Retirement is supposed to be simple — a time to relax, travel, and enjoy the fruits of decades of hard work. But for many Americans, navigating this life stage feels more like a full-time job. From figuring out when to claim Social Security to understanding Medicare, managing fixed incomes, and dodging financial scams, the golden years are anything but carefree.

With just 45% of Americans feeling prepared for retirement, credit unions are stepping up — offering seniors personalized guidance, financial tools, and a sense of trust that’s hard to find elsewhere. And as the needs of aging members evolve, so too does the industry’s commitment to serving them well.

A Personalized, Proactive Approach

“Whether you’re about to retire, approaching retirement, or just exploring your options, trying to figure it out can be overwhelming,” says Kent Lugrand, CEO of InTouch Credit Union ($834.4, Plano, TX).

According to the CEO, members must take an active role in planning their financial future. That’s why in 2022 InTouch expanded services for those nearing or in retirement.

“Being a trusted source that members can rely on — knowing we’re vetted, accurate, and will educate them along the way — has proven to be extremely beneficial,” Lugrand says.

Some of the biggest misconceptions his team encounters are that there’s only one way to claim Social Security or that Medicare covers everything.

“Another common misunderstanding is that financial planning for retirement ends the day you stop working,” he says. “In reality, it continues long after.”

At InTouch, education is key. The credit union uses a variety of channels — such as seminars, one-on-one counseling, and digital resources — to deliver information in a way that works for all members. Of course, in addition to accessibility, messaging is also key.

“We focus on simplifying complex topics and providing clear, actionable guidance,” Lugrand says.

In Northern California, Golden 1 Credit Union ($19.6B, Sacramento, CA) was named No. 1 on Money.com’s “Best Banks and Credit Unions for Seniors for 2025” list. The credit union describes its approach to senior members as personal, proactive, and comprehensive.

“Our senior members often have unique financial needs and challenges shaped by their life stage and goals,” says CEO Donna Bland. “I’d say retirement and healthcare costs are predominantly the most important concerns they have.”

Golden 1’s investment services focus on everything from retirement and estate planning to transfer of wealth and tax strategies. The credit union also regularly hosts workshops about managing debt, recognizing scams, and using mobile and online banking.

“We address these topics with practical tools, education, and personalized support,” Bland says. “We also understand that many seniors manage finances with help from family or caregivers. We offer resources that support these multigenerational needs, too.”

Partnerships For Better Products

Golden 1 snagged its Money.com ranking largely thanks to its Golden Prestige package, which is available to members aged 62 and older. The package includes free checks annually, no monthly maintenance fees, up to 10 free cashier’s checks per month, access to notary services, and 30,000 surcharge-free ATMs in the CO-OP Network.

“It helps members avoid unnecessary fees while our financial advisors and education teams provide custom budgeting, debt reduction, and income-maximization strategies,” Bland explains. “We also connect members to trusted nonprofit and government resources designed to help members plan around inflation, healthcare costs, and retirement income to improve peace of mind.”

Strategic partnerships also help the credit union provide better products and services, too. For example, Golden 1’s partnership with eHealth allows members to take advantage of specialized guidance to find a plan that fits their needs.

“It can be a daunting process, so we work to assist members in selecting options that align with their financial and healthcare goals,” Bland says.

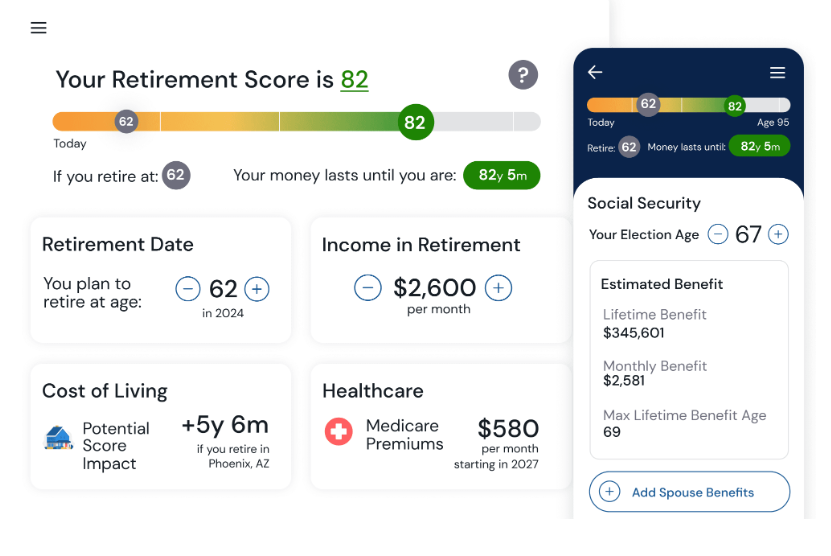

Both Golden 1 and ITCU use a retirement planning app that offers free AI-powered tools. Silvur’s Retirement Simplified app includes calculators, Social Security and Medicare guidance, and more than 500 on-demand educational lessons.

“We were looking for a digital solution that was user-friendly and provided clear, educational insights into retirement finances,” says Lugrand at InTouch.

According to the CEO, InTouch helps 99% of its members transition into retirement thanks to personalized planning resources.

“We want our members to make informed decisions while still having the ability to connect with a trusted advisor when needed,” he says.

At ITCU, more than 2,700 members have created profiles with 62% starting the process to obtain a retirement score and 48% completing it.

“Notably, 77% of those who started the process followed through to completion,” Lugrand says. “Our approach is resonating with the right audience and helping members take an active role in their retirement planning.”

Retirement Reimagined

Recent surveys of individuals as well as businesses show weaker sentiment across the board. In times of economic doubt and shifting financial priorities, the value of trust and personal connection can’t be overstated. That’s where credit unions have carved out a distinct role — not only as financial institutions but as lifelong partners in their members’ financial journeys. For seniors especially, that difference can be life-changing.

“Unlike traditional banks, we prioritize education and long-term financial wellness rather than just transactions,” Lugrand says. “Our members trust us to look out for their best interests, and that makes a big difference.”

Despite the credit union receiving notable praise for its services for seniors, Bland says the most rewarding outcomes for Golden 1 are in member experiences, like when a member struggling with high-interest debt attended a cybersecurity workshop and started working with the credit union’s financial coaches. After a full financial review, she improved her credit, qualified for a personal loan to consolidate debt, and adjusted her budget. She now saves $400 every month and enjoys greater financial stability in her retirement.

“Stories like this reflect the lasting impact of personalized support and financial education,” Bland says.

Members Need Help. Do You Have The Solution? Discover strategies that truly resonate with members facing complex financial decisions. Callahan Webinars brings you practical approaches for offering personalized guidance. Our on-demand library showcases ways to offer assistance when members need it most. Your members are waiting — click here for access.