CONSUMER SENTIMENT INDEX AND AVERAGE CREDIT CARD BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

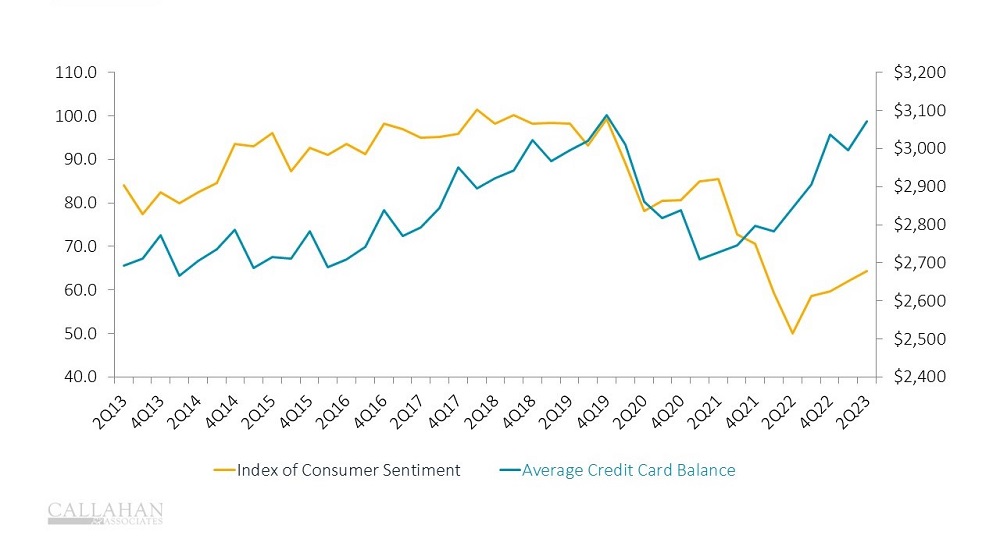

- Americans are pessimistic about the economy. According to the University of Michigan Consumer Sentiment Index, consumer sentiment has cratered since COVID-19 struck and the post-pandemic inflationary period began. Despite a slight uptick in recent quarters, the index trails its historical norms, revealing the broad pessimism Americans feel about their financial conditions.

- When Americans face financial difficulties, they often rely on credit cards to finance large purchases. With the inflation rate hitting levels not seen since the 1970s, more products have become large purchases in the past year. Consequently, the average credit card balance at U.S. credit unions has steadily risen since the end of the pandemic. It grew 8.0% year-over-year to reach $3,072 as of June 30.

- Credit card delinquency, meanwhile, has also risen. It stood at 1.54% at midyear — 78 basis points higher than its pandemic lows.

- This is where credit unions can help members. Financial counseling and education workshops have proven to be effective in bringing down delinquency. Credit unions that offer financial education and wellbeing programs report lower credit card delinquency. Facing higher average credit card balances, members will be particularly susceptible to delinquency. Lowering that risk pays off for credit unions and for communities.

Measure Your Success With A Free Performance Scorecard

Develop a clear picture of your credit union’s performance with a complimentary scorecard from Callahan & Associates. Armed with your desired KPIs plus a few we might suggest, you’ll be in a better position to benchmark against desired peer groups, share findings with your board, and help members reach new levels of financial stability.

Request Your Scorecard Today

Request Your Scorecard Today