In 1960, a group of U.S. Postal Service employees formed a credit union in a basement closet a South Carolina post office. The credit union became Carolina Foothills Federal Credit Union ($188.5M, Spartanburg, SC) in the 1990s and expanded its presence in the Appalachian foothills with locations in Greenville and Gaffney.

During the past decade, new businesses and people have moved to the Upstate region, which is perhaps best known for its high-tech BMW automotive plant situated on Interstate 85 between Atlanta and Charlotte. The growth has attracted nearly 30 banks and 20 credit unions, including national players JPMorgan Chase, Bank of America, and TD Bank.

“The growth has been phenomenal in the Upstate and the counties we’re in,” says CEO Scott Weaver. “About 20 people a day are moving to Greenville and almost as many are moving into Spartanburg every day. It’s a dynamic area.”

Weaver joined the credit union in 2007, replacing a CEO with 25 years of service. At the time, Carolina Foothills had $34 million in assets. Since then, the cooperative has grown nearly sixfold, and despite the increased competition, it topped $190 million in total assets in October 2022.

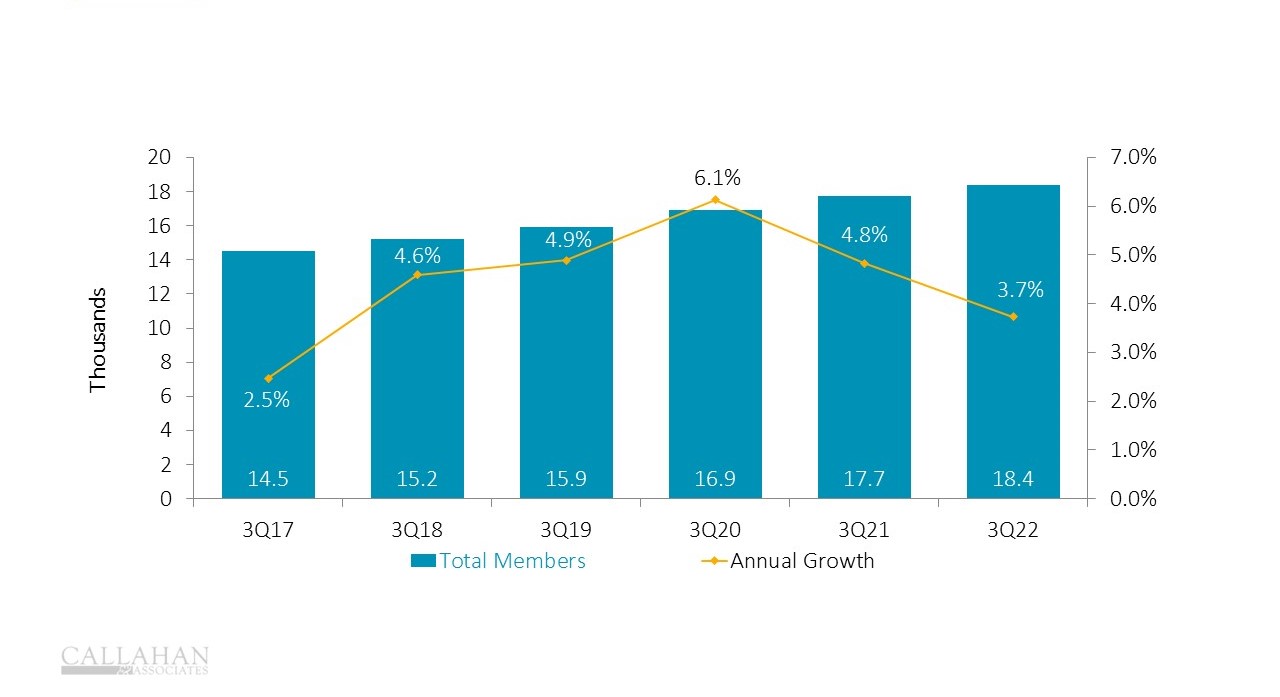

MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Surprisingly, much of the growth at Carolina Foothills didn’t come from well-to-do newcomers or trendy neighborhoods. Years ago, Carolina Foothills made a conscious decision to focus on low-income families who were not benefiting from the region’s upward economic trajectory.

