The COVID-19 pandemic has pushed analytics teams out of their cubicles and onto the front lines as they identify for their credit unions which members need help the most and how to deliver it. They are spotting trouble in the fall offs of direct deposits and timely loan payments. They’re also parsing channel usage and branch traffic for actionable insight that decision-makers can use for tactical changes now and strategic planning later.

Here, six accomplished credit union data analysts share what’s happening inside their shops.

Affinity Plus Federal Credit Union

Stephen Geyen has been vice president of business intelligence for the past five years at Affinity Plus Federal Credit Union($2.4B, St. Paul, MN).

With COVID-19 turning the economy on its head, credit unions are well advised to identify and support struggling borrowers sooner rather than later. For the past couple of years, the analytics team at WSECU has helped the credit union determine which borrowers are at risk of defaulting and who might just need a push to pay. Borrower data also helps the cooperative determine how to reach out and via what channel.

It costs approximately $1 a minute for the average call center to serve a caller. That’s according to callback solutions provider VHT. As such, reducing callvolume by shifting calls to automated phone systems, online banking, and mobile apps can translate into big savings.

For credit unions, outbound calling is an important channel for borrower communication, debt collection, and charge-off reduction. However, how can a credit union determine which borrowers to call? How soon and how often should the credit union call?And, which slow payers are at risk of becoming delinquent borrowers?

Analytics and member data are helping to answer those questions at Washington State Employees Credit Union ($3.0B, Olympia, WA), which has doubled in size in the past decade and today has branches stretching from Seattle to Spokane.

WSECU is employing analytics and machine learning to make smarter, more efficient use of member solutions department resources, reducing costs related to its third-party collections partner and improving collections results across its loan portfolio in the process.

Bill Peterson, vice president of analytics and insights at WSECU, says his team has gained numerous insights for predicting borrower behavior and prioritizing collection attempts. But to get here, the credit union had to take several swipes at analyzing data and fine-tune its methodology.

Initially, the team at WSECU looked at whether a pre-built collection score from a credit bureau was useful in predicting a loan charge-off. Early on, the team discovered the collection score wasn’t a meaningfully better predictor than the member’s last reported FICO score, which the credit union already collects for risk purposes.

So, the credit union combined the FICO score with other member data and created its own custom collection scoring system.

We used machine learning algorithms to generate the scores and found they worked really well across a range of products, says Peterson. While the overall methodology employed is proprietary, I can share that it includes dimensions that weigh the strength of the member’s relationship with WSECU, as it includes an understanding of the member’s previous history of default. This gives us the ability to better identify members who will self-cure’ [repay]based on less-expensive contact methods.

Armed with the custom collection score, WESCU can identify members who need fewer contacts or who are just as likely to respond with automated phone reminders. That’s helped WSECU significantly reduce call volume handled by its collections vendor and has saved the credit union nearly $8,000 per month.

We’re also improving member experience by using contact methods that are less intrusive than a live person calling, Peterson says. This more impersonal touch by automated phone messaging can serve as a nudge with results that are just as successful.

On the flipside, WSECU also can identify members it needs to contact earlier because they have a higher risk of default.

We have more meaningful conversations with the people who need our support sooner in the process, the VP says.

No Credit Check Necessary

WSECU’s analytics department is a central support group and aids in the success of QCash and QCash Plus, an instant loan program with a low fee and no credit check. QCash grants loans between $50 and $700, while QCash Plus grants loans of $700 to $3,000. WSECU uses a statistical modeling approach and internal scoring to underwrite the loans.

The model has been in production for a little over a year and we’ve seen great results in charge-off reductions, says Bill Peterson, vice president of analytics and insights at WSECU.

And what about mailed notices and physical communications? Peterson says the organization as a whole is looking for ways to communicate with members in the channels they prefer.

That work is more complicated and would likely be less impactful than our initial gains, Peterson says. But, it’s the next obvious step in extending the models into different areas of the credit union.

WSECU’s analytics department is a central support group for the Evergreen State cooperative. As such, the department also is using analytics to improve results for other parts for the credit union such as marketing and risk.

One area we hope to get more traction in is product recommendations, Peterson says. This area lends itself to the type of automation that data science works best with, and we think it will be a useful growth tool.

