Lenders reported a record year for originations in 2021 despite rising asset prices and rates increases, both of which were substantively driven by inflationary pressures. The average 30-year fixed mortgage rate rose 20 basis points from 2.90% as of Sept. 30 to 3.10% as of Dec. 31, according to data from Freddie Mac.

Despite increasing rates, homebuyers continued to purchase property at ever-higher prices, although it’s important to note the mortgage pipeline acceleration is slowing from mid-pandemic records. On the consumer lending front, the Federal Reserve reports that outstanding consumer credit balances increased 6.6% over the fourth quarter. Consumers are spending more, and the debt is starting to stick around as prepayments slow.

Key Points

- Loan balances increased 8.0% year-over-year and 2.7% quarter-over-quarter to reach nearly $1.3 trillion. First mortgages and used autos were the main drivers of growth in 2021. They increased 10.8% and 10.3%, respectively, year-over-year. Notably, credit card balances which were most impacted by pandemic-era paydowns expanded 4.9% in the fourth quarter.

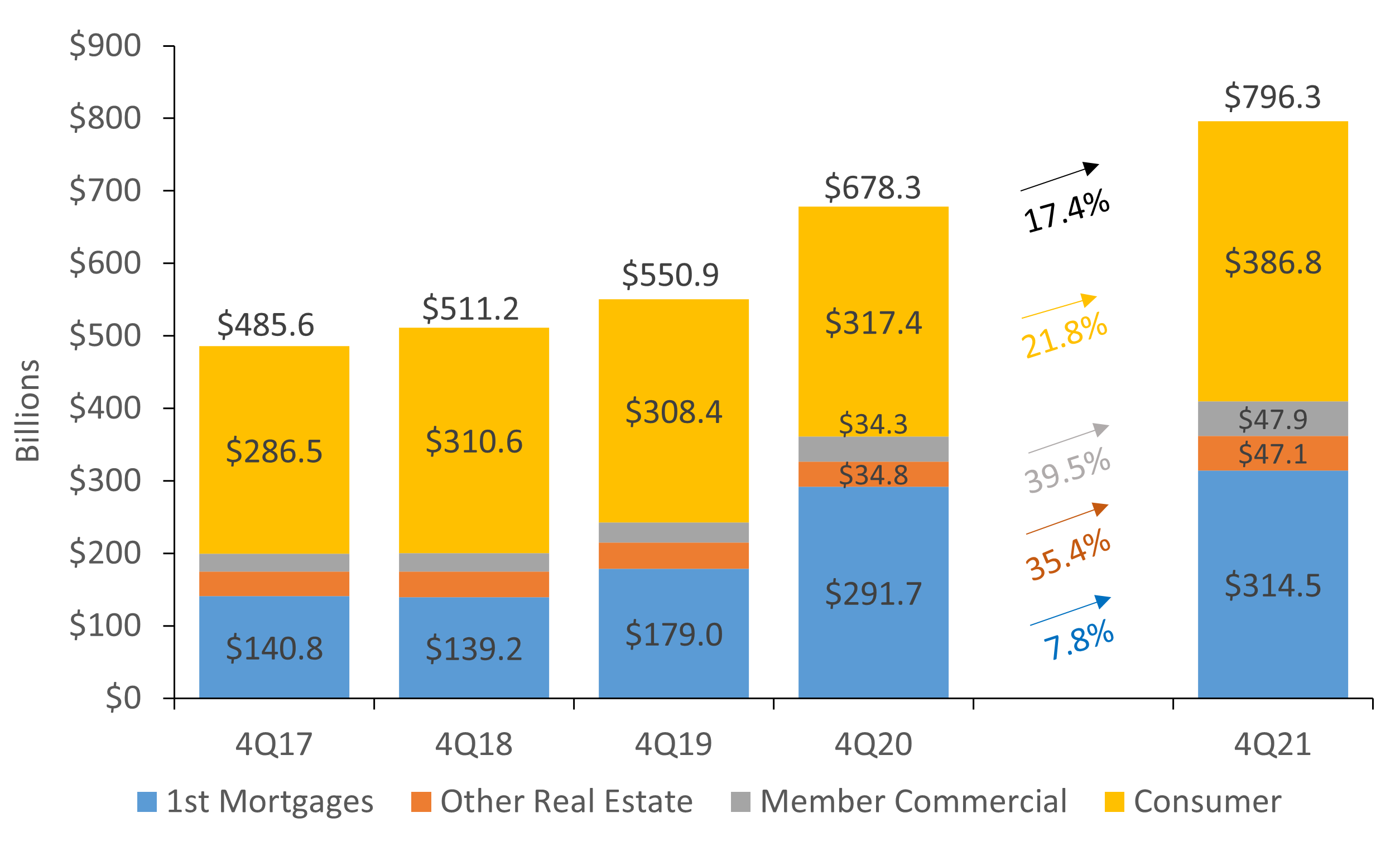

- Total loan dollars originated by the industry in 2021 increased 17.4% from the previous year. The greatest growth came in the consumer lending space, which originated a record $386.8 billion in loans through 2021, $69.4 billion more than the year prior.

