In a landscape where small businesses are increasingly seeking flexible, low-cost financial solutions, credit unions are stepping up to meet the demand for more personalized business checking options. With their community-focused approach and competitive offerings, credit unions are becoming a go-to resource for entrepreneurs looking to manage cash flow and grow their businesses with greater financial support.

Platinum Federal Credit Union ($320.1M, Duluth, GA) introduced business checking services in 2004. Today, the product comprises 44% of the credit union’s portfolio.

According to CEO Kabir Laiwalla, the credit union wanted to offer its local businesses simpler, more cost-effective solutions.

“That’s what attracted small to mid-sized businesses to bank with us,” he says. “That’s how we now have 2,500 business accounts.”

At Platinum, business members enjoy a flat monthly fee of $60 per month, up to $100,000 in cash deposit withdrawals, and unlimited transactions for everything else. This is a stark contrast from the strict limits on transaction and withdrawal amounts that are common in business checking.

In the Northwest, Pacific Crest Federal Credit Union ($346.3M, Klamath Falls, OR) has experienced similar success with its business services, with business checking accounting for 17% of its portfolio.

“We were in the bottom third in the nation eight years ago,” says CEO Chad Olney. “We’re in the top quartile now.”

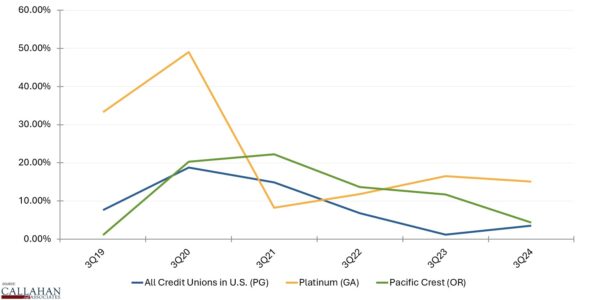

YEAR-OVER-YEAR DEPOSIT GROWTH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

Like Platinum, Pacific Crest’s business accounts offer lower fees on average or no fee at all for some options. However, Olney says the real differentiator is the credit union’s quality of service, especially its responsiveness.

“They know they can call or come in and actually talk to somebody who can help them and is responsive to their individual needs,” he says.

Olney does warn, however, that businesses often have higher standards than the average retail member because businesses have more to lose.

“If there’s an issue with a regular member’s debit card, it might stop them from making a purchase,” he says. “But if on the business side you do something that decreases the revenue coming in, it’s significantly more impactful and remembered for a much longer time. So, you have got to dial in your processes.”

Relationships And Reputation

In the business banking world, the power of word-of-mouth is too big to ignore.

“Business owners tend to talk to other business owners,” Olney says. “They run in the same circles. They share similar struggles. Business members talk about their relationship with their banks to other business representatives.”

Laiwalla recalls the lasting impact a single wholesaler had on Platinum after opening an account in 2005. He used his Platinum business account to pay vendors and conduct business, which amplified the credit union’s presence in the community.

“A lot of community members were buying supplies from him for their gas stations or convenience stores,” Laiwalla says. “They said, huh, he’s banking at Platinum, maybe we should move our account to Platinum.”

To increase the chances of this ripple effect occurring, many credit unions find it useful to build relationships with trade associations or their local chamber of commerce.

Platinum benefitted early on from its involvement with the Atlanta Retailers Association, which had provided a large donation toward the founding of the credit union. This relationship combined with regular appearances at trade shows and community events made business services soar at the credit union.

“Our membership sees the value that banking with a community-focused financial institution brings,” Laiwalla says.

According to the CEO, businesses know they can turn to Platinum in times of crisis because it’s a trusted name within the community. Ergo, why not regularly bank with the credit union?

Pandemic And PPP

Similarly, Olney says the secret sauce behind Pacific Crest’s business checking growth is its positive reputation among CPAs and accounting firms.

“That came about purely by accident and had a lot to do with PPP,” he says. “During the pandemic, we became a sort of community expert on it.”

This was unexpected because the credit union originally had no intention of participating in the paycheck protection program at all.

“We didn’t have an established relationship with the Small Business Association,” Olney says. “We were telling our businesses to go anywhere else that had their credentials and relationships and do it faster. They did, and banks literally wouldn’t accept their applications.”

During the pandemic, banks were accused of prioritizing larger businesses over smaller ones. It didn’t take long for Pacific Crest to identify a need among its membership.

“We had a member come to our drive-thru, put his application in the tube, and say, ‘I know you guys aren’t planning to do this, but you’re my only hope because nobody else will take it,’” Olney says.

Determined to help as many small businesses as possible, the credit union contacted local accountants to spread the word that it was taking PPP applications.

“That really kicked things off,” Olney says. “We were just trying to help our businesses stay in business.”

Meanwhile, Platinum became a licensed SBA lender in 2019 but intentionally chose to not promote its new certification until staff could become more familiar with it. That all changed less than a year later.

“We grew a lot of business accounts during COVID,” Laiwalla says. “Not all of them stayed with us, but a lot of them did. That’s how we had a big boom in 2020 to 2021.”

By the end of the pandemic, Platinum serviced $25 million in PPP loans.

Both CEOs say their organization’s dedication to saying yes when other financial institutions were saying no left a lasting impression on their markets.

Looking Ahead To 2025

The economic landscape presents a mixed but cautiously optimistic picture. This is good news for many business owners and, by extension, the financial institutions serving them. After all, prosperous businesses present cross-selling opportunities.

“Most of the time it’s loans first, checking second,” Olney says.

Businesses also tend to maintain higher account balances than retail members, giving credit unions a boost to their liquidity and lending capacity.

“On the deposit side, because many industries are seasonal, we know when to expect to see a decline or uptick in deposits,” Olney says. “On the lending side, because of the repricing nature of commercial loans, it’s helped with our portfolio management.”

Laiwalla says he often consults other credit union leaders about the impact business checking has had on his organization.

“With businesses, that cash flow keeps churning,” he says. “We are working with new businesses pretty much every week, and that is bringing in more and more cash flow. So, we have not had any issues with liquidity.”

Unlock Smarter Deposit Strategies With Peer Suite. Compare your credit union’s deposits and savings performance against industry peers to uncover trends, identify opportunities, and elevate your strategy. Peer Suite gives you the data-driven insights you need to stay ahead. Request a performance analysis session today.