Over Labor Day weekend 2020, 11 different significant wildfires defined as burning 1,000 acres or more broke out in Oregon. All told, these fires burned more than 721,000 acres of land, destroying thousands of structures and causing dozens of injuries and even death.

The largest of the group, the Holiday Farm fire, raged in Lane and Linn counties between September 7 and October 26, affecting 173,000 acres, destroying 770 structures, and resulting in six injuries and one fatality. It ranks as the 10th-largest fire in the state’s history, behind two other 2020 fires Lionshead and Beachie Creek that burned concurrently to the northeast.

In response to the activity, OCCU Foundation (OCCUF) launched a Fire Relief Fund on September 8. The 501(c)(3) foundation of Lane County-based Oregon Community Credit Union (OCCU) ($2.6B, Eugene, OR) created the fund specifically to support those affected by Oregon’s wildfires. In addition to starting the restricted fund, OCCUF matched the first $100,000 donated.

Here, Laura Brown, OCCU Foundation Administrator, discusses her foundation’s quick response, its experience in establishing the fund, soliciting donations, the future of the fund, and more.

Laura Brown, Administrator, OCCU Foundation

OCCU Foundation responded a day after the fires started in 2020. What was the situation on the ground?

Laura Brown: We could have given $100,000 to another agency donating funds, but we have a different perspective we do and respond to things differently from other organizations and here was a chance to do that.

Many organizations were responding to basic, immediate needs money for gas, for groceries. We felt we could fund projects and services that come after those immediate needs are restored. Even when the initial hecticness of that time passes, there are still needs.

What were your initial expectations?

LB: With a lot of collaboration between departments, we beat our goal of raising $100,000. We’ve raised more than $150,000 and people are still contributing today.

The way we saw it, many organizations were responding to those basic, immediate needs money for gas, for groceries. We felt we could step in to serve those mid-term needs, funding projects and services that come after those immediate needs are restored.

Without that pre-existing architecture, where did you start? What did you do?

LB: I manage the OCCU Foundation, but I’m also on the credit union’s communications team, so I started by working with marketing to create a landing page for the website. I also worked with our digital services department to figure out what vendors we could partner with to quickly spin up a donation portal.

Although we launched a landing page and introduced the fund, we weren’t able to accept donations right away. There was procedural work with our accounting team to make sure we could seamlessly accept donations, whether cash or through a general ledger transfer, and track it all.

How did it feel to accept that first member donation?

LB: It was really exciting. We had not only local members but also members who no longer live in Oregon in some cases, as far away as Europe donating to the cause. It’s hard to know for sure how many of our members donated, but I know our members appreciated what we were doing and that we offered the match. Even businesses we had never worked with before donated to us because of that $100,000 match.

Everything went smoothly, we received good feedback, and it served our need well.

How did you publicize the option to donate?

LB: Because COVID was and is still a reality, there are a number of people who want to give back but don’t necessarily feel comfortable volunteering. Donating funds to a cause is one way to do that.

Our brand and marketing team is phenomenal. Rather than just placing marketing material in a newsletter, they shared a letter from our CEO that spoke specifically about the Fire Relief Fund and what we were doing with it. We provided the opportunity to donate through the email.

Who manages the fund internally?

LB: I am the only staff person for OCCU Foundation, and our Board of Directors make decisions for where funds go. Currently, all applications come to me via email, I review them and assess for impact, risk and fund alignment then send them to the Board for a formal review and vote to fund or not fund. Ultimately, the board approves all of our grant making.

CU QUICK FACTS

Oregon Community Credit Union

Data as of 06.30.21

HQ: Eugene, OR

ASSETS: $2.6B

MEMBERS: 203,559

BRANCHES: 11

12-MO SHARE GROWTH: 19.2%

12-MO LOAN GROWTH: 26.6%

ROA: 2.02%

How do institutions request funding from the Fire Relief Fund?

LB: We have a page on our website that lists our previous grantees and what we gave them a grant for. We’re looking for nonprofits, faith-based organizations, and public entities working in areas of relief or recovery.

Applicants download the application and then submit it as a PDF form. That’s the quickest way for us to receive applications.

What is your average grant size?

LB: We didn’t set a limit, and we did have some high asks. But ultimately, our fund is modest. Our average is around $8,000.

What information do applicants need to provide?

LB: We didn’t want the application to become a barrier. We ask 10 questions. Where are you serving people? How many people will you serve? How are you uniquely positioned to respond to the fires?

I come from the world of nonprofits and felt it was important to not have a super robust grant application. If these organizations are responding to fires, they need funding quickly. They don’t need to wait three or six months before we determine they should receive funding. It’s a quick application for a quick turnaround. As long as we understand what they’re doing, we don’t need all the fluff.

Do you have a sweet spot for the types of nonprofits or entities to whom you’re granting funds?

LB: It’s a pretty wide mix. We’ve given grants for basic needs but also environmental support. We tried to serve needs in different ways.

There are organizations who are helping individuals clean up their properties; there are organizations that were burned themselves that need to rebuild. In our own community, a local community center was burned, so was a local library. Our grants helped them meet the need now as well as take steps toward rebuilding in the future.

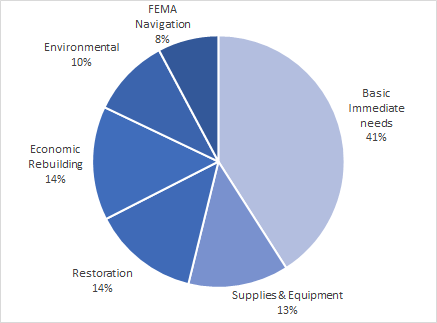

More than half of the OCCU Foundation’s Fire Relief Fund went to projects funding things other than basic immediate needs.

It’s been a year since you introduced this fund. Are you still funding requests? What comes next?

LB: We’ve granted to 17 organizations so far, with the largest donation totaling $20,000 and the smallest $1,500. We’ve given away quite a bit of our tally, but we still have funds to give away. Applications are slowing but we’ll continue to make grants until those dollars run out. At that point, we might launch another fund should the need arise.

The OCCU Foundation was created to serve the credit union’s giving pillars of education and health, while also being responsible to emergent community needs like fires or COVID-19. When it’s relevant to have another relief fund, I think we will, especially since we think we’ve had a great opportunity to make grants other organizations weren’t able to. For example, in the wake of the fires, many new 501(c)(3) organizations were founded. But some foundations can’t make grants to organizations founded within a certain period of time. We can and do.

What best practices or lessons learned from setting up this fund would you like to share?

LB: We’re working on finding a different way to process both the application and donation. We want to move away from a PDF application form because it didn’t work for everyone and ended up being somewhat technically inhibiting.

I also think we missed an opportunity with our donor relationships. Due to certain stipulations with our processor, we didn’t have permission to reach back out to the donors who contributed to the fund online. We moved fast and did the best we could, but I see those as two areas we could improve next time.

This interview has been edited and condensed.