Top-Level Takeaways

-

Maine’s Infinity and Arlington Community in suburban Washington, DC, are preserving high service standards while encouraging members to adopt digital delivery channels.

-

The cooperatives are using drive-thrus to educate members about robust online services and the personal touch that is still available when needed.

Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

This spring, a pair of similar-sized credit unions one in the big city suburbs and one in a smaller-town setting faced a challenge familiar to many credit unions across the country.

Arlington Community Federal Credit Union ($354.2, Arlington, VA) and Infinity Federal Credit Union ($334.0M, Portland, ME) needed members to use digital offerings in the face of a lobby-limiting pandemic. Each cooperative embraced the drive-thru as a point of contact primed for member education.

Here, Libby Snipe, director of marketing and community development at Arlington Community, and Ashley Wainwright, marketing assistant at Infinity, talk about how they protected members while ensuring enhancing, even member service.

Recognize The Challenge That Comes First

How to overcome new service barriers with closed and limited lobbies.

In the past, we ushered many members into the digital platforms during in-person branch visits, explaining how easy it is to skip the visit for check deposits and other transactions. When our lobbies closed, we had fewer in-person opportunities. The challenge became how to encourage them to adopt digital through other messaging platforms and the call center. Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

Ashley Wainwright, Marketing Assistant, Infinity FCU

As Maine’s first credit union, we have many members who have been loyal to us for decades, are accustomed to traditional banking, and have special bonds with our tellers and member specialists. We proudly serve many members from Maine’s growing immigrant community, which can present a language barrier. We’re great at serving those who don’t speak English as their first language in person and on the phone, but when our lobbies closed, it became clear we needed a longer-term plan. We also knew the best way to provide great service is to cut down on wait times and focus our attention on those members who need direct interaction with us. Ashley Wainwright, Marketing Assistant, Infinity FCU

Messages That Empower Members To Make The Switch

How to ramp-up product offerings and communications while tracking feedback

We were able to accelerate mobile product launches, such as self-service skip-a-pay and enhanced card management features, to support home banking during the pandemic. Our long-standing digital products such as mobile deposit, secure messaging, and the ability to manage your credit card online made the switch from branch to digital easy. In our email communications, we reinforce that they’re part of a cooperative, and we’re currently working on an e-statement campaign that will also feature that messaging. Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

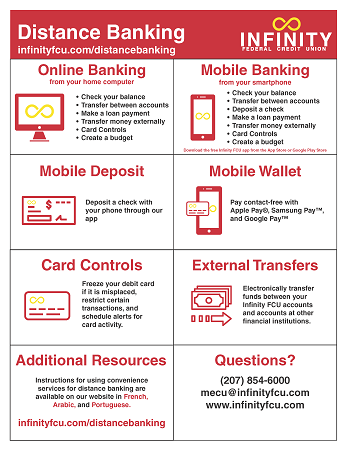

Switching our members to digital channels cuts down the drive-thru lines and phone queue for transactions that members can do themselves, like check a balance, deposit a check, perform a transfer, or make a loan payment. Many of our members didn’t know loan documents can be signed remotely and electronically. We analyzed drive-thru transactions, wait times, and member feedback, and from this information, the distance banking campaign was born. Ashley Wainwright, Marketing Assistant, Infinity FCU

The distance banking program at Infinity FCU has multiple facets. Download a one-page description of the program here, or find it along with other documents from cooperatives across the country in the Callahan Policy Exchange. Don’t have access? Click here to learn how to gain access.

Dialing In On Drive-Thrus

How to turn newbies into digital bankers.

We have signage in lobbies and also give members in our drive-thru a short flyer to encourage them to conduct their transaction digitally next time. Because we’re limiting the number of members allowed in the branch at one time, reinforcing this messaging at the entry encourages members to try new ways to conduct their transactions. Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

We created a handout to give to members waiting in line. The handout lists services available through online and mobile banking plus instructions for using those service. We translated them from English to some of the most commonly spoken languages in branches, including French, Portuguese, Arabic, and American Sign Language. We also use Geofence Google Ads within a small radius of our branches, linking members to our distance banking page, listing services, and providing translated instructions. Plus, we lined the approaches to our drive-thrus with campaign-style signs about these services. Ashley Wainwright, Marketing Assistant, Infinity FCU

Infinity’s Ashley Wainwright shows the multi-lingual sign the credit union uses to greet its multi-lingual members.

Infinity’s Ashley Wainwright shows the multi-lingual sign the credit union uses to greet its multi-lingual members.

Infinity uses Facebook posts to share the digital options members can use as an alternative to branch visits.

Infinity uses Facebook posts to share the digital options members can use as an alternative to branch visits.

Infinity designed a one-page handout to educate members about the options they have for digital banking. The Maine credit union distributes the handout in its drive-thrus.

Infinity designed a one-page handout to educate members about the options they have for digital banking. The Maine credit union distributes the handout in its drive-thrus.

Infinity marketers use an eye-catching email header to encourage members to use their credit union’s online channels.

Infinity marketers use an eye-catching email header to encourage members to use their credit union’s online channels.

Infinity FCU set up signage approaching its Westbrook branch to greet members, in multiple languages, and encourage the use of digital offerings.

Infinity FCU set up signage approaching its Westbrook branch to greet members, in multiple languages, and encourage the use of digital offerings.

Business development manager Adam Carrier sits at a table and greets members at the Westbrook branch drive-thru.

Business development manager Adam Carrier sits at a table and greets members at the Westbrook branch drive-thru.

Signs greeting members as they approach Infinity’s Portland branch lead all the way into the drive-thru.

Signs greeting members as they approach Infinity’s Portland branch lead all the way into the drive-thru.

Qualitative And Quantitative Member Response

How to comfort members so they know they can always get more personalized care.

Members take pride in being self-sufficient, so our branch and call center teams have done a remarkable job presenting clear instructions for adapting to digital channels and helping them get started. Once members are comfortable, they embrace the digital channels and use the call center and branches less; yet, we always remind them we’re here to support them and give them options for more personalized service where and when they need it. Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

We soft-launched the distance banking campaign on June 1 and did not fully launch until June 22, so we’re still gathering data and percentages will surely increase. Currently, 70% of our membership is enrolled in online banking, up from 65% in March 2020. Of those enrolled, the number of fully active users who were previously inactive has risen by 4.8%. In March, about 17% of our active users were using mobile deposit. That number has climbed to 24%. We’ve also seen a spike in payroll direct deposits and instant issue debit cards. Ashley Wainwright, Marketing Assistant, Infinity FCU

The Best Of Best Practices

How to listen, acknowledge, and take it one step at a time

Encourage members to adopt digital for one type of transaction and walk them through the process. Once they’re comfortable with the platform, they will explore other options for convenience and security. Libby Snipe, Director of Marketing and Community Development, Arlington Community FCU

Listen to your members and acknowledge their needs. This has been an uncertain and emotional time for everyone. Finances and emotions are closely tied. This is always true but is even more so with the presence of COVID-19. We read our text/email transactional survey results daily and use that feedback in business decisions, projects, and service initiatives. Ashley Wainwright, Marketing Assistant, Infinity FCU

Interviews have been edited and condensed.