The average member age at Altra Credit Union ($1.1B, Onlaska, WI) is a whipper-snapping 39 compared to the industry average of 47. How has it accomplished such a feat?

The credit union offers products that appeal to the young adult set, such as special youth certificates, student loans, and branded student credit cards. It has also adopted technology that allows members to open accounts online and deposit checks through mobile banking.

With branches in nine states, the credit union’s geographic footprint demands strong mobile offerings. Altra strives to provide excellent products and services to all members, but it realized it needed a specialized strategy to develop relationships with youth and gain long-term loyalty.

So five years ago, Altra committed to focusing on its young adult market with the addition a full-time youth coordinator. According to Mary Isaacs, Altra’s executive vice president and chief financial officer, and Cheryl Dutton, vice president of marketing, the credit union needed someone to focus on community events, financial literacy which has evolved into a full-time coordinator position and youth promotions.

The credit union now partners with colleges and high schools in Wisconsin, Tennessee, and Texas. It sponsors college financial aid nights, holds cash camps for 11- and 12-year-olds, and sponsors teens and money events for 13- though 17-year-olds. In addition, the credit union is a title sponsor for several high-profile community events that build awareness for the credit union and its youth programs.

Specialized Products For A Special Membership

- Youth match program. For members 0-17 years old, the credit union will match a $5 initial deposit.

- Youth match April special. The credit union’s $20 match brought in more than 700 new youth members.

- Youth certificates. An APY of 5% for up to $2,000 has generated more than $2.4 million in new deposits in one year.

- Student loans and branded credit cards. The credit union uses youth-oriented lending products to teach young members how to build good credit and make financially responsible decisions.

- Home-Buying After Hours. Social mixers to help young adults learn about the home-buying process.

- First-time home-buyer certificate. Members may deposit up to $25,000 and withdraw any time without penalty if they take out a mortgage with the credit union

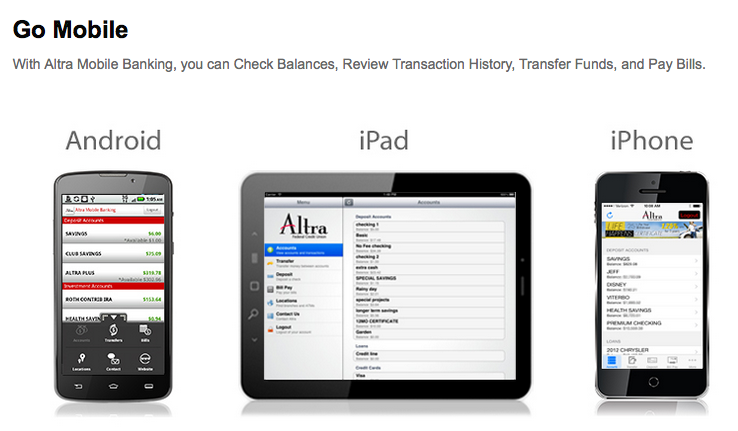

Two years ago, Altra formed its Go Mobile team to increase online and mobile services education. It conducted interviews across the credit union and assigned 27 team members to various events. Go Mobile team members wear branded clothing and travel to branches, college and athletic events, wellness fairs, and local businesses to demonstrate the credit union’s mobile capabilities and give away prizes. They hold prize drawings and use real $3 checks, courtesy of Altra, to orient members on the credit union’s mobile deposit application.

In addition to branded clothing, the Go Mobile team has leased a branded vehicle to increase awareness in the community even more in the coming year. Despite being the initiative of a billion-dollar institution, the Go Mobile team offers a more grassroots approach than traditional advertising and speaks to younger members.

Beyond achieving a dramatic decrease in average member age from 44 just a few years ago to 39 currently Altra has increased its mobile adoption as well. Mobile deposit transactions are now comparable to a medium-sized branch, and the credit union is planning to roll out even more mobile capabilities such as locks and unlocks for debit and credit cards and text fraud alerts.

Keeping up with technology remains a real challenge, but Altra is not afraid to try new things. It discusses and agrees to ideas quickly, knowing that not everything will work out. For example, when PC-based remote deposit proved difficult to support and text banking became obsolete in the face of smartphones and mobile apps, the credit union made the difficult decision to discontinue both services in favor of keeping up with newer technology.

Mary Isaacs and Cheryl Dutton presented on Altra Credit Union’s Go Mobile strategy during a 2015 Callahan & Associates Leadership Webinar. View the full webinar recording if you are a Leadership client, or contact us to request access and discuss Callahan’s Leadership Program in more detail.

You Might Also Enjoy

- Smile For Selfie Pay

- Mobile App Drives Short-Term Lending At WSECU

- Mobile Services And Delivery Channels