A highly diverse board, millions in federal grant funding, financial planning services, and deep partnerships with the community have enabled the credit union to deliver services to more than 125 partner companies and 17,992 members. Its branch network helps, too. While many banks have consolidated their footprints, Carolina Foothills has added three branches in the past decade, bringing the total to six.

“Our branch network is a little bit more extensive than most credit unions our size,” Weaver says. “I guess it’s an expensive way to do business, but we are a low-income designated credit union. We deal with a lot of folks who are cash-dependent. They like to come into the branch and get cash to use around town. They’re also dependent upon us for financial advice.”

Diversity In The Region. Diversity In The Board.

More than a decade ago, Carolina Foothills’ board of directors was like that of many other credit unions — mostly white men at retirement age or beyond. The exception was Isaac B. Dickson, the first African American elected to the board. Dickson joined the board 31 years ago and has served as chairman since 2004.

A former chairman of the South Carolina Credit Union League’s Diversity Committee, Dickson was a founding member of the African-American Credit Union Coalition and instrumental in building a board at Carolina Foothills that represents the diversity of the membership — including age, race, and gender. The demographics of the region have changed, with growing communities of people with African American and Latin American heritage, and the credit union wants its board to reflect that.

Today, Carolina Foothills’ board is composed of four women and three men. It includes three African Americans and one Latina member, and ages stretch from the 30s into the 60s. To ensure the credit union is connecting with the community, the board even has a principal of a local elementary school.

Of course, ensuring this kind of representation requires ongoing intent.

“It’s a concerted effort to see who we can recruit to help us make sure we are serving the people we need to be serving,” says Terri Hendrix, vice president of engagement at Carolina Foothills. “Sometimes we’ll bring in board members through the supervisory committee. They’ll serve there for a number of years, and then board members will interview them and make sure it’s going to be a good fit for the board.”

Hendrix joined Carolina Foothills in 2014 after the board decided to apply to become a certified Community Development Financial Institution through the U.S. Department of Treasury. Hendrix was working for SC Telco Federal Credit Union, now Spero Financial Federal Credit Union ($594.8M, Greenville, SC), where she crossed career paths with Weaver before he joined Carolina Foothills.

When Weaver took over as CEO, he asked Hendrix to move to Carolina Foothills, and the pair started talking seriously about how CDFI certification could carve out a niche for Carolina Foothills, Hendrix recalls.

“It made sense,” the VP says. “The board now is probably the most diverse it’s ever been. I had made lots of good contacts and gathered a lot of knowledge and data about how to go about doing it and how to live the mission of a CDFI.”

Transformed Lending Through CDFI Funding

CDFI certification has made a major impact on the staff and lending practices at Carolina Foothills.

The funding helped train nearly half of the cooperative’s 60 employees as certified financial coaches located across all of its branches.

“That’s actually a job requirement,” Weaver says. “Branch and collections staff have a development track, and the last step is to become certified financial coaches. When they get that certification, they’re able to coach our members, help them budget, and help them improve their credit scores.”

Since obtaining certification in 2015, the credit union has received more than $4.5 million in grants from the program. Four rounds of funding helped fuel loan loss reserves for mortgages, car loans, and small businesses loans that would have been turned down by most banks and credit unions.

Initially, Carolina Foothills focused on its consumer lending program, backing millions in car loans, personal loans, and consolidation loans. But Weaver said the credit union also wanted to make an impact on the area’s business community.

“The second grant we had was specifically for small business lending,” the CEO says. “In that grant, we had money available to hire someone to help us with small business loans.”

Those loans — which Carolina Foothills calls micro loans — are anything that’s $15,000 or less. According to Weaver, they typically go to startup businesses or businesses that haven’t been operating long enough or have good enough financials for normal lending channels.

