This is part of the Callahan Financial Performance Series. Presented by the analysts at Callahan & Associates, the series helps leaders interpret data to drive smarter decisions and uncover new approaches to measure performance.

Callahan clients can access the full version of this article right now on the client portal. Read it today.

For the first time in more than two years, credit unions reported a slight acceleration in annual member growth to the tune of 2.0% year-over-year. Although credit unions welcome new members every day, the rate at which these members have joined has been slowing — until now.

Credit unions reported a gain of 2.7 million net new members from the third quarter of 2024 to the third quarter of 2025. What’s more, they’ve added 920,402 members in the past three months alone, nearly twice the number gained during the second quarter of 2025.

Relationships Support Membership Growth

Core membership often starts on the deposit side, where helping members safeguard their assets is a positive first step toward building a trusting financial relationship.

Reflecting this trust, annual share growth at credit unions is slightly higher than the national personal savings rate, indicating that members are depositing their excess funds with credit unions at a slightly higher rate than at other financial institutions. Of note, bank customers are slightly more likely to invest funds in the stock market or other securities, whereas credit union members are more apt to build a savings-account-based nest egg. Still, this is a strong sign for credit union-member relationships.

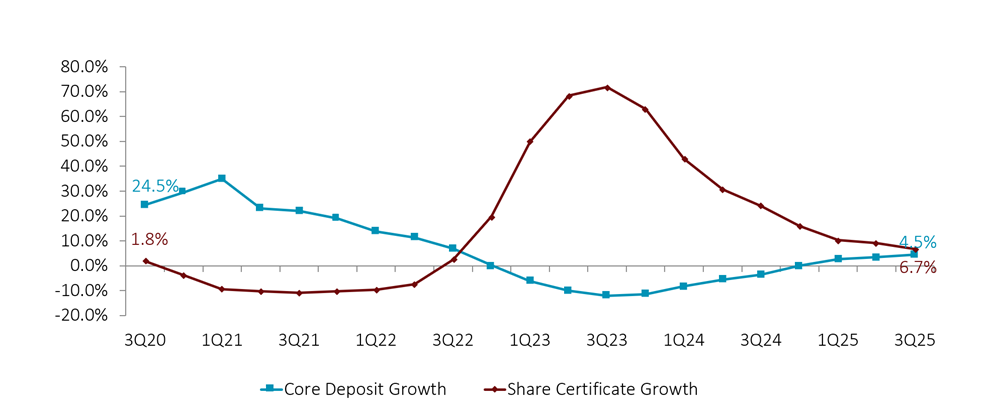

CORE DEPOSIT GROWTH VS. SHARE CERTIFICATE GROWTH

FOR U.S. CREDIT UNIONS

SOURCE: CALLAHAN & ASSOCIATES

In addition to attracting members through deposits, credit unions are also welcoming members through lending, especially via real estate loans as new refinancing opportunities from late-year rate cuts renew member interest in credit union offerings. Notable, however, is that a rise in both HELOCs and credit card balances could indicate members are struggling and turning to credit unions for help.

At a time when the K-shaped economy overwhelmingly benefits high-wealth households, credit union membership growth suggests a renewed trust in institutions that prioritize people, purpose, and community. This is credit unions’ time to shine.

Ready To Read The Full Story? Callahan clients may access this exclusive content within the client portal. Read more about core deposits, then dive deeper into what increased membership means for the lending portfolio. Not yet a client but looking for expert insights to help you adapt to change, develop your organization’s leaders, and stay at the forefront of industry trends? Connect with our team to learn more.