- At 39.1 million, the year-to-date number of loans granted was the highest on record for credit unions. Non-mortgage lending reported strong growth in quantity though 2021. However, mortgage originations while up in dollar terms – fell in number. Rising asset prices rather than volume are what spurred the production growth in the mortgage space.

YEAR-TO-DATE LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

As mortgage rates picked up in the last quarter of 2021, first mortgage loan origination growth slowed; however, it remains higher than the historical average.

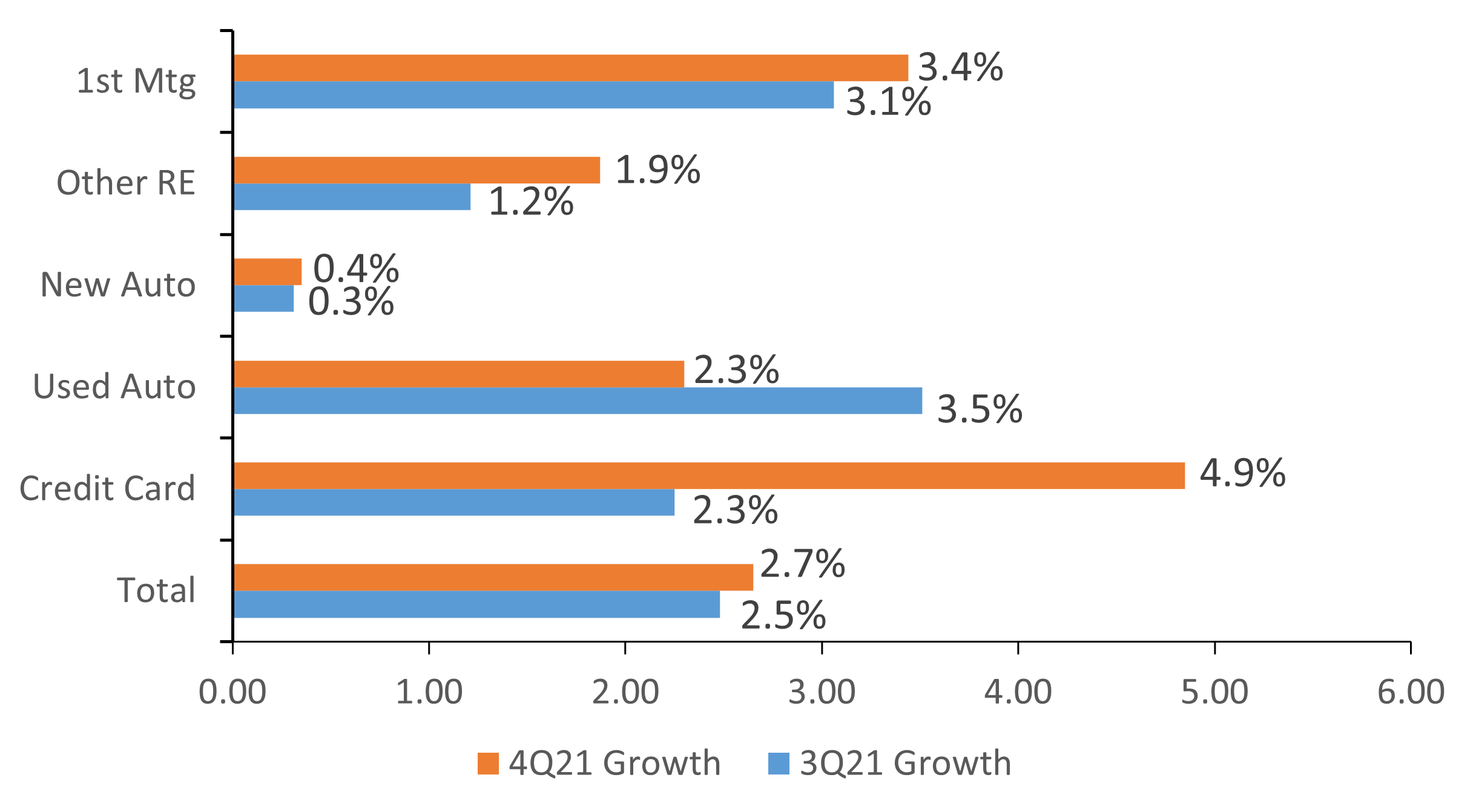

QUARTERLY OUTSTANDING LOAN BALANCE GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates |CreditUnions.com

All major loan categories expanded quarter-over-quarter. Credit cards and first mortgages led that growth.