During the pandemic, Carolina Foothills also went above and beyond in funding loans through the U.S. Small Business Administration’s Paycheck Protection Program. The credit union initially estimated it could support $500,000 in loans but ended up lending $4.5 million.

As a result, the credit union helped 132 Upstate women entrepreneurs — 92 of them women of color — keep their small businesses open during the shutdown and economic downturn. Nearly half of the 276 PPP loans went to women-owned businesses, with an average loan amount of $16,403.

First-Time Homebuyers

Through its CDFI funding, Carolina Foothills also is focusing on home ownership.

“We’ve reached a critical point where even middle-income folks are having a hard time finding affordable homes,” says Weaver, adding that high inflation and a slower economy should push down real estate prices or at least hold them steady.

Under the Carolina Foothills first-time homebuyers program, qualified borrowers can take out a 30-year mortgage with a 97% loan-to-value maximum and no requirement for private mortgage insurance. The credit union prices the loan at just 50 basis points above the market rate. Underwriting guidelines require a maximum 30% housing ratio and 45% maximum debt-to-income ratio, a minimum credit score of 600, with compensating factors, and two years of verifiable income.

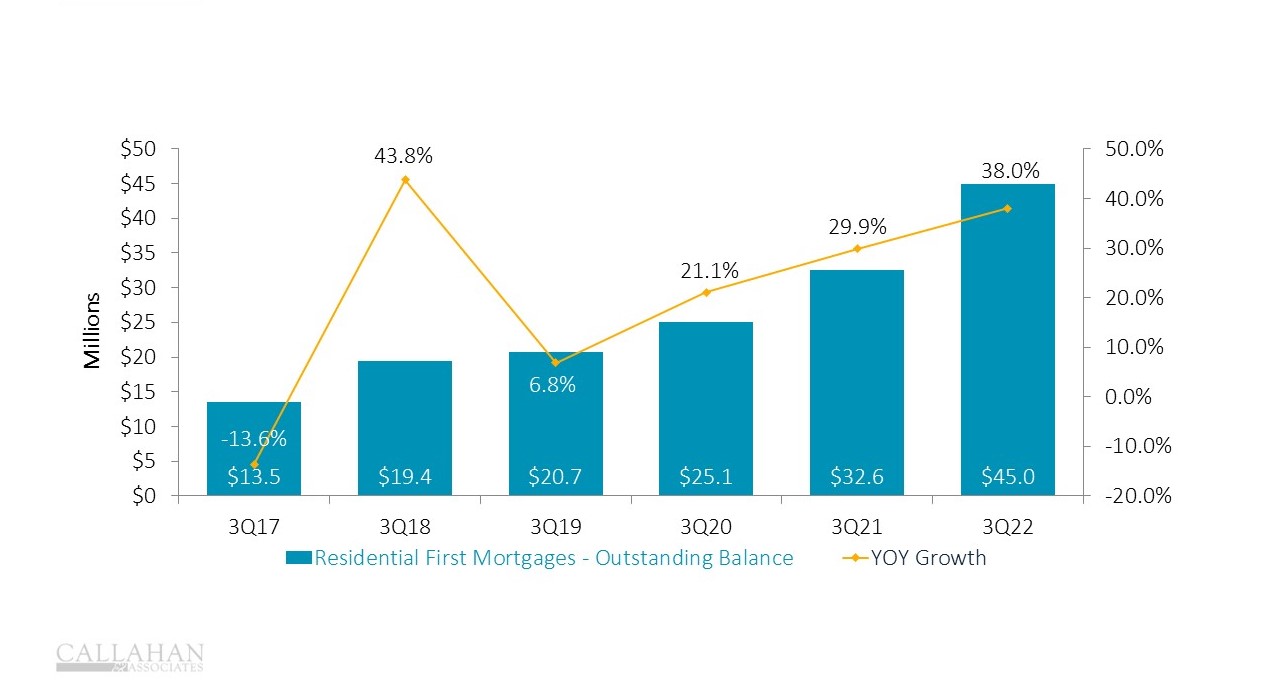

FIRST MORTGAGES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Carolina Foothills partners with various local agencies to identify potential borrowers and has created an in-house financial education coaching program. According to Weaver, the credit union previously hadn’t been an aggressive mortgage lender, but that has changed. Within the first year, the credit union made 20 loans to first-time homebuyers for $3.2 million, with 74% of the loans going to low-income borrowers.

