but fell by more than 10,000 by the end of 2023, according to the FDIC.

2011: Credit union branches peaked at 21,219 but fell by nearly 1,000, according to data from Callahan & Associates.

2021: A study from the National Community Reinvestment Coalition found 77% of consumers still used a branch monthly, underscoring the existing demand for branches.

The negative impacts of banking deserts are well documented and severe. A study of Native American reservations found credit scores of people raised in banking deserts were 10 points lower than Native Americans living in communities not located in banking deserts. Additionally, they were 4% more likely to have delinquent accounts. These effects depreciate slowly after moving to a banked area. According to the study, branches are a beacon for those on the economic margins.

In the absence of traditional financial institutions, predatory alternatives, such as payday lenders, blossom. Or, residents forego banking services altogether. Not surprisingly, when a region has fewer banking services, it has higher rates of underbanked residents.

For local businesses, branches serve as key access points for capital. According to a 2019 study by economists at the University of California, when a branch closes, business lending drops for approximately six years. Annual originations can decline by $453,000 after a closing. Many economists attribute this slowdown to a fracturing of the relationships important to retail banking.

How Can Credit Unions Help?

The Treasury Department has developed two designations to help financial services providers operate in communities that might be uneconomical to serve:

- Minority deposit institutions.

- Community development financial institutions.

The MDI designation allows qualifying banks and credit unions to tap specific government programs and grants to better serve predominant minority areas. For example, among other requirements, the majority of a credit union’s membership and board leadership must fall within an eligible minority group to earn MDI designation. As of year-end 2022, 147 banks with combined assets of more than $330 billion and 475 credit unions with combined assets of more than $54 billion were MDI-designated.

Similarly, the CDFI program specifically targets areas underserved by banks. Established in 1994 by the Riegle Community Development and Regulatory Improvement Act, the CDFI fund’s purpose is to “promote economic revitalization and community development in low-income communities.”

During the pandemic, the Treasury Department invested $9 billion in CDFIs and MDIs in an attempt to provide financial products to small and minority-owned businesses and consumers in low-income and underserved areas.

“America has always had financial services deserts … but the pandemic has made these deserts even more inhospitable,” said Treasury Secretary Janet Yellen. “The Emergency Capital Investment Program will … allow people to access capital, especially in communities of color and rural areas.”

How Are Credit Unions Making An Impact?

Outside of official designations, credit unions are getting creative in their efforts to reach areas teetering on the desert line.

- University FCU ($4.1B, Austin, TX) extended financial services and resources via a mobile branch to geographical areas with limited or no banking presence.

- United Bay ($282.6M, Bay City, MI) broadened its reach and returned financial services to a banking desert with some unintended help from a for-profit bank.

- Great Lakes Credit Union ($1.5B, Bannockburn, IL) partners with local organizations to address the needs of Chicago’s underbanked residents, becoming the banking partner of a revitalization effort for a neighborhood that lacks financial, grocery, and healthcare providers.

At the point when a financial institutions closes its last branch and a banking desert emerges, a credit union is responsible just 8% of the time, according to the Federal Reserve Bank of Philadelphia. By contrast, when it comes to re-opening a branch in a desert census tract, a credit union does so 35% of the time. For reference, credit unions account for 20% of all financial institution branches.

When it comes to banking deserts, credit unions are serving where other FIs won’t.

Opportunities Abound In Banking Deserts. When an underserved community lacks access to nearby financial services, that’s a critical gap credit unions are suited to fill. Yet, pinpointing these markets and understanding their demographics has been challenging — until now. Peer Suite is launching banking desert maps that make it simple to find and evaluate underserved areas so you can expand your reach and impact. Want to be the first to see it? Pre-book your demo today.