Credit unions can’t stop America’s population from aging, but they can make the process easier.

CU QUICK FACTS

MICHIGAN LEGACY CU

HQ: WYANDOTTE, MI

ASSETS: $ 217.9M

MEMBERS: 20,290

BRANCHES: 5

EMPLOYEES: 66

NET WORTH: 12.76%

ROA: 0.21%

In 2010, the U.S. Census recorded the highest number of people age 65 or older in the record’s history, making up 13% of the population. Some estimates predict that figure will nearly double by 2050, leading many financial institutions to consider how to tackle the steady rise of elder financial exploitation (EFE). This form of fraud gets expensive fast for the victims, their families, and their financial institutions. Earlier this year, a report by the AARP estimated that victims of EFE lose $28.3 billion annually.

After watching members experience this firsthand, Carma Peters, CEO of Michigan Legacy Credit Union ($217.9M, Wyandotte, MI), began looking for solutions.

“When an older individual loses their entire life savings, who’s going to care for them?” she says. “That’s been our heart behind it.”

A few years ago, Michigan Legacy launched a pilot program with the Institute of Gerontology (IOG) at Wayne State University in Detroit to identify potential fraud and exploitation of vulnerable adults. Today, every employee undergoes training on the topic, and the number of incidents the credit union sees has decreased dramatically.

“It was actually one of the easiest implementations we’ve ever done,” Peters says.

Members At Risk

The partnership began when Peters met Dr. Peter Lichtenberg, a national expert in financial capacity assessment and financial exploitation of older adults.

“He was telling me about all his research and that he had been trying to work with a financial institution, but nobody would work with him, which blew my mind,” the CEO recalls. “I said, ‘I’ll do it!’”

As a starting point, the IOG provided free training to all MLCU staff on how to recognize and respond to EFE. Then it became a question of how to implement this among members.

That year, the credit union decided to introduce Lichtenberg’s elder financial exploitation risk assessment during its annual Money Smart Week. MLCU hosted a giveaway where any member who voluntarily completed the assessment and shared their score with the credit union would be entered to win a $250 Visa gift card.

The results were shocking.

“We are a low income-designated credit union, and half of the members that completed the risk assessment over the age of 50 were at moderate to high risk for financial exploitation,” Peters says.

In response, Michigan Legacy adopted IOG’s Financial Vulnerability Survey as routine but optional for members age 50 and older. MLCU also worked with its core processor and internal auditing team to introduce a due diligence code. When the credit union identifies a member as being at higher risk, it enters a code into their account so internal auditing can better watch for abnormal activity.

“It’s not going to stop all [financial exploitation],” Peters says. “But it’s another tool in our tool chest.”

MLCU also worked with Lichtenberg to develop a training program for financial institution employees to learn how to identify and discuss cognitive risk factors before exploitation occurs. That training is mandatory for all MLCU employees, regardless of their role or department, and is repeated each year with applicable updates.