WSECU has been working on the product recommendations it makes through its new online banking platform. However, the biggest technology challenge there lies in how to automate the delivery of the recommendations rather than what model or analysis to deploy.

Going forward, we feel like this is going to be a major use of data science within the organization as it lends itself well to automation and machine learning, Peterson predicts. There are a lot of promising opportunities for using analytics.

How are you using analytics to serve members during this crisis?

Stephen Geyen: We began to see a significant drop off in member activity on March 16. Within two weeks we created approximately 25 PowerBI visuals that showed the changing member activity on a day-to-day basis. The changes were breathtaking,and seeing them allowed us to quickly ask critical questions about how we should reallocate resources and support our members.

At the employee level, their roles changed when we closed lobbies on March 17. The branch employees who were not working the drive-thru began working remotely, taking member calls, making outbound calls to members, supporting off-the-charts mortgage activity, and helping with inquires to our credit work-out team.

At the member level, we began analyzing changes in activity to identify those who could benefit from immediately working with us versus waiting until they had to throw in the towel.

What are you looking for in the data, and what do you do when you see it?

SG: We began tracking unemployment deposits, skip-a-pay, forbearance requests, loans past due, and changes in revolving debt, and we developed models to identify changes in member income and spending. We use these data points to identify members who are feeling financial stress and provide lists to the outbound call teams so they can reach out with an offer of support. We’ve also used these lists to create offers of support via email and digital banking pop-ups.

What results have you seen so far?

SG: We’ve seen significant spikes in use of forbearance, consumer loan skip-a-pay, members calling in for financial support, and clicks on our educational content that we specifically designed for COVID-related issues. Furthermore, member feedback has been positive, and results suggest our NPS score could increase due to the efforts we’re making to proactively work and communicate with our members.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

SG: The PowerBI visuals span nearly every member channel, product, and service from fee activity to RDC use, loan apps to closing, phone use to card use. That has allowed us to dive deeper based on other factors such as location, channel, platform, and FICO scores.

Amplify Credit Union

Matthew Monagle joined Amplify Credit Union($994.5M, Austin, TX) as marketing communications manager in March 2019.

How are you using analytics to serve members during this crisis?

Matthew Monagle: When shelter-in-place orders started going into effect around the state of Texas, our loan servicing and account resolutions teams went to work implementing a new deferment program. If our members’ income has beenimpacted by the COVID-19 pandemic, we will help them set up a series of scheduled deferments for personal, business, or real estate loans.

With so many people in our community struggling, this has been an opportunity for us to practice what we preach as a credit union. The challenge, though, has been making our members aware of this option before their loans become delinquent.

What are you looking for in the data, and what do you do when you see it?

MM: The Amplify marketing team crafted an automated email that goes to all members near the end of their late payment grace period. Using payment data, we identify which members are at risk of going into a delinquent status and proactively offer them a payment solution. This report also helps highlight at-risk members for our team to follow-up with directly.

What results have you seen so far?

MM: As of the middle of April, we’ve delayed 2,010 months of payments on 1,042 loans for balances totaling approximately $34 million. Just as important, however, is the number of members who are experiencing a hardship who have reached out to discuss loan payment options. Education is a key component of what we do at Amplify, and it’s been gratifying to see members recognize that they do have options during this difficult time.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

MM: Identify problems before they become problems. We’ve all seen cases where a negative situation might’ve been avoided if a member had an opportunity to make changes to their account. Informing our members of their deferment opportunities before their loans go delinquent protects our finances as well as theirs.

Centra Credit Union

Carrie Jenkins has been assistant vice president of business analytics at Centra Credit Union($1.6B, Columbus, IN) for the past three years.

How are you using analytics to serve members during this crisis?

Carrie Jenkins: My team and I have been providing our decision-makers and front-line staff with real-time information to help them keep a thumb on the pulse of the credit union. The analytics we’ve provided have helped develop relief programs and provided insight into the communications members need so we can proactively educate them about these programs.

We have call logs and call reason trending for our contact center, transaction volumes, daily cash withdrawal trends, lending production and pipeline reports, VPN connection volume reports, and information on accounts that are delinquent but do not have a history of delinquency.

What are you looking for in the data, and what do you do when you see it?

CJ: I haven’t been monitoring much of this myself; however, my team and I always look for opportunities to help decision-makers implement new programs or changes to meet members’ needs, improve the member experience, and promote business continuity.

