Credit unions seeking long-term growth are finding that the path forward runs through financial wellbeing — a measure not of what members know but of how they feel about their money.

That was the message from Andrew Robertson, a principal at Gallup, which partnered with Callahan & Associates for a credit union webinar about how emotional engagement can lead to growth. Here are five takeaways.

1. Members Are Nervous About The Future

Research from Gallup and Callahan slots consumers’ financial wellness into three categories: Thriving, Struggling, and Suffering. Where someone fits into those categories depends on their satisfaction with their current financial condition and their confidence about the future.

Now the bad news: Credit union members generally have lower satisfaction and confidence levels than bank customers. But that’s somewhat by design.

“Credit unions serve consumers who are often underserved or unserved and might find themselves more in that struggling or suffering category,” Robertson says.

2. Want Members To Participate? Show Them The Credit Union Cares.

A variety of factors influence financial wellbeing, including job prospects, healthcare costs, living situation, social networks, the overall economic outlook, and more. Credit unions can’t control any of that.

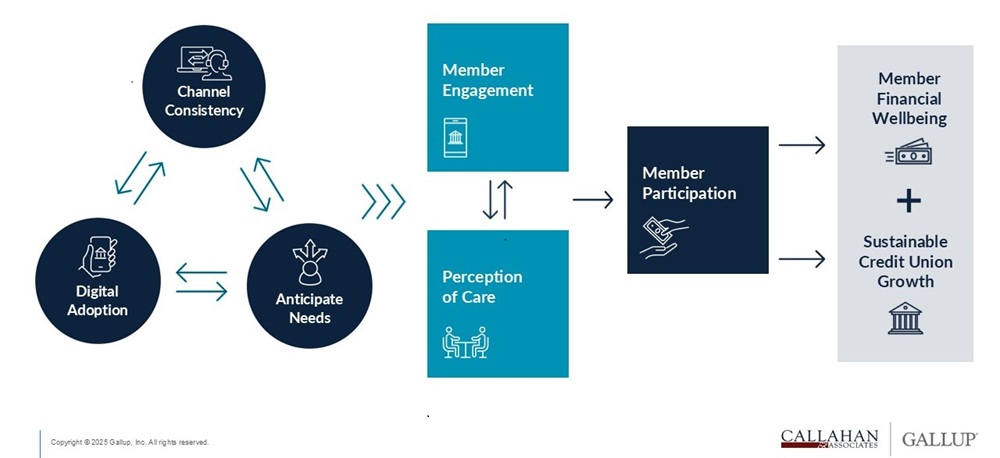

What they can control, however, is member engagement and the perception of care, both of which are crucial to driving participation, Robertson says.

To strengthen those foundations, credit unions can:

- Provide a consistent experience across all channels.

- Encourage digital adoption.

- Anticipate members’ needs.

Taken together, that trifecta fuels member engagement and the perception of care, which leads to member participation and, in turn, greater financial wellbeing and sustainable growth for the credit union.

Did You Miss The Webinar? No Problem. Join Callahan & Associates and Gallup to learn about exclusive research and insights on how emotional engagement and the perception of care drive member participation and, ultimately, credit union growth. Watch A Roadmap To Credit Union Growth today.

3. A Stool Can’t Stand Without All Three Legs

It’s important to act on all three elements of that trifecta, emphasizes Andrea Pruna, a strategic consulting principal at Callahan & Associates who also presented on the webinar with Robertson.

“All three of them are extremely important,” Pruna says. “There’s not one that’s more important than another. When these actions are taken, it creates better engagement for the member and they perceive that the credit union cares for them, which drives participation.”

