Artificial intelligence is helping credit unions respond to member requests in a way that doesn’t make selfand service seem like they don’t belong together. The chatbots these cooperatives are deploying not only learn on the job but also offer a touch of personality.

Here, five credit unions offer insight on best practices and lessons learned from using chatbot avatars. Read on to learn how credit unions are using high-tech to keep high-touch member service alive.

MASSMUTUAL FCU

eMMA has been serving up answers for MassMutual Federal Credit Union ($358.4M, Springfield, MA) since mid-May, says Christopher Brown, the Bay State’s chief operations officer for the past nine years.

Brown says the members love the self-service provided by the POSH chatbot, and the cooperative benefits, too, from the reduced number of live calls.

Where has MassMutual FCU deployed the chatbot? Who handles the responses?

Christopher Brown: eMMA is available on the website itself, on the online banking pages, and within the mobile app. Answers might be different if the member is within online banking rather than the website. The bot itself handles the responses for now. We’re implementing a service next year that will be able to hand off a chat through the chatbot to a live person or a live chat.

How much do members use it? How do you think it has impacted member service, especially in light of the pandemic?

CB: In the past month, we’ve had 188 total chats with 843 total messages exchanged. For us, these are good numbers as we only did a soft rollout of the chatbot it pops up right as you enter the website. It’s given members more freedom to bank and get questions answered when it’s convenient for them.

What’s your advice to credit unions considering a chatbot?

CB: Start small, get it out there, and add as you go. Don’t try to think of every possible question at the beginning. See what your members are asking that the bot can’t answer. Then, add those questions.

How’d you come up with the name eMMa?

CB: We’re a single sponsor credit union sponsored by the Massachusetts Mutual Life Insurance Company (MassMutual). The name is partly derived from our sponsor, which is known as MM internally.

TELCOE FCU

Telcoe Federal Credit Union ($438.4M, Little Rock, AR) went live with Lucy in August 2020, says marketing vice president Michele Beasley.

Lucy provides an easy way for members and potential members to get answers to commonly asked questions, says Beasley, who has been with the Arkansas cooperative for 19 years.

Where has Telcoe FCU deployed the chatbot? Who handles the responses?

Michele Beasley: It’s only on our website right now, but we’ll make sure Lucy is accessible through our mobile app when we launch our new app next year. We have a dedicated staff member, Amanda McCarty, who responds to inquires emailed from our website and our chatbot, and we get monthly reports.

How much do members use it? How do you think it has impacted member service, especially in light of the pandemic?

MB: At its peak we received as many as 695 opens on the chatbot to ask a question. It averages about 450 per month.

What’s your advice to credit unions considering a chatbot?

MB: The chatbot should evolve. It’s not a product or service to implement and then leave alone. The questions should grow, and input from front-line staff and members is vital to make it useful.

We know members want to solve problems when we’re closed or without picking up the phone to call. Allow members to ask for someone to contact them if they did not find what they were looking for in the chatbot. This is vital to make the experience positive and helps you build questions going forward.

Also, consider letting members see the credit union’s personality in the way you answer questions.

Allow members to ask for someone to contact them if they did not find what they were looking for in the chatbot. This is vital to make the experience positive.

How’d you come up with the name Lucy?

MB: The chatbot went live without a name, and I received a message from a member suggesting we give it a personality and name. We wanted a short name and research from our website vendor, Avtec, said a female name was more popular among chatbots. We narrowed down name suggestions and, with the iconic TV series I Love Lucy in mind, we hope our members love Lucy as well.

UNITED FCU

United Federal Credit Union ($3.7B, St. Joseph, MI) began offering members a basic chat function in early 2020 and has been refining it since, says Warren Pattison, the cooperative’s head of digital innovation and emerging technology.

A major advancement was the launch of AI-enabled Mya in March 2021, which helps the cooperative better keep up with members growing needs and demands for convenient, contactless service, says Pattison, who has been with United for four years.

Where has United FCU deployed the chatbot? Who handles the responses?

Warren Pattison: Mya is available at UnitedFCU.com and in our mobile app. We wanted our members to have a chatbot that delivers value today and can scale as technology and consumer expectations evolve. Finn AI has a natural language processing engine that is pre-trained on millions of real-life generic questions from retail banking customers, and its data science team focuses on continually improving and expanding the model.

At UFCU, our job is to write the responses to each member in a way that reflects our brand and desired user experience. We also review conversation analytics and identify opportunities to expand end-to-end user experiences either with content iterations, API enablement, or process adjustments. Ultimately, responses are a partnership where Finn AI identifies what the member is asking, and we deliver the UFCU-branded response and experience.

How much do members use it? How do you think it has impacted member service, especially in light of the pandemic?

WP: United averages 5,000 engaged sessions per month within Mya. Since its launch, Mya has maintained an average containment rate of 51%, which has had a positive impact on our member service center’s engagement handling, especially for high-touch needs. We launched Mya almost one year into the pandemic, and it has been a great way to provide convenient and contactless service.