What results have you seen so far?

CJ: I’ve received positive feedback about the information my team provides. Knowledge really is power. No one is operating on a hunch or a guess.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

CJ: Just because the information is presented in a chart does not mean it’s easy to understand. At times, it seems like people are looking at a Rorschach test and not a bar chart. Everyone has their own opinion about what the chart really means. This type of summarized information needs a clear explanation of the source, the results, and the key takeaway. I find myself explaining things like why a decrease in the rate of increase is not just a decrease. As storytellers, we have the responsibility to make sure what we say cannot be misconstrued.

Teachers Credit Union

Mike Benassi has been with Teachers Credit Union ($3.3B, South Bend, IN) for 17 years and in his current role for the past two-and-a-half years.

How are you using analytics to serve members during this crisis?

Mike Benassi: We look at eight weeks of members’ direct deposit history in two-week buckets to spot deviations outside the norm. If a member normally gets $3,000 every two weeks in direct deposits but now is getting only $1,000,that’s a significant reduction in income.

What are you looking for in the data, and what do you do when you see it?

MB: We flag outliers and call and ask, Hey, how are things going? and let them know TCU is here to offer assistance. We tell them about loan deferrals and about our skip-a-payment program. It’s a wellness check tohelp support the health and safety of our members in these trying times.

What results have you seen so far?

MB: Our CEO sends daily emails about what he’s hearing from members, and he says a lot of them are grateful to hear from us. TCU members like knowing we have their financial needs in mind and that we’re here to help. We also are building dashboards that show some interesting results. For example, skip-a-payment use greatly exceeded our original expectations. In fact, we did more of these transactions from March 15 to April 15, than we did in all of 2018.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

MB: You can do some pretty easy calculations to really help people in these trying times. It’s not rocket science. We used simple stats from looking at direct deposits, just means and standard deviations, to quickly come up witha good list. You can spend a lot on expensive software and powerful modeling tools, but there are also things you can do inexpensively and easily that can immediately make a real impact.

Wings Financial Credit Union

Mike Lindberg has been with Wings Financial Credit Union($5.6B, Apple Valley, MN) for the past six years and leading the data solutions team for the past three-and-a-half years.

How are you using analytics to serve members during this crisis?

Mike Lindberg: The COVID-19 pandemic and subsequent response is unprecedented in the level of impact to society at least in the lifetime of most reading these words. Unprecedented events tend to instill anxieties and fear into the people facing them. The single most valuable thing Wings is using analytics for is to provide foundational clarity in the details, thus calming some of the emotions we feel.

We’re using data to support a greater understanding of where our members are currently affected. We’re also using data to provide insight and forecasts/predictions into what the next six to 12 months might look like.

Knowing we don’t have much data to base our forecasts and predictions on, we’re working diligently with the business to ensure we capture more data than ever to be able to provide useful information to help them drive their strategy in servingour members most effectively.

What are you looking for in the data, and what do you do when you see it?

ML: We’re helping identify members who might be suffering financial hardship. We’re also helping to understand branch traffic, how we can balance employee health and member service, and how much cash we need to keep on hand.

We’ve seen that stay-at-home orders reduce overall spending, so what is the impact of that? The longer stay-at-home orders remain in effect, the more likely our members’ channel preferences will be affected, so how do we best support the continued build-out of our digital channels?

What results have you seen so far?

ML: We’ve seen the business lean-in to data solutions and leverage analytics to answer ad-hoc questions and enhance business processes that further our ability to make things easier for members.

As an organization, we’ve seen employees and leaders come together to serve our membership in amazing ways. We’ve seen the organization take on complex efforts to truly leverage data in the service of members. Most importantly, we’ve seen and are experiencing the credit union difference the ability to unabashedly serve our members during this difficult time.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

ML: Difficult times might be the best time to ask co-workers, members, friends, family, and those we encounter, How can I serve you? This is an isolating time, and we have the opportunity to feel connected. It’s in these isolated, difficult times that we remember lessons best.

As a person, I want those around me to receive the lesson that I care. As a co-worker and as a data solutions team, I want the business and membership to know we are here to lift them up. As a credit union movement, I want our members to know, without any doubt, that we are here to serve them.

Workers Credit Union

Cassandra Stoddard has been with Workers Credit Union ($1.9B, Fitchburg, MA) since October 2013 and in her current role for four years.

