Since its founding more than 70 years ago, Community Financial Credit Union ($1.5B, Plymouth, MI) has been making the kinds of loans for-profit financial institutions won’t. The credit union is so serious about its lending philosophy, it clearly published on its website that it “will not deny a loan based on credit score alone.”

The approach helped the credit union post an impressive annual loan growth rate of 24.3% in the first quarter of 2023. CFCU’s Path To Homeownership program helps renters become homeowners and is part of a concerted industrywide effort to address the affordable housing crisis.

Something Different In Detroit

Jill Johnson, chief revenue and lending officer at CFCU, has experience in the world of for-profit banking and welcomes the fresh take on lending the credit union offers.

“I previously worked for big mortgage companies and banks where approvals were cookie cutter,” Johnson says. “It was awesome to look at mortgages as an opportunity to do something different and help people at CFCU.”

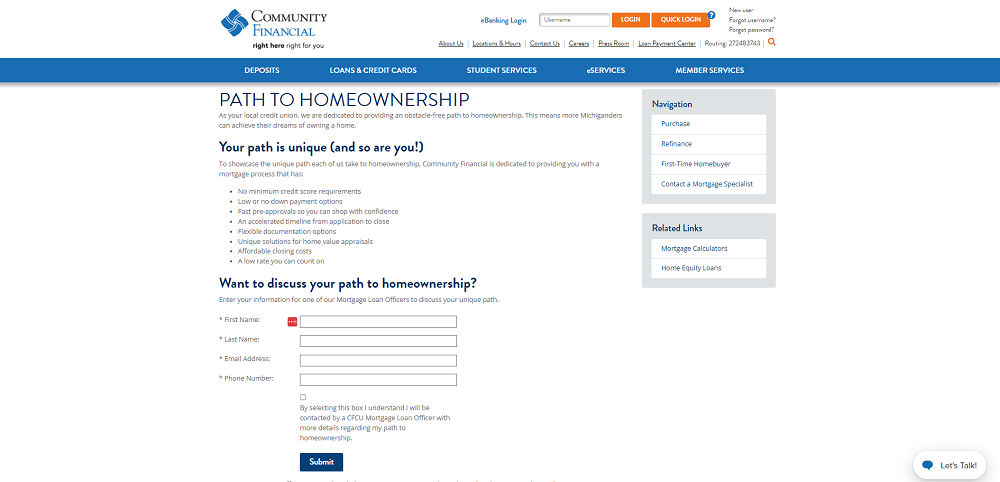

Case in point: As local rental costs have increased, the credit union has seized the opportunity to help renters become homeowners. It launched Path to Homeownership in December 2022 to help those making timely rental payments move into a home of their own.

“Many don’t see owning a home as part of their life path,” Johnson says. “We want to make sure people see homeownership as an opportunity that’s accessible to them.”

Working with developers and local organizations focused on first-time homebuyers in the Detroit area, CFCU’s leaders discovered downpayments and credit scores were two of the primary hurdles to homeownership in their community. As a result, Path to Homeownership requires a low — or no — downpayment and no minimum credit score. The program also offers accelerated timelines for application and closing as well as flexible documentation.

Features To Serve Community Needs

The valuations of homes, including the biases that can impact them and the cost of traditional appraisals, represented another challenge in CFCU’s community.

“One of the key differences in our program is that we use unique solutions for home value,” Johnson says.

Those solutions include not requiring a full appraisal when it complies with regulations and is better for the borrower. Instead, CFCU uses automated valuation tools, a state equalized value computation, or broker price opinions. These alternatives not only minimize bias that can plague traditional appraisals but also save the borrower from appraisal fees that cost $500 or more.

And when it comes to adding fees to beef up the balance? CFCU doesn’t do it. In fact, the credit union doesn’t even require a minimum loan amount, and it never has. By contrast, other lenders won’t write home loans for less than $100,000, leaving out borrowers who don’t need that much mortgage.

A Continuing Evolution

Path to Homeownership is ever-evolving. For example, the credit union has changed the program’s maximum loan amount from $150,000 to $250,000 based on input from Habitat for Humanity, which recently showcased four homes ranging from $195,000 to $245,000. Listening to community needs and not making assumptions are critical to success, Johnson advises.

CFCU has also enhanced the program by offering low-rate auto refinances to new members closing a Path to Homeownership mortgage and plans to introduce a 1% rate reduction after three years of timely mortgage payments.

Does your institution know what it means to pursue a purpose-driven strategy? Callahan’s Purpose Alignment Tool — developed in partnership with leading credit unions — provides a baseline purpose score with insight into employee tenure and role. Take the survey today to assess your organization’s understanding of purpose.

“It’s all part of our ongoing effort to improve a person’s overall financial situation,” Johnson says.

For some borrowers, high-rate auto loans negatively impact their monthly budget and hold them back from being able to afford a mortgage payment. In some cases, refinancing with the credit union to a lower-rate loan can ease budgetary pressure and move applications to the “approved” pile.

Early Results And Advice

Since launching at the end of last year, CFCU has processed 60 Path to Homeownership applications and closed 15 mortgages. Approximately 10 applicants are working with a credit union representative to create a personalized plan that will help them gain an approval in the future, and other program participants are actively searching for homes. According to Johnson, a dearth of inventory is the biggest hindrance right now.

CU QUICK FACTS

COMMUNITY FINANCIAL CREDIT UNION

DATA AS OF 03.31.23

ASSETS: $1.5B

MEMEBRS: 80,634

BRANCHES: 15

EMPLOYEES: 347

NET WORTH: 9.9%

ROA: 0.70%

In terms of how CFCU expects the program to perform, Johnson thinks it is likely to surprise people.

“Many of the homebuyers in this program are creating generational wealth for the first time in their families,” Johnson says. “There might eventually be some delinquencies or losses along the way, but I think these borrowers are going to do everything possible to make their mortgage payments and keep that asset for the future.”

And CFCU will be there to support these members along the way. For example, the credit union’s comprehensive approach includes educational videos on home maintenance and savings accounts for future repairs.

It all goes back to knowing the borrower. To that end, Johnson encourages other credit unions to listen to local needs and partner with organizations that already have trusted relationships within the community.

“This isn’t a program you promote on TV or radio,” she says. “It’s about leveraging trusted community connections and encouraging individual conversations.”

Improve Your Mortgage Performance

Claim Your Mortgage Scorecard Today