San Francisco Federal Credit Union ($832.4M, San Francisco, CA) welcomed Steven Stapp as its new CEO five years ago. At the time, the credit union was dealing with aging facilities and struggling to differentiate itself in a crowded marketplace.

When Stapp came on board he challenged the credit union to evaluate what it was internally versus what it wanted to be in the market. The credit union wanted to freshen up its brand with an updated look and messaging. But in order to ensure the credit union could deliver on the promises it wanted to make, it had to first develop a strategy to address its internal challenges.

The credit union had two primary goals: One, to match the progressive spirit of its membership; and two, to become the financial hub for city residents. Neither of these goals would be easy to achieve in SFFCU’s tech savvy, diverse community.

San Francisco is composed of 10 districts, each with its own distinct characteristics. In a city where everything is bright and screamed for consumers’ attention, SFFCU’s brand and organizational tone appeared muted by contrast. Its facilitiesneeded reviving and its remote services needed a makeover. It needed to review and revamp everything from products and services to individual processes. Andstaff at all levels needed onboarding to ensure they were prepared to embrace all the change for the long haul.

An Uncommon Solution

The credit union undertook significant research, both externally and internally, to determine the new brand position. It gathered feedback from members and non-members alike and sought employee ideas. It even hired an outside firm that knew the creditunion’s marketplace. SFFCU knew it couldn’t rely on providing good service or good products it had to do something different to set it apart.

After much discussion, the credit union settled on a new brand promise: to deliver uncommonly good banking. The credit union spent 18-months on internal preparations to ensure it could deliver on this new promise. Every corner of the creditunion was involved, including all staff members and the board of directors.

The credit union used its new brand lens to make decisions regarding products, services, and processes. It redesigned its website, remodeled its branches, and overhauled its lending process. It replacedmortgage applications sent via the post office with an online, interactive process that better met member needs. It thoroughly trained staff on how to deliver an uncommonly good banking experience. The credit union also increased its community involvement,focusing on events in districts where it has branches and connecting with members current and potential through its Community Share program.

By the time SFFCU publically launched the new brand, the credit union’s team was ready to live up to it.

The new brand lens and more vibrant approach to opportunities helped develop a stronger relationship with the City of San Francisco. In 2010, when the city was searching for financial institutions to launch a taxi medallion financing program, SFFCU redefineditself as a community leader by stepping up when other financial institutions would not. The credit union loaned $50 million through the medallion pilot program and now provides funding for approximately 98% of the taxi market. It is working withthe city to make the program permanent. And because San Francisco requires medallion owners to also be drivers, efforts on behalf of the program are helping local, small business owners.

Uncommonly Good Banking, Uncommonly Good Results

By focusing on the member experience, the credit union has found it doesn’t have to offer the best rates or advertise heavily to achieve growth. It is now receiving more member referral and return business based on the service it provides.

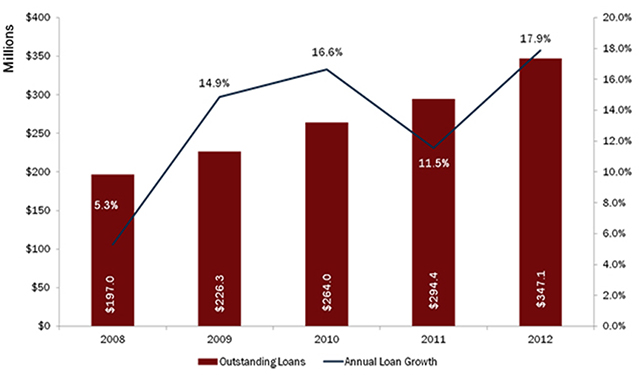

Loan growth increased 18% in 2012. Real estate loans doubled thanks in part to the new application process. Membership growth is now positive, in the 3% range, and the credit union expects to achieve higher growth in the future.

SFFCU OUTSTANDING LOANS & 12-MONTH LOAN GROWTH

DATA AS OF DECEMBER 31, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates’ Peer-to-Peer Software.

But the organization-wide makeover and brand overhaul SSFCU embarked on is not complete.

We’re making great progress, Stapp says. But this is a journey.

The fulfillment of SFFCU’s new brand promise is an ongoing process that the credit union will likely refine and improve along the way. In the meantime, city residents are learning firsthand from friends and neighbors about the uncommonly good bankingexperience San Francisco Federal Credit Union provides.