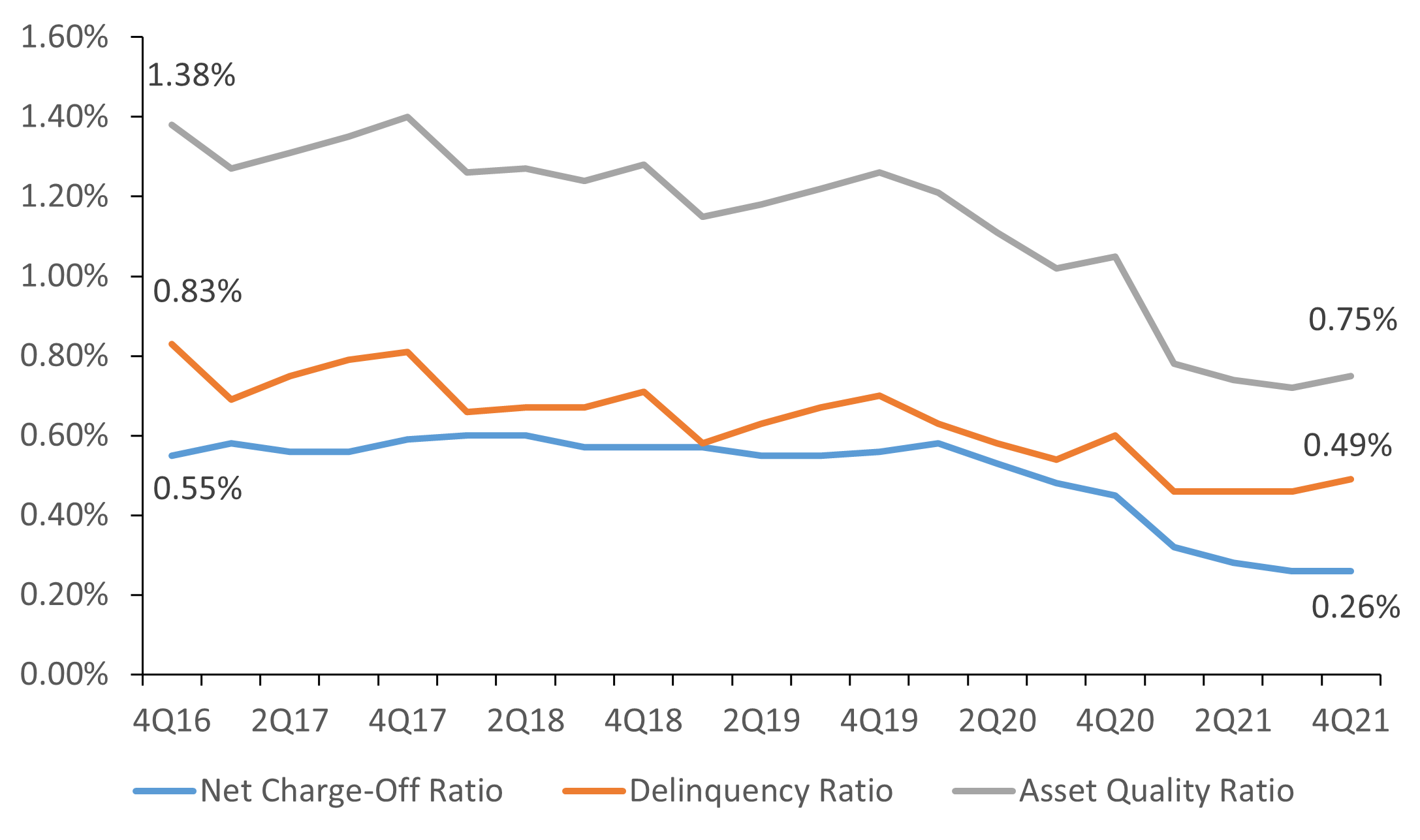

ASSET QUALITY

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

Consumer loans became marginally more delinquent in the fourth quarter. Consequently, the asset quality ratio the delinquency ratio plus the net charge-off ratio increased 3 basis points.

The Bottom Line

First mortgage lending set another calendar year record and remains a primary line of business for credit unions; still, the real lending story of 2021 is in the consumer space. Despite headwinds from inflation, supply chain shortages, and rising interest rates, credit unions made more loans, in both number and dollar terms, than in any year prior. And these originations are staying on the balance sheet.

Asset quality remains strong, yet there was a slight degredation toward the end of the year. This is good to monitor, as higher-risk consumer loans encompass a greater portion of portfolios.

Read the full analysis or skip to the section you want to read by clicking on the links below.

|

AUTO |

EARNINGS |

HUMAN CAPITAL |

|

INVESTMENTS |

LOANS |

MACRO |

|

MEMBER RELATIONSHIPS |

MORTGAGES |

SHARES |