Top-Level Takeaways

-

Delinquencies have dropped from 3.17% to 0.82% in less than three years at Total Choice FCU.

-

Seven of the credit union’s 18 employees are certified financial counselors.

Beleaguered borrowers might be just numbers to big banks and collectors, but Total Choice Federal Credit Union ($54.0M, Hahnville, LA) takes the measure of its members by looking them in the eye.

A new philosophy at the New Orleans-area financial cooperative combines financial counseling with aggressive collections and has resulted in sharply lower delinquencies as well as members who understand the benefits of financial wellness.

To see the looks in their eyes, to see they are getting it,’ that’s the true reward, says Mary Vedro, CEO of Total Choice since late 2015.

CU QUICK FACTS

Total Choice FCU

Data as of 06.30.17

HQ: Hahnville, LA

ASSETS: $54.0M

MEMBERS: 6,415

BRANCHES: 3

12-MO SHARE GROWTH: 3.6%

12-MO LOAN GROWTH: 8.4%

ROA: 0.40%

When Vedro joined the credit union as COO in May 2013, she found delinquency rates across the loan portfolio high enough to threaten the credit union’s viability. Perhaps that’s no surprise given the credit union’s approach to member service.

The credit union’s attitude toward lending and collections was just too lax, she says. In a way, we were babying members and not holding them accountable to the lending contracts they signed.

ContentMiddleAd

So, Vedros beefed up the credit union’s collections and financial counseling efforts.

Hiring a dynamic collection manager and getting board support for active collections were critical first steps in the rapid descent of delinquencies that occurred none too soon for the small credit union.

I knew if we didn’t do something, ultimately our delinquent loans could become the death of us, Vedros says. Once we started enforcing our rights and using a collections attorney, members started realizing we were serious.

Click through the tabs below for a deeper dive into Total Choice FCU’s financial performance. Click on the graphs to view in Peer-to-Peer.

TOTAL DELINQUENCY

Loan delinquency at Total Choice had been consistently higher than average since it converted to a community charter in 200. That trend has reversed.

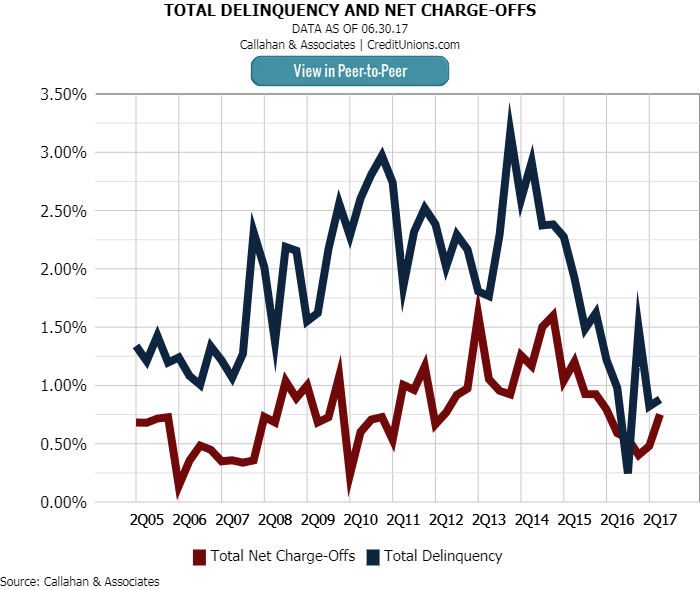

TOTAL DELINQUENCY/NET CHARGE-OFFS

Total Choice’s overall delinquency rate and net charge-offs alike have fallen sharply since the credit union began emphasizing collections and financial counseling in 2013.

CREDIT CARD DELINQUENCY

Credit card delinquencies at First Choice have flat-lined as a result of the credit union’s collections and counseling work.

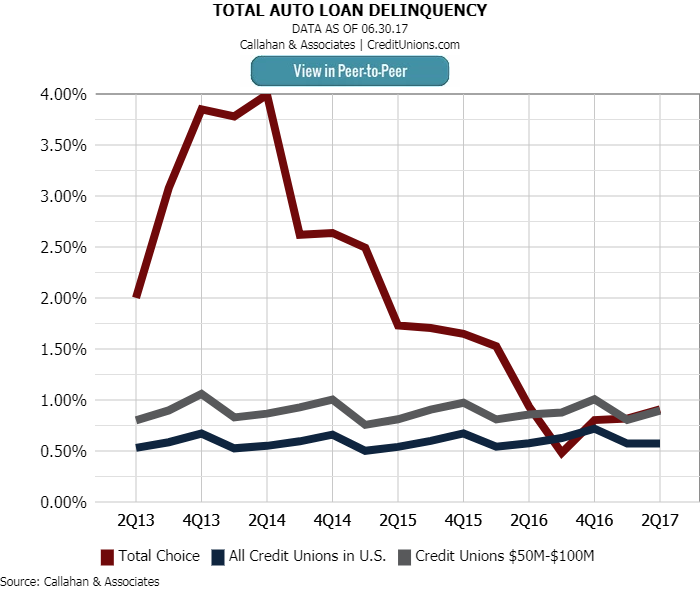

TOTAL AUTO LOAN DELINQUENCY

Total Choice’s auto loan delinquencies plummeted soon after Mary Vedros became COO in 2013 and assembled a new collections team.

Mary Vedros, President/CEO, Total Choice FCU

Total Choice also got serious about showing members another way to approach finances.

It instituted a robust counseling program targeted at folks who have either been turned down for a loan or have fallen behind on payments.

Seven of the credit union’s 18 employees are CUNA Certified Credit Union Financial Counselors. They focus on teaching money management skills, debt reduction, and how to avoid predatory lenders.

Use Data To Guide Your Strategy

Benchmarking your delinquency against relevant peers shows can show whether a strategy like Total Choice’s is needed at your credit union. Callahan’s analytics software can help.

Their stated goal is simple: Help members become responsible for their own financial lives.

The counseling process includes a budget analysis; developing a monthly plan for spending, paying bills, and saving; and follow-up sessions.

Counselors are not there to provide therapy focused on personal issues, the guidelines stress. Instead, according to the program’s guidelines, the counselors can demonstrate ways to make things better for the member by:

- Teaching members how to control spending and reduce dependency on credit.

- Discussing ways to enjoy a fulfilling frugal life.

- Helping members to know the amount of credit they can afford.

- Helping members speed up debt reduction and cut interest expenses.

- Helping members resolve errors on credit reports.

An Outline For The Benefits Of Financial Counseling

Soon after Mary Vedros became COO of Total Choice FCU in 2013, the credit union adopted a financial counseling program that includes the following outline for specific uses and benefits of financial counseling:

- Enhances member loyalty to the credit union.

- Possibly reduces losses due to bankruptcy.

- Public relations tool that demonstrates goodwill.

- Offers a competitive edge over other financial institutions.

- Helps members improve credit worthiness.

- Assists members with in-depth workout plans.

- Creates a financially strong membership base, which in turn strengthens the credit union.

The counselors meet with their clients approximately four months after the initial visit to review and revise. And the results are usually promising.

I can think of only one case in which the member did not heed the advice of the counselor and got stuck in an upside-down car loan at a high rate, Vedros says. Unfortunately, I think he learned his lesson.

The more typical ending is happier.

It’s a true blessing to see members’ joy when their credit rating has improved and their financial life is more secure, Vedros says.

As for her staff, they feel empowered to help more members when they see the results the members are working hard to achieve.

When you become a partner to help your members stay on track and become educated about finances and their own situations, you can only succeed, the Total Choice CEO says.