Top-Level Takeaways

- Social media has increased the amount of financial misinformation available and its accessibility to consumers.

- Misunderstanding the difference between debt management and debt settlement is a common misconception.

- Credit unions can help combat misinformation with empathetic, well-trained staff in their collections and lending departments.

In the battle against financial misinformation, credit unions everywhere are on the front lines.

Unfortunately, it’s not as simple as debunking a social media post here and there. Real change starts with addressing why people are seeking information in the first place: economic hardship and the embarrassment they feel when they fall into hard times.

To protect communities from bad advice and bad actors, credit unions have several tools within easy reach. Proactive outreach, flexible products, and well-trained, empathetic staff members are the trifecta of the “credit union difference.”

Where Does Financial Misinformation Come From?

“Social media has changed where people get their financial information,” says Matt Stegall, assistant vice president of credit resolution and recovery at Vantage Credit Union ($1.1B, Saint Charles, MO). “You have a lot of influencers out there trying to take advantage of people, giving financial advice they aren’t certified to give. They sometimes make promises that can’t be kept.”

In 2023, a Nationwide Insurance survey found more than one-third — a full 34% — of non-retired investors aged 18 to 54 had encountered, then acted upon, misleading or incorrect financial information they saw online or on social media.

Susan Butler, vice president of lending at Merck Sharp & Dohme Federal Credit Union ($842.4M, Chalfont, PA), says she once came across a TikTok video claiming a person can take out an auto loan, make payments for a few months, and then stop. When the creditor eventually gives up trying to collect, the borrower will own the car outright.

Unfortunately for borrowers who might have attempted this scheme, that’s not the way it works.

“That doesn’t mean they are forgiving the debt,” Butler says. “We still have a repossession agency out there looking for the car.”

Although social media makes it easy to discover and share financial misinformation, it is far from the only source of bad advice. Some debt relief companies, for example, encourage consumers to stop making payments on loans, promising a negotiated settlement but failing to disclose the risks, such as plummeting credit scores and potential legal action. Others charge excessive fees while delivering little to no actual benefit.

“It can impact a member’s whole relationship with the credit union,” Butler says. “ They see Visa or Mastercard on their card and don’t realize the credit union is who issued that and is who is actually taking the loss. That’s one of the biggest things we struggle with.”

It Starts With Vulnerability

Credit unions that want to take on financial misinformation must first and foremost be on the lookout for members primed to take it. Members who find themselves in a difficult economic situation and who misunderstand their financial options, for example, might be more likely to accept bad advice and make a poor monetary decision.

“When people fall behind or get into financial binds, they’re embarrassed to ask for help from the right people,” Butler says. “Instead of calling their credit union or creditor, they ask someone who can’t really help them. That’s how they end up with bad advice.”

At Vantage, Stegall says the depth of a member’s relationship with their credit union can make a big difference.

“If they haven’t developed that full financial relationship with their credit union, they’re probably more likely to go through debt settlement,” he says. “If they are more involved with checking, savings, mortgage, car, and so on, they’re probably going to go through debt management.”

Stegall adds that he sees people hurting now more than ever and acting out of desperation.

“Nobody takes out a loan or gets into a financial situation with the intent of defaulting or not being able to meet their obligation,” he says.

Proactivity + Empathy = Financial K.O.

Identifying vulnerable members and finding financially healthy solutions is where the credit union difference shines.

“Have financial health tools available to your members virtually and have well-trained staff in person that can guide them through that information,” Stegall says. “It has to be a partnership between your front line and your back-office staff. There can’t just be one or the other.”

Stegall says this one-two approach helps break down uncomfortable barriers and encourages members to seek the help they need.

Similarly, Butler says Merck Sharp & Dohme is intentional about how it communicates with members in poor standing. She emphasizes the importance of intentional check ins and building rapport with members.

“Having somebody who has an empathetic approach to the situation rather than a demanding approach is key for us,” she says. “We are always of the mindset that you’re still a member, you’re still important to us, and we’re still here to help you achieve your financial goals.”

If verbal communication doesn’t result in a breakthrough, Butler’s staff also sends letters and emails to members encouraging them to come in for help.

In the past year, efforts to increase boots-on-the-ground outreach for underserved communities have ramped up, especially as they relate to financial literacy for young people.

“One of our internal teams this year will be rolling out a student card to help young members start to build their credit,” Butler says. “Another team is focusing on financial literacy geared toward younger borrowers where they’ll be able to take classes to earn points toward rewards.”

Merck Sharp & Dohme also takes extra care to educate its elderly members.

“Senior citizens are such a targeted group, especially from a technology standpoint,” Butler says. “We’re intentional about communicating about scams to all our membership but particularly them.”

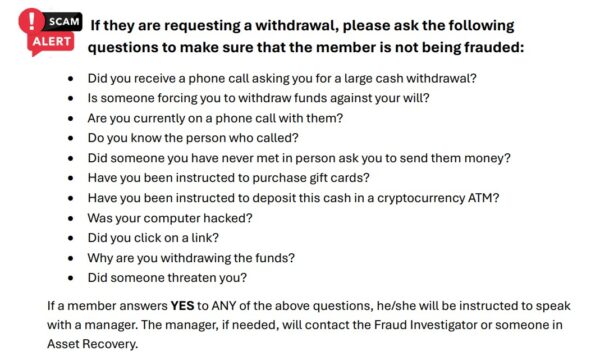

Front-line staff at Merck Sharpe & Dohme FCU keep physical cards on hand to give out to members. The cards contain easy tips and questions to ask if they think they’re being given misinformation or falling for a scam.

“We try to make it easier for the staff and for the member,” Butler says. “There’s so much fraud out there, there’s so much misinformation. We want to protect them the best we can.”