Top-Level Takeaways

- First Harvest Credit Union created an in-house call center to provide seamless, personalized member service.

- The new call center integrates chat, online account opening, and concierge services.

- The credit union also made updates to its leadership structure.

Three years ago, during the height of the COVID pandemic, South Jersey Federal Credit Union embarked on a major experiment. The credit union, founded in 1940 to serve shipbuilding manufacturing employees, rebranded to First Harvest Credit Union ($462.0M, Deptford, NJ) and outsourced its member service center and marketing program.

There were practical reasons for these changes — including the area’s slow recovery from the pandemic and labor market challenges. Plus, the credit union wanted to enhance its infrastructure and ultimately create a better growth platform. But by the time president and CEO Mike Dinneen joined in July 2023, the credit union had suffered net membership losses for several years.

“There were many operational and brand familiarity changes at once,” Dinneen says. “Outsourcing our member service center had both a material and an emotional impact on staff and membership. When I arrived, this was a clear pain point for our credit union. We needed to reconstitute our own in-house call center and reinvigorate the member experience.”

In less than six months, the credit union made some significant changes, most notably jettisoning its outsourcing arrangement and hiring more than 20 local employees to create First Harvest Direct, an in-house member service call center that also oversees chat, online account opening, member concierge calls, and new member onboarding.

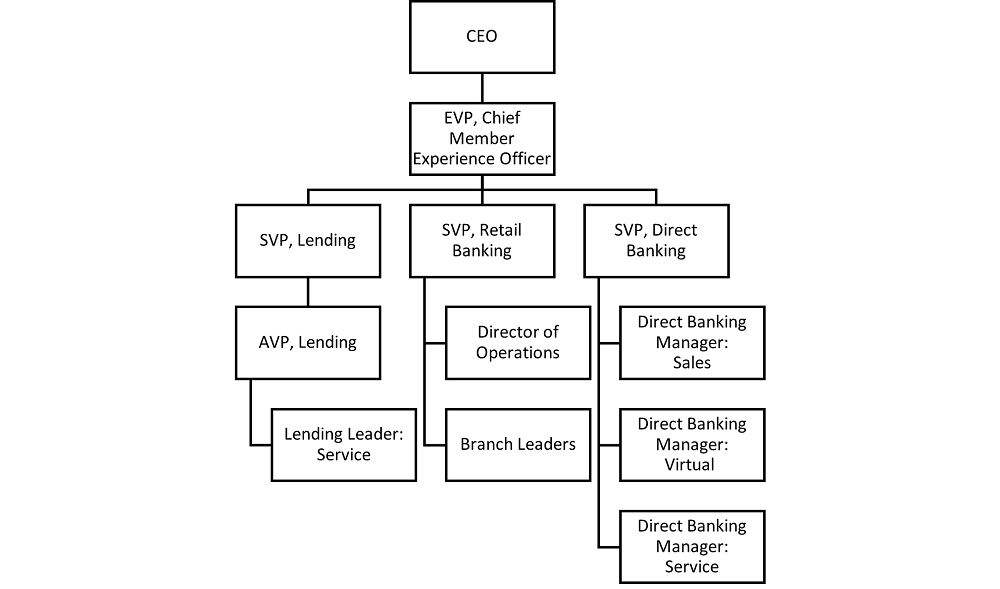

Dinneen also reorganized the credit union, bringing together lending, branches, ATMs, mobile, online, call center, and key SEG functions together under Justin Hendrickson, executive vice president and chief member experience officer.

“This will make the member experience more seamless and reduce the friction and time it takes for members to transact or resolve problems,” Hendrickson says. “At the end of every channel, every decision, every policy, and every operation is a member with a real-life experience and a real-time need.”

Constant Change

Like many credit unions, First Harvest has navigated a lot of change. It has built up a SEG business with more than 700 companies and municipal agencies, serving as the largest credit union in southern New Jersey and second largest in the state by membership. It has rebranded four times during its history and responded to market changes brought on by the pandemic.

Dinneen, who previously served as senior vice president of marketing and business development at the much larger American Heritage Credit Union ($4.7B, Philadelphia, PA), knew the value of member experience, particularly in-house call centers.

“There’s an intrinsic benefit to having your own staff, who are generally also members of the credit union, directly handle member inquiries,” he says. “Secondly, good call center employees are also subject matter experts and generally know which peers can quickly assist in a member issue. Thirdly, many of our branch and back-office team members were promoted from call centers, so it also becomes a fertile ground for cultivating future credit union leaders.”

