Much has been made of the millennial generation or Gen Y those young adults born around or after 1982 and their predicted effect on the housing market in 2015 and beyond. More than one research organization has proclaimed a stronger market as these young adults become motivated to form their own first households, taking advantage of historically low interest rates and before home prices increase with an improving economy. In a study released in December 2014, Zillow reported that 42% of millennials want to buy a home within the next few years.

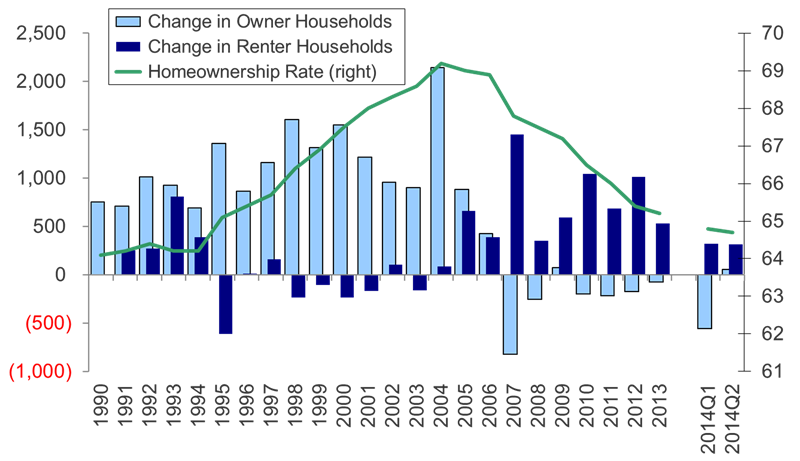

Other statistics paint a different picture. The rate of new renter households has far outpaced the creation of owner households, as illustrated in the chart below from the Mortgage Bankers Association. Likewise, the National Association of Realtors found that first-time homebuyers made up only 29% of the housing market in 2014 compared to a normal range of roughly 40%.

What’s one of the biggest reasons for the drop? Three words: student loan debt. The average college grad in 2012 had approximately $30,000 in student loan debt compared to $24,000 in 2004 according to the National Postsecondary Student Aid Study. Student loan debt represents $1 trillion and more than one-third of all non-housing debt. Little wonder that millennials may consider it daunting to take on additional debt in the form of a mortgage.

Added to the situation are tighter credit conditions. According to U.S. Mortgage Insurers, borrowers with a credit score of 620 to 720 dropped from 43% in 2008 to 15% in 2013. Typically, first time home buyers have lower credit scores and lower down payments, which result in loan level pricing adjustments that increase the interest rate, which makes qualifying that much harder.

The Qualified Mortgage, with a 43% DTI ratio, has kept the average 30-year-old with student loans from purchasing a home like they once did. Instead, they require a non-agency product, but that so-called patch will only be available until 2021. (There may be a silver lining here, however. Student loan debt will thicken a credit report because it contains more information on an applicant’s propensity to pay on time and thus may actually improve a credit score compared to another millennial with a slim credit profile.)

Regardless of what economist or statistician you believe, first-time buyers are out there. So how do we get 80 million millennials which is more than the Baby Boomer generation, by the way out of apartments or Mom and Dad’s basement and into homes of their own? Here are a few considerations and concrete tips for connecting better with first-time homebuyers:

- Cut the jargon.Consider this statement from a Loan Officer to a mortgage applicant: A 3/1 IO ARM with 5/2/5 caps calculated on the 12-month LIBOR with a starting APR contingent on your FICO and LTV gives me pause because the DTI based on your qualifying rate will affect your ATR per QM. We might be able to find safe harbor with TQM if we try a different GSE and run your paper through the AUS LP. Seriously?Confusion causes fear and fear causes flight. Don’t drive young buyers away with intimidating insider language. Make the mortgage process easy to understand using all the media millennials use, including a mobile version of your website, YouTube, blogs and social platforms. They won’t buy what they don’t understand, so keep it clear.

- Bust the 20% down payment myth.Who knows why, but many first-time homebuyers believe a 20% down payment is required. Not true, of course. Get the word out on loans with down payments as low as 3%. And because first-time buyers typically do not have a lot of cash, explain clearly that gift funds for a down payment are acceptable for some programs. On top of low down payments, FHA’s recent reduction of the mortgage insurance premium by .50 on loans with terms greater than 15 years is making monthly payments even more affordable.This is all good news that needs to be shouted from the rooftops, or more realistically, pushed out continually on social media sites. And don’t forget the tax benefits of homeownership, down payment assistance programs, and local, state, and national bond programs all benefits that should be brought into the conversation and consultation. Again, it gets back to educating young buyers about the options.

- Reflect the market. The chart below shows the difference in household profiles in 2012, in which 65% were occupied by white owners and 35% by minorities. However, from 2012 to 2025 the projected composition shows whites as approximately 25% of household growth while Asians, Hispanics, blacks and others will comprise 75% of household growth. Does your marketing look like the people you want to reach?If your communication is not reflective of these shifting demographics and your tactics for reaching homebuyers are stuck in 2012, you must rethink your strategies. And diversity is more than race; it’s the composition of households as well. While it’s true that approximately 54% of new households are formed by married couples, that leaves another 46% that are formed by single women, single men and unmarried co-borrowers of all persuasions.

No mortgage lender has a magic formula for capturing first-time buyers, but those that do it best are those that are willing to trade traditional tactics for a fresh approach. By offering low down payments, great education and targeting diverse populations, credit unions can capture their share if they are willing to modernize their methods and learn a new language.