How are you using analytics to serve members during this crisis?

Cassandra Stoddard: The fastest, most effective way to gain a directionally accurate picture of how our membership is being affected in this time of crisis is to look at our transactions. As luck would have it, my team had just finisheda complete overhaul of our transaction data, which includes a bi-monthly check and balance from our warehouse back to core. Data integrity is the pillar of success in driving a data-driven culture, crisis or no crisis.

There have been a handful of existing processes that, working with our member experience team, we have chosen to relax or enhance. That includes identifying members with paper statements and urging them to convert to e-statements as mass mailings can be delayed, identifying members who will fall out of the level needed for higher interest on their checking accounts, designing a new set of user fields that my team can access and report on, and identifying the members who have been granted several deferred loan payments.

We’re also involved with helping to respond to additional regulatory reporting and reforecasting our budget because of pandemic-related changes in cash flow, loan mixes, and more.

What are you looking for in the data, and what do you do when you see it?

CS: Our enterprise analytics team answers questions and delivers analytics that positively impact the financial wellness of our credit union and our members. This is where the rubber meets the road.

As the situation unfolds, we look for guidance from our management teams, making sure the EA team is there to support those that have committed to using data to help solve problems. We look for opportunities to listen to them and help them adjust to fit today’s circumstances, building on their existing relationship with familiar data.

It’s common for organizations with even the most advanced analytic capabilities to fight the ever-lasting power of gut-feeling decision-making, but when past experience fails you, data doesn’t.

What results have you seen so far?

CS: We have very few metrics so far. We can track transactions and document contact center activity, but we’re still in prevention mode.

The organization is confident the EA team can use data to help our peers respond to changes with agility and accuracy. We’ve had productive meetings where managers are collaborating and coming up with a range of scenarios in which we could find ourselves, helping to keep the credit union more stable.

4 Critical Areas Of Analysis

The analytics team at Workers Credit Union has looked at transactions to develop a fast, accurate picture of the COVID-19 pandemic’s effect on the Massachusetts credit union’s 104,210 members.

Cassandra Stoddard, assistant vice president of enterprise analytics, details four areas in which her team has delivered crucial data during the past few weeks:

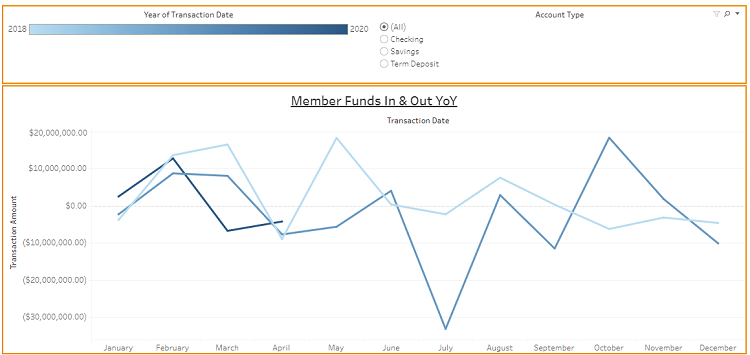

- Trend Analysis: How are members using the credit union today versus in the past?

- Channel Analysis: How are members communicating with the credit union? How can Workers best use the staff it has to accommodate channels most frequently used by members?

- Shared Branching: Does Workers have members who typically transact with other organizations for convenience? Are these members aware of what the credit union has in place to support their financial needs while respecting social distancing?

- Transaction Fluctuations: Are ACH and external deposits dropping? Has a member stopped making loan payments? Which members are receiving unemployment deposits?

We’ve also noticed urgent data requests are slowing down, which means we’ve done an adequate job of providing a variety of analytics around our most pressing areas of concern.

What have you learned about using analytics in this way, either as a best practice or a lesson learned?

CS: The EA team has focused for years on being able to answer 80% of our questions with 20% of our data. We have built a data environment that houses the main pieces of our core, which some find to be overly defensive in terms of strategy but has resulted in an incredibly high confidence level in the data we have needed to get us through this crisis day by day.

My decision to be conservative has positioned our credit union to deal with emergencies. Our foundation is rock solid. Not to say I don’t look back and consider the benefits of being more innovative in nature and where that would have put us in all of this, but I feel good that we can build upon what we have.

Interviews have been edited and condensed.