Substantial loan growth is helping propel Kellogg Community Credit Union ($818.1M, Battle Creek, MI) toward the $1 billion-asset mark. But rather than concentrating on asset milestones, it remains focused on the impact it can deliver to the members and communities it serves.

Year-over-year loan growth during the third quarter of 2021 was 18.5%, nearly three times the national average. The credit union reported growth across a variety of areas, but two of the most significant were business loans made through the Paycheck Protection Program which totaled roughly $10 million and mortgage loans, which also grew at an 18% annual rate.

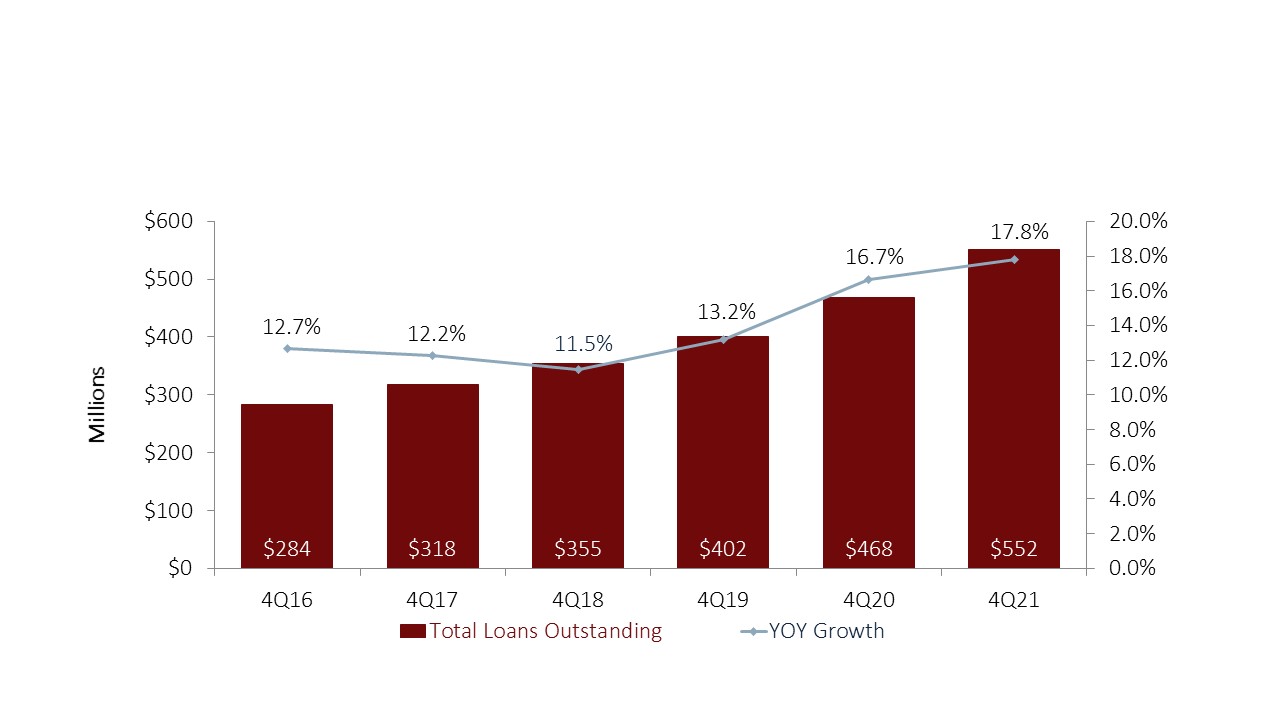

TOTAL LOANS AND ANNUAL GROWTH

FOR KELLOGG COMMUNITY CREDIT UNION | DATA AS OF 12.31.21

Approximately 75% of KCCU’s PPP business came from existing members, and the offering presented both opportunities and challenges.

“Right away we were going, Wow, here’s a new niche we can tap into with these businesses that chose us to help them during the pandemic,'” says Lindsey Law, chief lending officer at Kellogg Community.