What’s your advice to credit unions considering a chatbot?

WP: Integrating chatbots across many platforms and service providers is a large undertaking. This was an interesting year at United as we undertook a major project in a core conversion in addition to an acquisition of a bank, which stretched our internal resources beyond 100% capacity.

The one piece I’d recommend if I could do this over, would be to ensure there would be little overlap with major projects. We were fortunate to have selected an outstanding chatbot platform, but there were a lot of learnings from the execution that required a lot of time.

How’d you come up with the name Mya?

WP: We had a committee working on the chatbot project, and they selected a few options for names. Since the chatbot was going to be an addition to Team United, we wanted to give our employees the chance to vote on the name they thought best represented what the chatbot would offer our members. They selected Mya, which is short for My Assistant.

USALLIANCE FINANCIAL FCU

USALLIANCE Financial Federal Credit Union ($2.0B, Rye, NY) went live with its Posh AI chatbot this past July, says Deanna Rasco, the New York City-area cooperative’s vice president for call center and member relations.

Since then, it’s proven its ability to handle member inquiries and seamlessly transition the member to a live representative for more complex interactions, says Rasco, who’s been with the credit for seven years, four in her current role.

Where has USALLIANCE Financial FCU deployed the chatbot? Who handles the responses?

Deanna Rasco: We’ve chosen a multi-phased approach to our implementation of AI. Currently, Alli is only available on our website. The remaining phases will cover our interactive voice response (IVR) system, online, and mobile banking. It’s a joint effort between our member services team and marketing. This allows us to provide accurate and relevant information to our members while keeping the USALLIANCE brand and voice intact.

How much do members use it? How do you think it has impacted member service, especially in light of the pandemic?

DR: Members have acclimated nicely to using Alli. Our website chat volume has increased 65% since we launched at the end of July. Alli has been able to handle approximately 74% of the chats received without needing to escalate the member to a live representative.

We ask for member feedback during each chat interaction, and it has been overwhelmingly positive. The feedback has allowed us to make updates and changes in real-time to optimize the member experience.

What’s your advice to credit unions considering a chatbot?

DR: A solid knowledge management system helps greatly. We were able to provide hundreds of custom responses in a short amount of time because we already had the information documented.

But the most critical piece for us was the testing. We needed to make sure the content flowed and made sense. Alli was put through rigorous testing with USALLIANCE employees before launching to our members. This made Alli the awesome chatbot she is today.

How’d you come up with the name Alli?

DR: This was the fun part. We included all USALLIANCE employees in the project. We sent a series of surveys requesting name ideas and asking staff to vote on their favorite name. Alli was recommended by an employee.

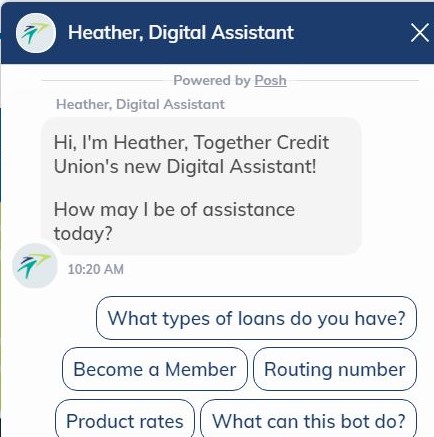

TOGETHER CREDIT UNION

Members have been getting together with Heather since March at Together Credit Union ($2.3B, St. Louis, MO).

The chatbot launched on March 15 to better support the response to a surge in member service requests during the pandemic and currently has more than 125 automated answers that are provided through natural language processing technology, says Tom Kraus,chief operating officer at the St. Louis cooperative for the past three years.

Where is the chatbot deployed and who handles the responses?

Tom Kraus: Heather is available in our online and mobile banking systems. Our next step is to add live chat technology for additional real-time support. We have representatives from multiple teams currently contributing to the success of Heather. However, our goal is to centralize the responses to our Member Contact Center. This will allow us to provide a consistent member response across our service and support channels.

How much do members use it and how do you think it has impacted member service, especially in light of the pandemic?

TK: Within two months of launching, Heather engaged in more than 2,500 chats and provided more than 6,500 responses. Heather is meant to assist members in the moment with basic questions, allowing contact center and branch staff to focuson building relationships and more complex situations. Together, they can help an even greater number of members.

What would be your best advice to other credit unions who are considering doing the same?

TK: It’s important to evolve your technologies to assist members and create touchpoints for interactions. When members interact with Heather, we can capture those interactions and learn from them. If there’s anything Heather doesn’t know today, we can add that knowledge tomorrow.

How’d you come up with the name Heather ?

TK: We hosted a Digital Assistant Sweepstakes designed to encourage our members to try out a feature and begin building the habit of asking Heather their questions first. We also hosted a sweepstakes for our employees to gather feedback on Heather. It was a great experience!

Interviews have been edited and condensed.