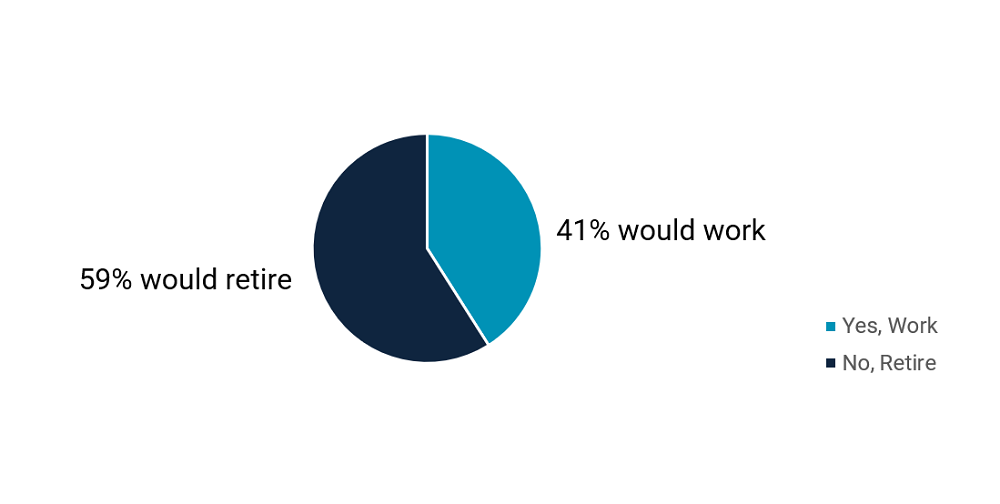

Faced with financial fragility and rising costs, many Americans would rather work indefinitely than risk retiring broke. In an April 2025 BlackRock survey of 1,000 registered voters, 31% of respondents had no retirement savings, 30% would have difficulty paying an unexpected $500 bill, and 23% had no readily available savings. What’s more, in the same survey, 41% of respondents said they’d rather work their whole life than risk running out of money in retirement.

WORK VS. RETIRE

FOR 1,000 REGISTERED VOTERS | DATA AS OF APRIL 2025

SOURCE: BlackRock Redefining Retirement

In today’s economic environment, saving is more important than ever, yet, many Americans have trouble doing so. The latest data underscores a growing sense of retirement insecurity and highlights key opportunities for credit unions to support savers at every stage of life.

Strategic Insights

- The closer people are to retirement, the more they tend to worry about their savings. In the BlackRock survey, 47% of respondents between the ages of 45 and 54 reported worrying about their retirement savings at least once a day; half between the ages of 55 and 64 check the performance of their retirement savings on a monthly basis at least. This continues into retirement, when 76% wished they had saved more money for retirement.

- IRA and Keogh plans are an optimal offering to help members actively plan for retirement, as such accounts offer potential tax benefits for individuals as well as self-employed or small-business owners. Among U.S. credit unions, 72% offer at least one IRA/Keogh account; however, IRA/Keoghs account for only 4% of the credit union share portfolio.

- Given the power of compounded savings, it’s better for members to plan ahead and start their retirement savings earlier rather than later. But, how does compounded savings work? How early should members start saving? How much might they need to retire comfortably? These are all common questions that credit unions can easily address through financial education programs.

- Even better — consider offering different programs for different member needs. Financial education programs geared toward smart retirement are a good way to coax younger members into thinking about how to manage their personal finances now to be better prepared down the road, whereas programs developed for older members might focus more on claiming Social Security benefits and the details of living on a fixed income.

- Abound Credit Union ($2.5B, Radcliff, KY) has partnered with Western Kentucky University since 2021 to give high school students a week of college experience learning about basic savings, budgeting, and lending. Read more about that in “School’s Out For Summer, But Financial Education Continues.”

- In 2022, InTouch Credit Union ($835.9 Plano, TX) expanded services for those nearing or in retirement, and in 2025, Golden 1 Credit Union($20.3B, Sacramento, CA) was named No. 1 on Money.com’s “Best Banks and Credit Unions for Seniors” thanks in part to its personal, proactive, and comprehensive approach. Read more in “Credit Unions Make Retirees’ Golden Years Brighter.”

Want to dive deeper into retirement data? Check out “Americans Aren’t Ready For Retirement. Credit Unions Can Help” and “What Does The Data Say About Financial Wellness?” on CreditUnions.com.