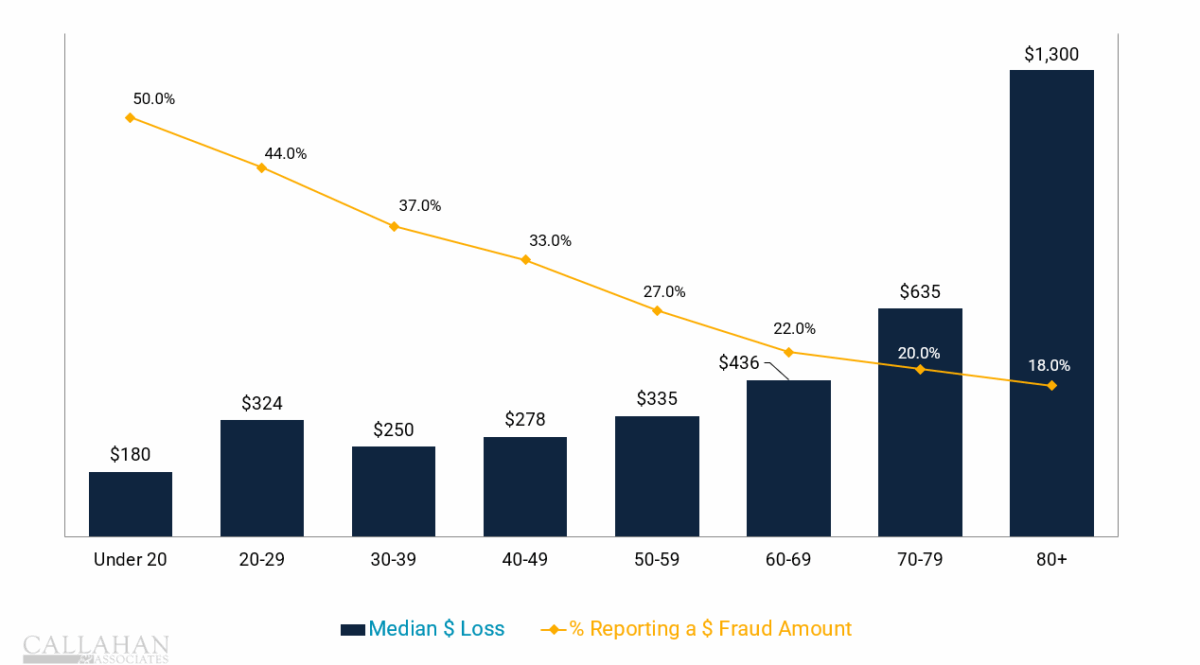

PERCENTAGE REPORTING A FRAUD LOSS & MEDIAN LOSS BY AGE

FOR U.S. ADULTS

SOURCE: FEDERAL TRADE COMMISSION

From Obstacles To Improved Outcomes

Peters says one of the most valuable takeaways of the IOG’s training is how to have conversations with members who push back against concerns.

“When an older individual is a victim, they’re ashamed and embarrassed, and sometimes they don’t talk about it or report it,” Peters explains. “Even if they’ve been a member for 30 years, they might believe the person manipulating them over their financial institution. We learned to ask questions in a different way to get them to stop and think more often.”

MLCU also keeps subject matter experts in each branch who can clearly explain the vulnerability assessment’s purpose to apprehensive members.

“They tell the members, ‘I know you want to believe it won’t happen to you, but we’ve seen it over and over again. It’s a tool in our toolbox to help you. It is strictly voluntary. You do not have to take it, but we strongly encourage it,’” the CEO says.

In addition to offering the assessment to new members, the credit union also will advise members to take it whenever major life changes occur, such as the death of a spouse. Peters says those types of events can further put someone at risk.

STRATEGIES FOR FIs

Source: CFPB December 2024

- Revisit oversight and risk policies

- Invest in employee training

- Employ holds and delays

- Lean on trusted contacts

- File SARs on suspicious activity

MLCU also met with representatives of Michigan’s Adult Protective Services department to understand why the agency was closing cases the credit union submitted.

“We were reporting financial things like the money they’re losing, but Adult Protective Services is not a financial services enforcement division,” Peters says. “It’s more about emotions and behaviors to them, so that’s been helping us have a higher rate of cases reviewed at the state level.”

Although Michigan doesn’t require financial institutions to report potential exploitation to authorities, 26 states, DC, and Guam all have some form of mandated reporting.

Peters says year-over-year data captured by MLCU’s internal auditors confirms the partnership has shown positive, measurable results.

“Like many credit unions, our size can make it difficult for us to respond when an incident of fraud like this occurs,” the CEO says. “Since its adoption, the number of reported incidents has dropped by more than 50 percent.”

No Gatekeeping Here

Data voluntarily collected from MLCU’s members has enabled further research and grant work by the institute, and the training and resources are not exclusive.

“There are a couple other credit unions he has also helped, and he will absolutely do this for any credit union throughout the country,” Peters says. “And it’s completely free.”

In addition to working with financial institutions directly, Lichtenberg also created the SAFE Program, or Successful Aging through Financial Empowerment, a resource for older adults and their caregivers who have experienced some form of EFE and need help filing police reports, contacting credit agencies, closing accounts, and more.

Stopping Member Fraud Before It Starts. When fraud surged, Langley FCU didn’t just respond — it restructured. Hear how a dedicated fraud-mitigation council helped reduce incidents and improve member trust. Watch now.