To read a more in-depth analysis on specific 4Q19 industry trends, select a section below.

LOANS,MORTGAGES,AUTO LENDING,SHARES,INVESTMENTS,EARNINGS,MEMBER RELATIONSHIPS

HUMAN CAPITAL

The economy continued the longest economic expansionary period in U.S. history. Real GDP increased at an annual rate of 2.1%, the 23rd consecutive quarter of positive growth.

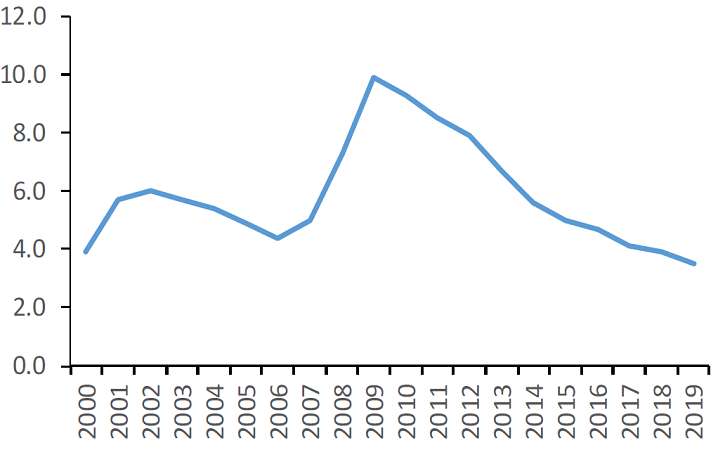

Unemployment remained at historic lows through the calendar year, and the 3.5% rate recorded in December 2019 was the lowest year-end unemployment rate since 1968. According to data from the University of Michigan, consumer sentiment in the market becamemore optimistic toward the end of the year, rebounding from a third quarter that was marred by trade woes and recession fears.

Key Points

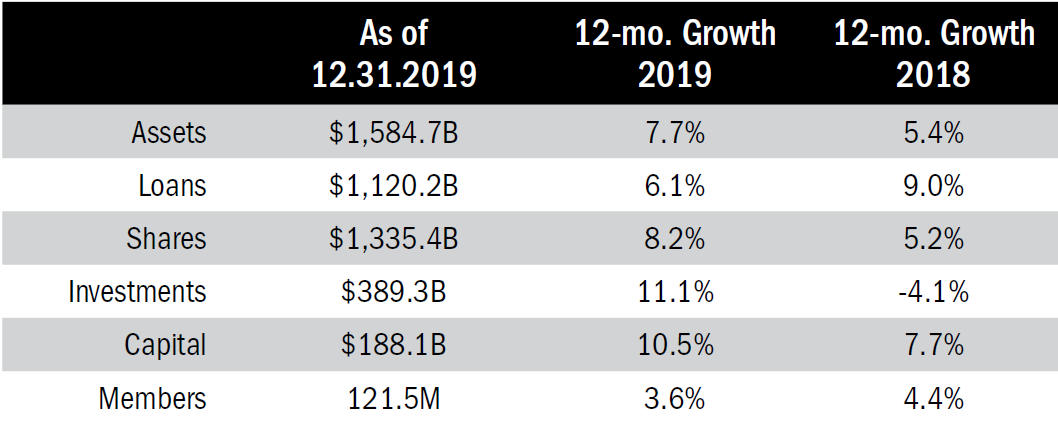

- At year-end 2019, the 5,349 operational credit unions in the nation held $1.6 trillion in assets. Total membership was 121.8 million, a 3.6% year-over-year increase.

- Total loans at credit unions across the United States surpassed $1.1 trillion in the fourth quarter, increasing 6.1% annually. Total loan growth has slowed 2.1 percentage points in the past 12 months. Share growth accelerated 3.0 percentage points annually to 8.2% as of Dec. 31.

- Credit unions branches totaled 21,225 nationwide as of the fourth quarter, 113 more than year-end 2018.

- Average ROA increased 1 basis point year-over-year to 0.93% as of Dec. 31, 2019.

- In the past year, the industry reported 135 mergers and 3 purchases, acquisitions, or liquidations.

U.S. UNEMPLOYMENT RATE

DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The December unemployment rate in the United States was 3.5%. That’s the lowest year-end rate since 1968.

Source: Bureau of Labor Statistics

CREDIT UNION INDUSTRY OVERVIEW

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

Assets, shares, investments and capital all grew at a faster rate in 2019 than they did last year.

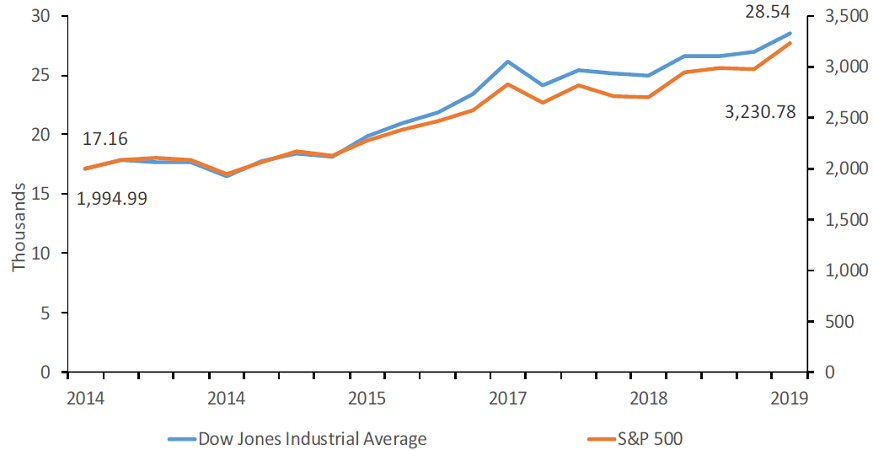

DOW JONES INDUSTRIAL AND S&P 500 AVERAGE

DATA AS OF 12.31.19

Callahan & Associates | CreditUnions.com

The S&P grew at the fastest clip since 2013 while the Dow had its fourth-best annual performance since 2000./p>

Source: Freddie Mac

The Bottom Line

At year-end, credit unions continue to benefit from expansionary macroeconomic trends with deposits up 8.2%, loans up 6.1%, and membership up 3.6% in the past 12 months. Despite a slow first quarter, the industry reported strong growth across core financialsin the past 12 months; optimistic members continue to grow and diversify their financial relationships with credit unions.

This article appeared originally in Credit Union Strategy & Performance.