As the clock ticks closer to 2020, people around the world are thinking about resolutions for the New Year. And if the past is any indication for the future, saving money will top their lists.

According to an article in Inc., researchers estimate 60% of the population makes a New Year’s Resolution, with saving money ranking amid the top five most popular. Given the state of debt in the United States, that might come as no surprise. According to the New York Fed, total household debt hit $13.95 trillion in the third quarter of 2019, the highest amount ever in nominal terms. Consumer credit reporter Experian says Americans have $830 billion in credit card debt, while Transunion predicts the share of borrowers who are at least 90 days past due on their credit card accounts will likely increase to 2.01% next year.

Americans could benefit from building a savings habit; unfortunately, Inc. also reports only 8% of resolution-makers achieve their goal. But all hope is not lost. Among its tips to keep a New Year’s Resolution, online mental health social network Psych Central suggests setting a time frame, creating bite-sized portions, receiving support, and keeping it simple which are all things credit unions can offer their members.

It’s crucial for credit unions to help members save their money, says Bradly Ford, content marketer at Educators Credit Union.Credit unions were created to serve our member-owners. Saving money goes a long way in helping someone be financially successful, and part of our goal is to see our members be successful.

Indeed, credit unions across the country are deploying a number of creative solutions to engage members and encourage more fruitful savings habits. Here are four.

Round Up Savings

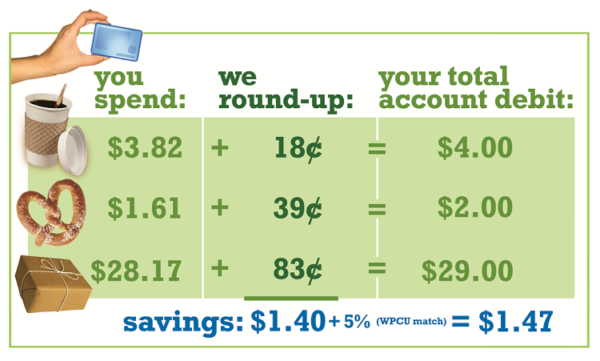

Wright-Patt Credit Union ($4.9B, Beavercreek, OH) has offered its debit roundup program, EasySaver, since 2006. The big Ohio cooperative rolled out the program as an easy way to save a sort of out of sight, out of mind savings experience that was on par with what the big banks were doing.

“We saw that Bank of America was doing something similar and didn’t want to lose members,” says Tracy Szarzi-Fors, vice president of marketing and business development for the credit union. “This ties to everyday transactions and allows the member to save without paying attention. It’s an automated and easy way to save. Kind of a no brainer.”

In a traditional roundup program, the financial institution rounds up a purchase to the nearest whole dollar and deposits the difference into the spender’s savings account. So, for example, if someone makes a debit card purchase of $20.20, their FI debits $21.00 and drops $0.80 into their linked savings account. But as a member-owned financial cooperative, Wright-Patt takes an extra step to make EasySaver even better. It matches 50% of a member’s roundup savings made during the first 30 days of enrollment; after that, it matches 5%.

The credit union has approximately 65,000 enrolled in EasySaver and is looking forward to creating more engaging savings programs for 2020.

“We worked on how to have better, more meaningful conversations around savings with our front-line staff this year,” Szarzi-Fors says. “This aligned with our Financial Flexibility and Freedom philosophy, which teaches members about save, spend/manage, borrow, and plan.”

And as for tips on how any credit union can help members keep their New Year’s saving resolutions? Szarzi-Fors says it’s simple: “Make it easy.”

Don’t stop here. The Save My Change program at Community First of Florida helps members build savings and the credit union build interchange income. Read how in “A Strategy To Score Swipes And Savings.”

Automated Savings

The members of the financial health check team at BECU ($21.8B, Tukwila, WA) recommend members put aside money each month into a designated account to save for important financial milestones and unplanned expenses. The credit union’s automated savings option helps them do just that.

Requiring no additional effort after the initial setup, members can create better savings and spending habits as well as track separate savings goals via different accounts.

“Having a savings account expressly for this purpose means members are more likely to be able to cover an emergency or unexpected expense without having to use a credit card or personal loan,” says Cea Burrough, BECU’s financial health check supervisor.

At the beginning of the year, the credit union speaks to many BECU members that have made New Year’s resolutions to save more, decrease debt, or stick to a budget. BECU offers free, one-on-one consultations over the phone and helps members automate a savings plan.

