Top-Level Takeaways

-

Five years ago, Infinity Federal Credit Union held more than $100 million in investments and made few high-risk loans. It has since expanded into consumer loans and extended its underwriting standards into lower credit tiers.

-

This opened the credit union to more risk, but also resulted in thousands of new members.

CU QUICK FACTS

Infinity FCU

Data as of 09.30.18

HQ: Portland, ME

ASSETS: $349.2M

MEMBERS: 17,487

BRANCHES: 4

12-MO SHARE GROWTH: 9.8%

12-MO LOAN GROWTH: 6.2%

ROA: 0.25%

Five years ago, Infinity Federal Credit Union ($349.2M, Portland, ME) was a conservative financial institution, even by the standards of a traditionally conservative industry. The credit union primarily focused on higher credit tier paper, principally made mortgage loans, and, at its peak, carried more than $100 million in investments on its books.

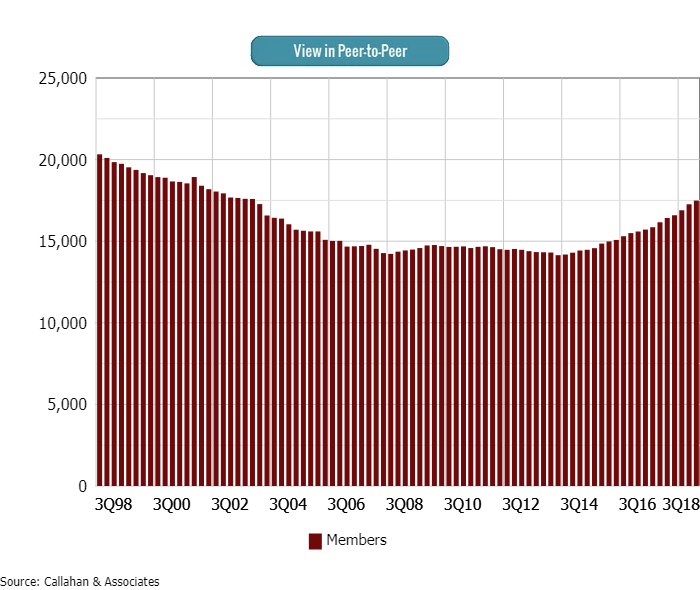

In 2013, current chief risk officer Sandy Cloutier assumed the role of interim CEO for nearly 12 months while Infinity looked for an external replacement. The change in CEO brought changes to the credit union’s philosophy on risk. Infinity had been turning away potential members, local people whose livelihood the credit union could positively impact. At the same time, Infinity was losing members. Between the first quarter of 1998 and the first quarter of 2013, the credit union lost nearly 6,000 members.

ContentMiddleAd

We were very conservative, Cloutier says. We needed new members, and we wanted to get out in our community and help our membership.

TOTAL MEMBERS

FOR INFINITY FCU | DATA AS OF 09.30.18

In the past four years, memberships at Infinity FCU have begun to rebound from more than a decade of decline.

A Culture Shock?

To add new members, the credit union had to open itself to new loans, new credit tiers, and new risks.

When you’re talking about C-D-E paper, you have to consider the potential losses to the credit union and how you’d mitigate those, Cloutier says. C-D-E doesn’t necessarily mean they are a bad risk, either. It could be they don’t have credit or they just need a second chance.

Infinity might have been philosophically ready to expand, but it also had to make sure it was in the right place financially. Turns out, it was. Across 2013 and 2014, Infinity’s capital ratio was near or higher than 11%, similar to other credit unions in its asset-based peer group.

We were ready, Cloutier says.

Well, almost. The credit union also needed approval from the board.

Infinity’s executive team meets with its board every month. That’s something that didn’t change after Cloutier took over as interim CEO nor when her successor, Liz Hayes, assumed the duties in late 2014. What did change, however, was the substance of these meetings.

The meetings are more conversational and transparent, Cloutier says. It’s not us giving them a financial report and asking if they have questions. It’s us bringing the report and then talking about it.