“The first-time homebuyer loan has been very successful for us,” Weaver says. “It’s usually about half of our mortgage loan volume every month.”

A program at Carolina Foothills FCU targets low-income borrowers with flexible underwriting practices, financial education, and partnerships with public, private, and nonprofit groups. Learn more in “Inclusive Lending Turns Dreams Into Reality” only on CreditUnions.com.

Healthier Programs, Healthier Policies, And Healthier Members

Carolina Foothills has had no foreclosures and reports a delinquency rate of just 0.12% as of Sept. 30, 2022 — lower than the national average. Christine Cooper, vice president of operations, credits the success of the lending program to the collections department.

“We have a seasoned collection manager, and she and her team really work with our members,” Cooper says. “It’s not like a hardcore collection company. They work with our members to find out what’s going on. Did they lose a job? Can we help lower their payment or combine loans? She’s probably the only collector I’ve seen in nearly 30 years of working in this industry that gets thank you cards from the membership.”

In response to high inflation, the credit union raised the threshold for non-sufficient funds in checking accounts from a $10 overdraft to $100.

“We don’t have as much fee income,” Weaver says. “If our member is healthy, we’re a better credit union. I would rather that we have a low fee income and folks are healthier in their checking accounts.”

Checking accounts provide vital deposits for the Carolina Foothills’ lending program, and in many cases, checking provides a path back into banking. In 2021, the credit union opened 274 second-chance checking accounts, called Refresh Checking. It includes a $9.99 monthly service charge — which the credit union recently lowered from $15 a month — and a direct deposit requirement; however, there is no minimum balance and identity protection is free.

“One of the reasons we’ve had success in growing deposits is because of our checking accounts,” Weaver says. “We put an emphasis on getting the direct deposit. We’ve grown checking accounts more than 10% this year and double-digits almost every year that I can remember.”

Although Carolina Foothills has invested in its branch network, the credit union went live in 2022 with an upgraded online banking platform, making both loan applications and account opening accessible through mobile devices. Future upgrades will allow electronic loan disbursements, so members can complete the whole process of taking out a loan without visiting a branch.

How To Lead With Purpose

Why does your credit union exist? Do you serve your members and community in ways that set you apart from other financial choices? Rethink your role and responsibility to members, employees, communities, and the environment with Sustainable Business Strategy, a learning experience Callahan & Associates offers in collaboration with Harvard Business School Online.

Another planned upgrade will send members a notice 23 hours in advance of an overdraft. This will give members time to re-order the way checks and ACH transactions post to their account and make a deposit by PayPal, Venmo, credit card, or account transfer to cover the payments.

“Eventually, they will be able to get a micro loan, which would be a 60-second decision to fund the account,” Cooper says.

That would allow members to avoid fees from the credit union as well as fees from the party that is set to receive the payment.

Weaver says Carolina Foothills might not be able to keep pace with large competitors, but technology is an important tool for growth. However, it’s not the only tool.

“Technology is a double-edged sword,” Weaver says. “Sometimes, the more technology you introduce, the less you know your members. It’s probably more expensive, but we try to be available to our members in the ways they want to do business with us. We want to be relevant to our membership.”

Under the credit union’s business model, the branch network enables front-line employees and financial coaches to have conversations with members about their needs. In fact, Carolina Foothills has a bilingual employee in every branch to assist Spanish-speaking members, a fast-growing segment of the membership.

“Looking ahead for us is to just keep doing what we’re doing and try to serve our member the best we can,” Weaver says. “We don’t like to turn people down.”

This is part of the “Anatomy Of A Credit Union” series, presented every quarter by Callahan & Associates. Read more about Carolina Foothills Federal Credit Union or dive into a decade of archives. Contact Callahan to learn about gaining access today.