Although the outsourced call center maintained a respectable answer and abandon rate and addressed many service issues, it simply did not have the cultural or institutional knowledge to address deeper member needs or inquiries, Dinneen says.

According to the CEO, a high-performing credit union call center should be able to address service and sales needs and provide downstream member consultation. It should facilitate a member’s journey across branches, the website, the mobile app, the SEG workplace, and more.

Dinneen also restructured his executive leadership team around four main areas: Member Experience, Safety and Soundness, Employee Experience, and Administration. Hendrickson, who most recently served as senior vice president at the New Jersey-based CUSO Member Support Services, joined First Harvest on Dec. 1 to lead the new member services organization. Among those reporting to Hendrickson are Kim Montgomery, recently promoted to senior vice president of retail banking, and Erik Young, recently promoted to senior vice president of direct banking.

Dinneen says the new organizations recognizes the “distinct yet intertwined delivery channels” and helps the credit union move away from being operationally driven.

“We have aligned all of the member touch points, and potential member entry points, under the MX area,” he says.

Although the industry has been moving toward digital banking, First Harvest maintains services at more than 700 workplaces and 20 ATM locations as well as eight branch locations spread across seven counties in New Jersey. This physical distribution channel alone requires its own focus and resources, and it must work hand-in-hand with the call center.

“Both the branches and our call center remain critical member touchpoints,” Montgomery says. “These areas must be well-versed in all aspects of the credit union, including being able to give guidance and offer a range of products, often based on a personalized picture of a members’ financial circumstances. These areas work together to build member trust and solve member issues, so it just makes sense to organize them under the same umbrella from a member experience standpoint.”

Is Your Team Structured For Success? First Harvest Credit Union rearranged resources to improve the member journey across numerous delivery channels. Find dozens of organizational charts in the Callahan Policy Exchange and evaluate how to improve your member touchpoints today. Learn more today.

First Harvest Direct

The credit union began running digital campaigns in August to promote the launch of First Harvest Direct in November. A lot of preparation went into the project, dating back to the implementation of a new core banking system in 2022 and new card issue system in early 2023. With the launch of First Harvest Direct, the credit union rolled out the ability for current and prospective members to open additional deposit accounts online.

CU QUICK FACTS

First Harvest Credit Union

DATA AS OF 09.30.23

HQ: Deptford, NJ

ASSETS: $462.0M

MEMBERS: 46,718

BRANCHES: 8

EMPLOYEES:133

NET WORTH: 8.1%

ROA: -0.61%

“Many members are simply not able to make it to a branch during working hours, and the online account opening allows us to grow into other areas of New Jersey beyond the branch footprint,” Dinneen says. “Many individuals like to begin, or deepen, their membership journey online. However, sometimes an additional step that involves a personal interaction with a staff member arises. This is where the partnering of the call center and digital banking can thrive.”

In a relatively short time, the combined group originated several million dollars in deposits and helped grow net membership by several thousand members in 2023. To provide a seamless experience to all those members, the new call center oversees phone, chat, and digital touchpoints.

“Our new call center team members are doing a great job in living true to our mission of providing world-class service to our members,” Young says. “We’ve been able to be more attentive to our members needs with a quicker response time toward problem resolution. Focusing on our members will get us there, and being active listeners to our members’ needs and concerns will help us grow in the years to come.”

Foundation For The Future

A dedicated area for virtual interactions with members also opens up opportunities to layer in ITMs, additional chat, and other video and virtual banking solutions, Dinneen says.

“It allows us to grow more quickly across the state without needing to construct branches,” Dinneen says. “However, in the immediate term, we can offer our members a seamless concierge membership experience. Like any credit union, we want to grow responsibly because we believe we are a better local banking alternative to banks.”

In addition to insourcing its call center and marketing department, First Harvest also expanded its training and development team and enhanced its SEG relationships — reinstating its government banking area that serves more than 100 New Jersey municipalities as a SEG partner. At the same time, First Harvest has adjusted its loan portfolio — reducing its concentration in long-term mortgages from 62% to less than 55% today — by focusing on auto, home improvement, and home equity loans to diversify the portfolio and working with local dealerships to introduce indirect lending.

“COVID certainly had a longer impact on business operations in our section of the country than perhaps in others,” Dinneen says. “We’ve let some of our recent changes season and come to fruition, but we’ve also been able to revisit some of those decisions in a more positive way for members.”

Running a credit union is becoming increasingly expensive, he says, with costs grouped around three things: people (staffing), places (buildings), and things (systems, equipment).

“While all are necessary, the people expense is always the best investment,” the CEO says.