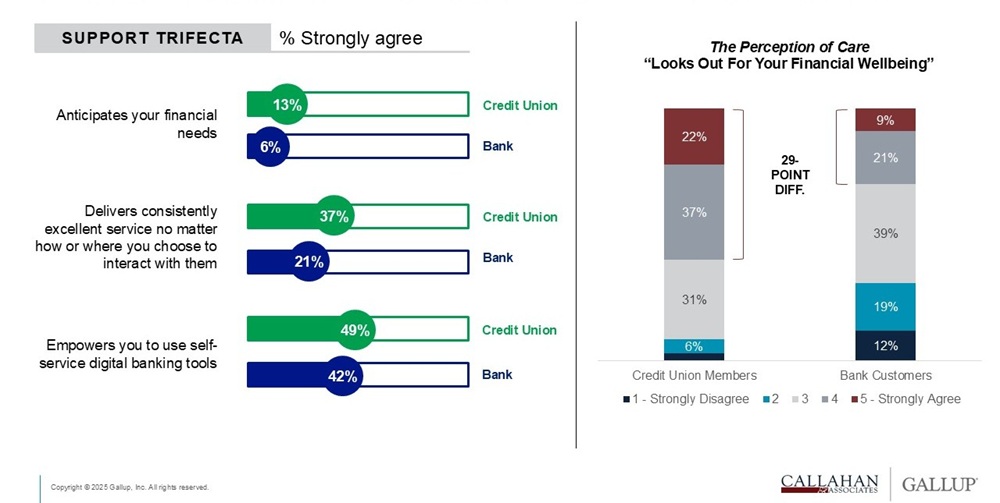

That’s backed up by real data. Research from Gallup and Callahan finds that when consumers feel their financial institution provides a consistent experience across channels, empowers them to use self-service digital banking tools, and anticipates their financial needs, credit unions consistently earn higher marks than banks when it comes to the perception of care.

“This is one of the ways we’re differentiating from banks,” Robertson says. “And it’s showing up in that perception of care.”

4. Don’t Assume Members Will Reach Out For Help

The past several years have been rough on consumers, as economic anxiety rises and the personal savings rate falls. But research from Gallup and Callahan reveals most consumers don’t seek support from their primary financial institution during times of financial change.

Data does show credit union members are more likely than bank customers to ask for that help — a 40% to 33% margin — but a majority of consumers are still likely to look elsewhere for help and advice. Roughly half of all consumers — 47% of credit union members and 53% of bank customers — turn to friends or family, whereas approximately 20% turn to financial websites. Fewer than one quarter — 22% — of bank customers turn to financial advisors compared to 17% of credit union members. Meanwhile, 15% turn to social media, and even fewer rely on podcasts, books, and TV, respectively.

Despite being more likely than bank customers to seek support, 60% of credit union members still don’t turn to their credit union when financial challenges arise. For many, it’s not a matter of loyalty but of awareness or uncertainty — they might not know what steps to take, how to navigate their situation, that help is available, or even that they need help.

“How do we help those who didn’t think to reach out or may not even be aware they need support or can seek it?” Robertson asks.

One important note, he adds: The 15% of consumers who turn to social media is a surprisingly low figure, debunking some myths around how much sway those tools have over consumers’ lives. But that also highlights an opportunity for credit unions to step in and provide a much-needed service.

5. Buy-In Brings It All To Life

Both Robertson and Pruna emphasize leadership buy-in as crucial to bringing these strategies to life. When leadership buys in, that trickles down to staff at all levels of the organization — including those who work directly with members.

“People often say, ‘There’s someone at my credit union that I trust,’” Robertson says. “It’s not just that they trust the credit union, they trust a person there. That trust lives not just within the brand, but in the people members are interacting with.”

As the industry continues to develop self-service tools, leaders can’t overlook the outsized impact people have on members. Engaged, empowered, confident, and well-trained employees can be a powerful force for cultivating deep-trust relationships.

The Member Engagement And Financial Wellbeing Consortium. This transformational multi-year program equips credit unions to take mission-aligned, data-informed action to change member behavior. Combining Gallup’s specialized research in human behavior and decision-making with Callahan’s decades of credit union expertise, the consortium drives both member impact and credit union growth. If your credit union is ready to lead the future of financial wellbeing, schedule a conversation with a Callahan program facilitator to learn more about the program.