Credit unions have been posting strong lending growth for a few years now, but individual institutions have their own strategies to help them achieve their growth goals. And bigger doesn’t always lead to better performance.

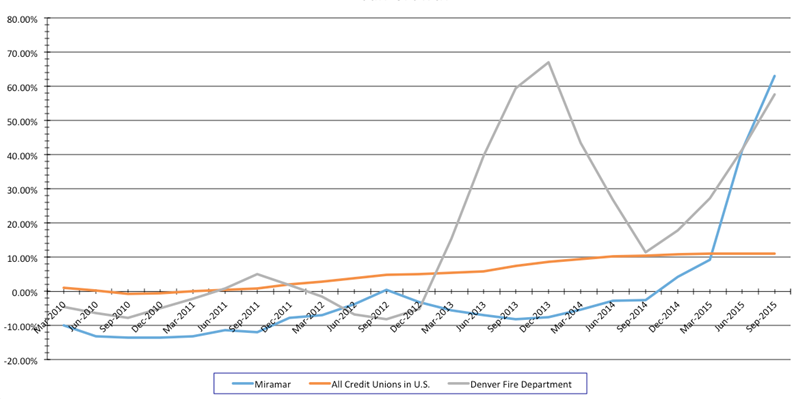

For example, two of the top 10 credit unions in third quarter 2015 loan growth Miramar Federal Credit Union ($171.6M, San Diego, CA) and Denver Fire Department Federal Credit Union ($142.9M, Denver, CO) are each single-branch institutions tightly focused on service-based SEGs, military and fire and rescue, but one has grown by making first mortgages and the other topped list by buying loans from other credit unions.

LEADERS IN 12-MO LOAN GROWTH

For all U.S. credit unions >$20M in assets* | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

| State | Name | 12-Month Loan | Loans as of 3Q 2015 | Loans As Of 3Q 2014 | Assets | |

|---|---|---|---|---|---|---|

| 1 | CA | Families and Schools Together | 71.10% | $82,382,266 | $48,148,140 | $135,643,698 |

| 2 | WI | Connexus | 69.12% | $1,005,091,707 | $594,315,891 | $1,136,605,516 |

| 3 | AK | ALPS | 67.46% | $40,940,054 | $24,447,828 | $64,508,985 |

| 4 | CA | Miramar | 63.18% | $80,165,808 | $49,128,442 | $171,602,962 |

| 5 | NE | Trius | 57.90% | $53,594,714 | $33,942,744 | $60,808,153 |

| 6 | CO | Denver Fire Department | 57.77% | $52,895,132 | $33,525,740 | $142,929,592 |

| 7 | MI | Kalsee | 56.66% | $127,614,252 | $81,460,584 | $168,744,887 |

| 8 | PA | Riverfront | 56.16% | $92,398,514 | $59,170,678 | $170,321,996 |

| 9 | PA | Inspire | 50.98% | $76,465,573 | $50,645,369 | $90,890,664 |

| 10 | DE | Dover | 49.37% | $271,854,890 | $182,002,090 | $421,762,806 |

* excludes significant mergers

Source:Peer-to-Peer Analytics by Callahan & Associates

Based at Marine Corps Air Station Miramar, Miramar FCU posted 63.18% total loan growth in the third quarter over the same period in 2014, increasing the rolling balance of its portfolio from $49.1 million to $80.2 million as of Sept. 30, 2015.

That’s fifth among more than 2,500 credit unions with more than $20 million in assets that did not report significant mergers in that quarter.

DFDFCU, meanwhile, is seventh on Callahan’s 12-Month Loan Growth leader table, with overall loan growth of 57.77% in the quarter ending Sept. 30, 2015, over the year-ago period, boosting its portfolio from $33.5 million to $52.9 million in oneyear.

LOAN GROWTH

For all U.S. credit unions | Data as of 09.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

So how’d they do it?

Trading Liquidity For Loans

Paul Socia says there was little organic growth and excess liquidity when he took over as president and CEO of Miramar FCU approximately 18 months ago. So he pushed a new strategy.

We cashed out of much of our lower-yielding securities either through maturity or taking a penalty for early withdrawal and used the funds to purchase loans already funded from other credit unions throughout California,Socia says.

Socia says Miramar bought primarily first mortgages and consumer auto loans, along with a small number of member business loans.

Consequently, in the third quarter of 2015, Miramar posted $64.4 million in first mortgage loans, a growth rate of 54.67% compared with 6.01% for its asset class of $100 million to $250 million credit unions, 12.39% for all California credit unions,and 10.46% for all 6,400 or so credit unions in the country.

Those moves also resulted in a 323.31% increase in new auto loans and 735.31% in used auto loans year-over-year at the Southern California credit union.

Follow The Leader

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight.

Good Deals For Great Credit

The membership at Denver Fire Department Federal Credit Union presents a challenge for profitable lending growth, president and CEO Mark Lau says, pointing to an average credit score of 785 and no delinquencies at the end of the year.

Traditional methods like going after indirect auto lending really won’t work here because everyone can get great rates anywhere, and we can’t get the spreads to make it work, Lau says.

So instead, the 5,700-member credit union began focusing on making first mortgages. It partnered with a local CUSO, Centennial Lending, to handle the underwriting and other back-office work, brought in employees with the needed skill set for the member-facingside, and began offering specials such as a zero-cost mortgage.

Find your next partner in the Callahan Buyer’s Guide. Click here to browse hundreds of supplier profiles by name or service area.

We ate the closing costs and were able to put on a lot of loans that way, Lau says. That really kicked it off.

Most recently, the credit union offered $499 in closing costs for five- to 15-year notes and $995 for 30-year mortgages.

In the third quarter of 2015, DFDFCU increased its mortgage portfolio by 87.81% to $31.6 million, compared with a growth rate of 6.01% for its $100 million to $250 million asset class, 17.90% for all Colorado credit unions, and 10.46% for all creditunions in the United States.

The word got out, Lau says. We have a steady stream coming in now, and with their high credit scores, we’re not taking on a lot of risk. We’re in good shape.

You Might Also Enjoy

- How Attentive Listening Makes For Stronger Lending<

- 6 Things To Know About Credit Union Lending Trends<

- Turn Approved Loans Into Funded Ones<

- How To Build An MBL Program<