To read a more in-depth analysis on specific 2Q20 industry trends, select a section below.

COVID-19 continues to define 2020. The pandemic’s impact has reverberated across all sectors of the economy, most visibly in the United States unemployment rate, which has surged to levels not seen since the Great Depression. Despite this labordisplacement, United States’ stock markets and savings rates are up dramatically, as easy money from Federal Reserve monetary policy and economic rescue packages from the Federal Government flooded into both cash and equity assets. Concurrentincreases in these investment types is a rare dynamic and highlights the separation in financial risk tolerances across the country today. Although the gap between Wall Street and Main Street seems to be growing, the aggregate market performance numbershave calmed some fears of global economic depression.

Key Points

- Total Assets at the nation’s 5,275 credit unions grew 15.0% annually, nearing $1.8 trillion as of June 30.

- Loan growth has remained steady year-over- year, up 8 basis points to 6.5%. Low interest rates spurred first mortgage originations, driving loan portfolio growth.

- Share growth accelerated 10.5 percentage points annually to 16.4%, due in part to a combination of government aid and decreased consumer spending.

- More than 4 million members joined a credit union in the past year, a 3.4% increase. To meet this member growth, credit union employee totals grew 1.9% annually, countering the national trend of increasing unemployment.

- The industry reported 73 mergers year-to-date.

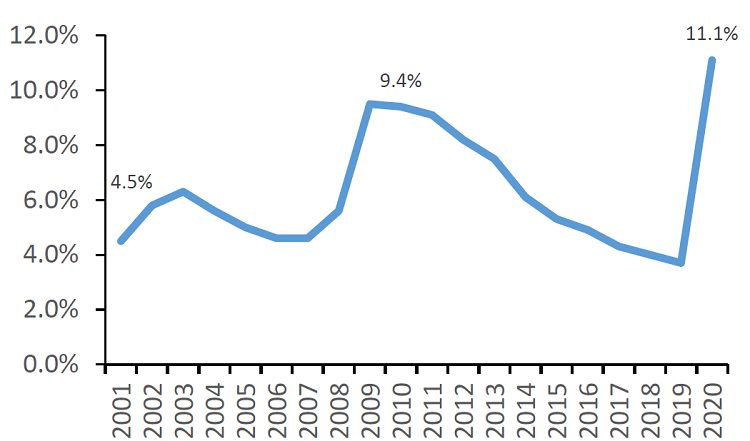

U.S. UNEMPLOYMENT RATE

DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Small business closures during COVID-19 lockdowns drove U.S. unemployment to the highest rate in 80 years.

Source: Bureau of Labor Statistics

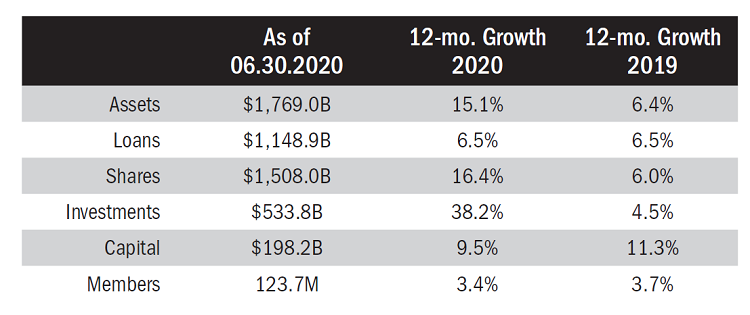

CREDIT UNION INDUSTRY OVERVIEW

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Government aid and low interest rates drove balance sheet growth in all major categories.

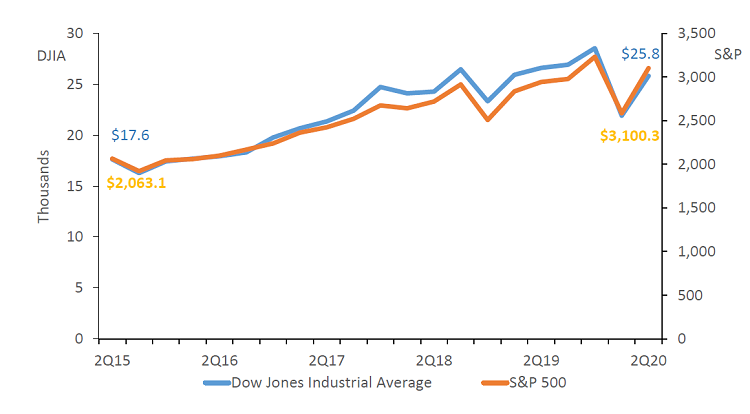

DOW JONES INDUSTRIAL AND S&P 500 AVERAGE

DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Stock markets have rebounded from March’s lows, buoyed by dovish monetary policy from the Federal Reserve.

Source: Freddie Mac

The Bottom Line

Back in March, when uncertainty surrounding COVID-19 was near its peak, few would have predicted the record growth that financial institutions have recorded in the past few months. At credit unions, a surge in deposits drove asset growth to record highs.Although discretionary spending has slowed, loan growth is supported by a 94.0% year-over-year increase in first mortgage originations. Tightening loan spreads have placed pressure on capital ratios, but credit unions are performing well given pandemic-eraexpectations.

This article appeared originally in Credit Union Strategy & Performance.