For most lenders in today’s hyper-competitive market, maximizing growth without excessive exposure to risk is a top priority. But how does an institution handle this when in-house resources are already stretched thin?

The answer is analytics.

One particular credit union wanted to lend deeper and was faced with the decision of how to approach such an endeavor with as little risk as possible. Without seasoned experts on staff to devise a game plan, the credit union decided to turn to an outsourced analytics consulting team for the answer.

The provider’s analysis identified loan characteristics associated with good payment behavior, particularly in those segments that a customer would like to penetrate. The analysis developed guidelines for decisioning certain segments more leniently, allowing for expansion into lower-score tiers while managing for risk. Custom model development partnerships are also available for clients that want to take analytics to the next level.

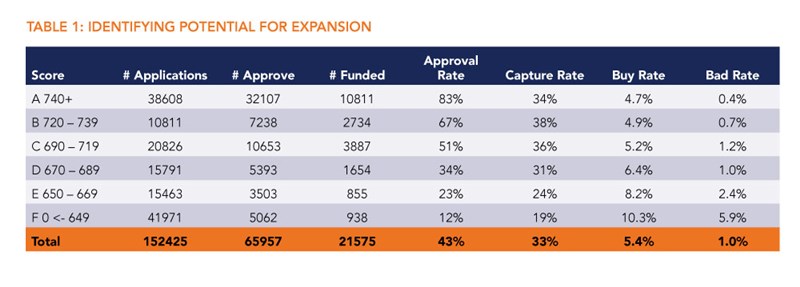

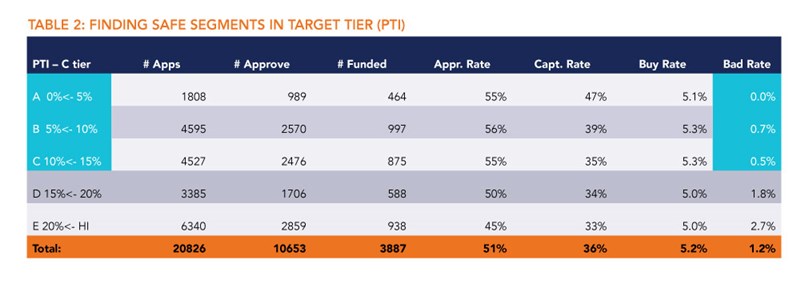

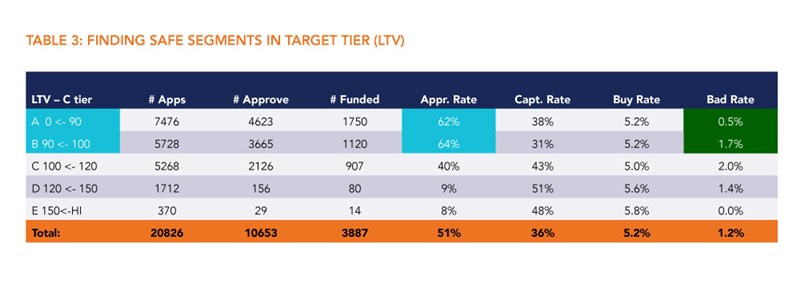

The credit union’s analytics provider used a combination of loan origination system and core data to generate detailed reports (excerpts of which are given below). It investigated the suitability of each score tier for expansion potential by looking at a wide variety of metrics such as the number of applications received, current approval rate, capture rate, price, and risk of default. It reviewed the target score tier by various attribute levels to find segments with acceptable risk and expansion potential.

The provider found that the credit union is currently approving C-tier applications with an LTV below 90% at roughly the same rate as applications with an LTV between 90% and 100%, and are also pricing them the same. However, the bad rate is more than three times as high in the latter category. Additionally, applications with a PTI below 15% show decreased risk of non-payment. Approving C-tier applications more liberally in low LTV and low PTI categories is a safe way for this client to expand into the C segment. Alternatively, lowering the price in these segments will increase the capture of loans with these desirable characteristics.

Using the provider’s findings, the credit union increased its approvals of applications in the C segment where LTV and PTI loan attributes are below 90% (LTV) and 15% (PTI), by loosening loan software requirements and changing their expert rules. These changes allowed for additional growth in this segment with minimal impact on risk levels. The approval rate of these applications increased from 58% to 65%, leading to an increase of 20 more loans funded every month. At a profit margin of 5% on this segment and a $400,000 increase in bookings, the credit union’s profits increased by $20,000 a month.

As an analytics provider, CRIF Achieve has a proven track record of helping credit unions like the one described above safely expand to lower score tiers and experience accelerated portfolio growth. How to safely expand into lower-score tiers is just one of the questions the Achieve team routinely hears from clients looking to increase growth opportunities while keeping risk at bay. For a copy of our latest eBook that details the seven biggest challenges Achieve helps credit unions conquer, please click the button below.

hbspt.cta.load(70258, ‘4f7e8990-8e98-4f74-8597-f1ac22d0724f’,{});

hbspt.cta.load(70258, ‘4f7e8990-8e98-4f74-8597-f1ac22d0724f’,{});