“Members save more and more often when they automate versus when they manually transfer funds into their savings accounts,” Burrough says. “Life happens. Members forget to make a transfer, or they wait to see if they have funds at the end of the month. Members that don’t have an automated savings plan often end up not saving at all.”

The credit union also helps members create a plan for paying down debt.

“We encourage members to put away credit cards until they pay their outstanding debts and are able to pay new credit card balances in full every month,” Burrough says.

It’s two sides of the same coin that ultimately helps members save more, reduce debt, and live better.

Savings Contests

To promote excitement around savings, Affinity Federal Credit Union ($3.5B, Basking Ridge, NJ) tried something new in 2019 when it sponsored a savings contest.

Dubbed the Great Savings Challenge, the program aimed to make saving money a priority and help members achieve a financial goal, whether small or large, to improve their overall financial well-being.

“Our main goal was to help members focus on saving, which many people don’t think about often enough,” says Jacqui Kearns, chief brand officer for the credit union. “Creating a goal, or a ‘pledge’ as we called them, gave members something to strive toward and celebrate.”

Members of the credit union earned entries into the Great Savings Challenge drawing by participating in a number of activities, such as discussing savings or investment goals with a credit union representative or Affinity financial advisor, opening a Savings Club Account, and setting up automatic transfers or direct deposits into a savings club account.

Don’t Stop Here. Superior Choice Credit Union encourages members to reduce debt and improve their debt-to-income ratio. Learn how in “The Great Debt Paydown Challenge.”

“This was a fun way to get members excited about something many consider to be a chore,” Kearns says. “The challenge was also a means of showing the importance of coming into a branch and meeting with a financial advisor. Meeting with experts is an often underused but very impactful way to reach savings goals.”

Through the Great Savings Challenge, members pledged to save more $8 million and set more than 700 savings goals. Despite this success, the credit union is not continuing the challenge in 2020. Instead, it will focus on the overall financial well-being of members, with savings being just one, important part.

“Now that we have completed the savings challenge, we believe ongoing education is the next step in empowering our members with personal tools to continue their journey toward financial wellbeing,” Kearns says.

Prize-Linked Savings

“We definitely notice a change in habits around New Year’s,” says Bradley Ford at Educators Credit Union ($2.1B, Racine, WI) says.It is one of the most active account opening periods because members have a goal to better themselves in many ways, including financially. We don’t have specific metrics on how savings increase or decrease throughout the year, but we know there is a slow down as the year goes on.

To help combat that drop in activity, the credit union offers the Saver’s Sweepstakes, a prize-linked savings program developed through the Wisconsin Credit Union League. The sweepstakes rewards members with a prize entry for every $25 they save, with a cap of six entries per month. In return, they can win $100 monthly, $1,000 quarterly, or $5,000 annually. All the member has to do is open the account and save money.

To underscore the importance of keeping money in savings, Educators charges a $10 fee the first two times a member transfers money out of the account and closes the account on the third, resulting in a loss of entries for the member.

“Of course, we know life happens, and we’re flexible with the fee, Ford says. “If a member needs this money, we don’t want to punish them because an emergency or sudden payment came up. Members can make a penalty-free withdrawal during a 30-day period starting on the anniversary of their account opening. That withdrawal doesn’t affect any entries they’ve already earned.”

Educators understands its members’ savings styles are as varied as its members themselves. That’s why it offers a full menu of savings option. Its Change Up debit card roundup program shows members how easy it can be to save a few cents at a time and how far those few cents can go over time. Saver’s Sweepstakes, on the other hand, requires members to actively make transfers and decide to save every month.

Don’t stop here. Lottery-driven savings accounts through state leagues and individual credit unions add an element of excitement to a positive financial behavior. Learn more in “The State Of Prize-Linked Savings Accounts.”

In 2019, nearly 2,000 members at Educators saved $1,000,000 through the Saver’s Sweepstakes program. The credit union fell short of its goal to open 3,000 Saver’s Sweepstakes accounts but hit its $1,000,000 savings goal on the head.

“Our members were using the account to save more on average than we were even hoping,” Ford says. “Going into the year, we knew it’d be a challenge to get 3,000 members. Now we know the account is doing its job and encouraging members to save.”

The program kicked off its second year of the Saver’s Sweepstakes in October 2019 and plans to keep offering it as long as members show interest. And this year, the League has added a few incentives, such as a $500 holiday winner. For its part raising awareness, the credit union promotes winners on its website and has picked up coverage from the local press, too.

“We believe more members will be tempted to participate now that we can tell the success stories of the prize winners,” Ford says.