With the end of the year already on the minds of many credit union professionals, now is a great time to think about new ways to present success stories and good works of the past year. Self-Help Credit Union ($1.8B, Durham, NC), uses its annual report to talk about how it serves members and the community through financial services, homeownership, commercial loans, advocacy, and more.

The Tar Heel State cooperative serves members across the country via a mission to create and protect economic opportunity for all. To actively measure its impact — both quantitatively and qualitatively — the credit union has invested in two full-time staff members with backgrounds in impact measurement and evaluation who track dozens of measurements throughout the year. This team-based approach allows Self-Help to identify key statistics and representative member stories for inclusion in its annual report.

Here, Crystal German, president of the Center for Community Self-Help, talks about how the credit union uses its annual report to tell its story and how it continually evolves and measures the effectiveness of this increasingly important communication vehicle.

How does Self-Help decide which impact statistics to include in its annual report?

Crystal German:The annual report reflects the impact of the work we do day-in and day-out. For every metric or infographic in the report, we probably have another half-dozen that don’t make it in.

CU QUICK FACTS

SELF HELP CREDIT UNION

DATA AS OF 06.30.23

HQ: Durham, NC

ASSETS: $1.8B

MEMBERS: 91,668

BRANCHES: 37

EMPLOYEES:297

NET WORTH:26.7%

ROA: 1.40%

To help us decide which impact measures to choose, we start by asking a few simple questions: What tells our story the best? What’s meaningful to the communities we serve? What are our borrowers and our depositors most interested in? How do we show up in tangible ways in their communities?

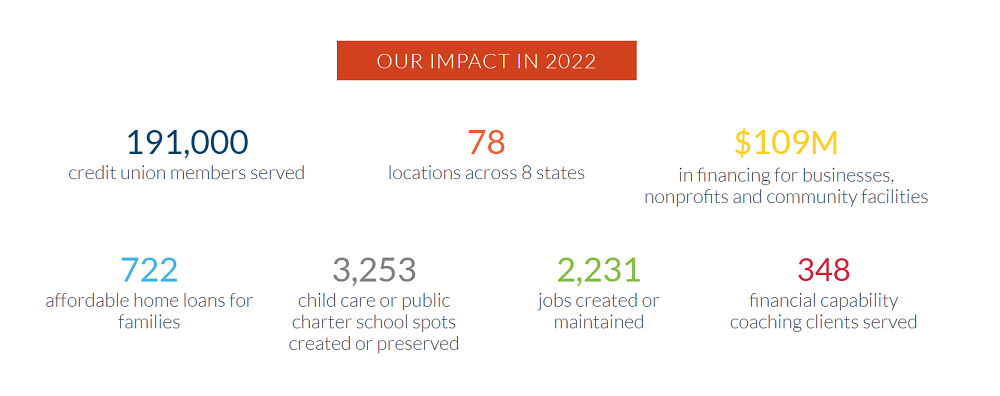

Inevitably, this leads to highlighting things like mortgages, business loans and consumer loans. However, it’s also led to the inclusion of other highlights such as lending to childcare centers and schools. Ultimately, our goal is to use the data in the report to demonstrate that when you walk through our doors, we’re going to do our best to give you fair, equitable financial products that fit your needs.

Did the credit union already have programs in place that addressed each of the impact areas?

CG: Yes, the work is the lead. The metrics simply help us measure how well we’re doing the work.

We always begin with what’s needed in our communities and how we can serve that need. We then measure how well we’ve done or what impact we’ve made. For example, addressing the racial wealth gap and serving needs of both low-income borrowers and those who live in rural communities are a few of the key impact areas you’ll see in the report.

Do the impact metrics change year over year or do they stay the same?

CG: They haven’t changed dramatically over the years, but it’s also not unusual to add in a new metric that we haven’t highlighted before or remove one that’s no longer a good measurement of what we’re doing.

We’re in the business of providing equitable financial services, so you’ll see mortgages, consumer loans and business loans year after year. However, when we started focusing more on childcare and school lending, which are two critical community needs, they became a metric for us to highlight. In the future, I expect we’ll add new metrics around our green products.

Who develops the report every year?

CG: It’s a team effort. Our marketing and communications folks and our impact folks are involved. Since they see the members on a day-to-day basis, it’s important for our front-line staff in the branches to weigh in on this process and share their insights regarding what’s most important to members. It’s not a straightforward process, but it takes all perspectives into account and allows us to tell a meaningful and compelling story about what we’ve accomplished as a credit union.

When do you start that process?

CG: We begin four to six months before the annual report is going to be published. Certain parts are standard each year, such as the financials and a letter from our CEO. Beyond that, we brainstorm and sketch out an initial proposal of what we’re thinking and what we want to highlight. Our retail, impact, and marketing staff do this together.

Then, we begin gathering the stories and metrics — pulling those in, placing them, and seeing where we might have gaps. Because we serve multiple states, we want to ensure there is representation. No matter where a member is in the world or along their journey, we want them to see themselves in at least one of the stories we feature.

How do you pull the data and stories?

CG: We track the data throughout the year. We’ve built an internal dashboard that pulls from a lot of different systems. Given the scope of what we offer, there’s simply no way we could calculate impact after 12 months of activity. We don’t measure our impact simply for the report, we’re using that dashboard to measure how we’re doing throughout the year.

On a monthly or quarterly basis, if we’re not hitting our goals, then we need to pivot along the way. The dashboard helps us hold ourselves accountable for what we say we’re going to deliver for our communities. When we do get to annual report season, the impact we’ve had is no surprise.

In terms of member stories, we’ve invested in creating an inventory of stories from the previous year. Our retail staff and community partners are great about telling us how we’re doing. We also put feelers out to staff if we’re looking to highlight a specific story that isn’t at our fingertips, such as an electronic vehicle loan or mortgage lending in western North Carolina.

How do you track impact metrics like jobs created or retained?

CG: The jobs created or retained metric comes directly from our commercial loans. The borrower provides that information as part of the application process. If we provide a $1 million business loan, we want to know how those proceeds will be used. That includes how many jobs are created or retained because of that funding.

Does Your Purpose Resonate?

Effective leaders often can identify weak spots where their organization’s mission isn’t resonating as well as it could. Callahan & Associates’ Purpose Alignment Tool helps credit union leaders measure how aligned their institution is across a variety of metrics.

What does Self-Help hope to achieve with its annual report?

CG: Our goal is to create brand awareness and prompt people to expand their relationship or become a member. We are in the process of developing key performance indicators of how effective our annual report is as a communication vehicle. Those might include the number of downloads, how often staff use the annual report to communicate with members, how often someone comes in and references that they saw the report, whether that prompted them to open an account or expand their relationship, and even media inquiries, such as this one, that happened because of our annual report.

What advice do you have for other credit unions regarding annual reports?

CS: Start with your members in mind, understand what matters to them, and build from there. If you begin by considering what impact you’re trying to create with your products and services and work backwards, it’s hard to go wrong. Investing in ongoing measurement is also important.

This interview has been edited and condensed.