The credit union paired business development officers with applicants to shepherd them through the PPP process as well as strengthen the relationship by encouraging the borrower to bring over account and lending relationships from other institutions. Although PPP was the initial relationship starter, Law says there was an understanding those loans would be forgiven eventually and new commercial clients wouldn’t stick around if staff didn’t take steps to form relationships.

PPP lending also helped the credit union diversify the range of businesses it serves. There were plenty of restaurants, medical accounting firms, and other local mom-and-pop shops, but those weren’t the only small businesses in need of aid.

“Shockingly enough, we had quite a bit of chiropractic offices, which has resulted in a lot of new relationships,” Law says.

Along with the boost in commercial relationships, KCCU has also recorded improvements on the credit card front. Volumes dipped at the start of the pandemic, when consumer spending slowed and government relief efforts led many to pay down outstanding balances. By the end of the third quarter, however, balances had returned to roughly where they stood in late 2019 and are in line with historical norms for the institution.

Law says KCCU has plans in place to bolster that growth with balance transfer specials, cash-back offerings, and more. Some automated loan increases are also in place based on certain criteria to help increase members’ credit card usage.

Business is booming in business lending and credit cards, but in the real estate space, KCCU is bracing for a slowdown. After extremely high volumes over the past two years, management is anticipating a return to relative normalcy with the prospect of rising rates. As a result and in expectation of a shift from mortgage refinancing to more purchase activity staff members are focusing on building relationships with real estate agents who partner with the credit union and can help bring in business.

We Have Them Covered’

Kellogg Community currently counts more than 45,000 members on its roster, and although membership growth has fluctuated a bit in recent years, it has generally ranged in the 5% to 6% range.

According to Tony Wright, chief financial officer, the credit union will be more proactive about getting into the community and raising awareness in the coming year. That starts by focusing on impact and ensuring consumers understand KCCU offers a better alternative than other banking providers.

Fees are one key example. Wright says management has long tolerated waiving any overdraft of $5 or less to avoid a fee and has been discussing raising that threshold to $10.

“We’ve never really marketed that $5 tolerance,” Wright says. “In the area we’re in, it’s not that common to have that so we’re going to market that and tell our story that way.”

One of our big initiatives this year is to tell people how we have them covered in a way we’ve never told them before. We have people living paycheck to paycheck in a couple of our communities. How can we help them?

In addition to promoting its friendlier fee policies, the credit union tells its story by emphasizing the value it provides to members. The Kellogg Community website includes a page that promotes the $15.8 million members saved in 2021, which breaks down to an average of $358 per member. A savings report shows how members with a deeper relationship with KCCU save more annually, and an account breakdown details the average savings for a variety of products. For members and nonmembers that want to learn how they can increase their savings, KCCU will review their accounts free of charge.

“One of our big initiatives this year is to tell people how we have them covered in a way we’ve never told them before,” Law says. “We have people living paycheck to paycheck in a couple of our communities. How can we help them?”

Kellogg Community has its eye toward serving members more deeply, and it has a solid foundation on which to build. The credit union consistently ranks high in Callahan’s Return of the Member (ROM) index, which assesses institutions by not only rates and fees but also the variety of products and services available to members and the average depth of member relationships.

How do you compare? Callahan’s Return Of The Member scoring system quickly shows credit union leaders how much value they’re delivering to members compared to credit union peers. Learn more today.

As far as the strength of the institution, annual asset growth stood at 13% at the close of the third quarter. Wright says assets are likely to cross $1 billion within the next three years; however, the credit union is emphasizing organic growth rather than, say, merging simply for the sake of growth. The coming year also will include a major focus on gaining efficiencies. Wright and Law pointed to new software the credit union is implementing to scale different processes. It’s also centralizing some loan processing so branch staff can focus more on having educated conversations with members about why the credit union is their best option rather than focusing on sales or checking off items from an underwriting list.

“The focus right now is already on efficiencies,” Wright says. “But as far as what we’re doing, hitting $1 billion isn’t going to change anything. We’re just trying to help as many members as we can.”