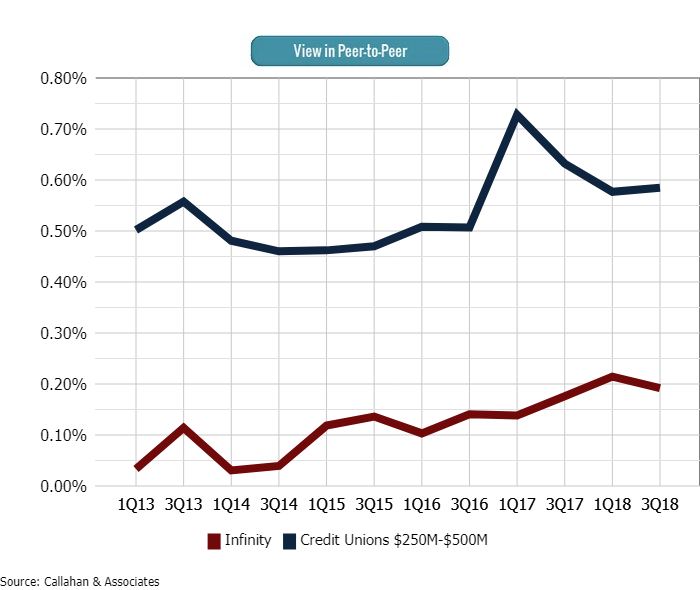

Cloutier and the executive team at Infinity provided the board with risk appetite statements that outlined the possible benefits and pitfalls of increased risk. Charge-offs and delinquencies would increase, of course, but product rates would also be higher and net interest income would grow. With those statements in hand, the board was more than accepting of taking on more risk.

They said, Yes we want to grow memberships,’ Cloutier says. ‘And we understand that to do that, we need to take risks and make loans that are not going to be A credit.’

Click the tabs below to view graphs.

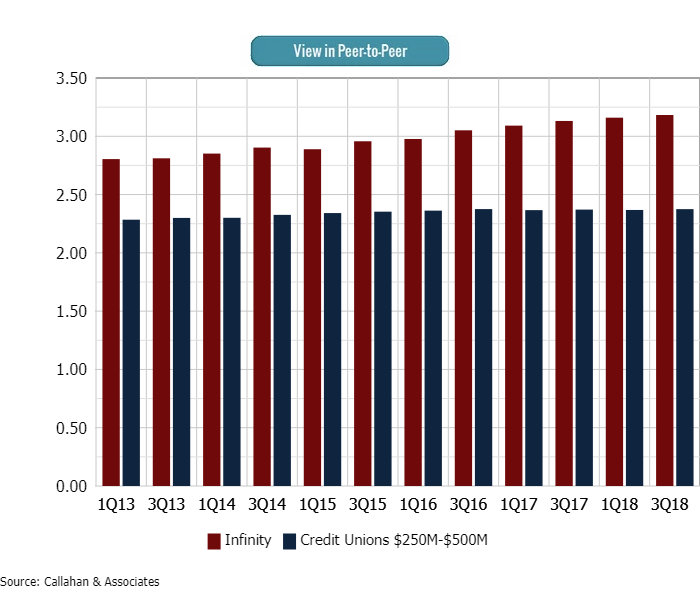

PRODUCTS PER MEMBER

PRODUCTS PER MEMBER

FOR Credit Unions $250M-$500M | Data as of 09.30.18

Infinity’s members have a history of using the credit union more than members of other credit unions in the same asset band.

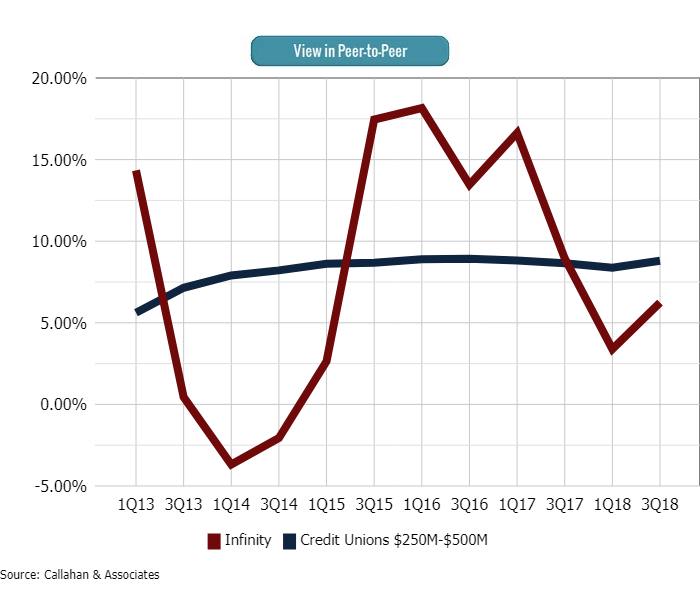

NET INTEREST INCOME / AVERAGE ASSETS

NET INTEREST INCOME / AVERAGE ASSETS

For Credit Unions $250M-$500M | Data as of 09.30.18

As Infinity has worked to provide more loans to members with lower credit, its net interest income has grown indicating how higher product rates affect the balance sheet.

LOAN GROWTH

LOAN GROWTH

For Credit Unions $250M-$500M | Data as of 09.30.18

Infinity’s loan growth was negative for several quarters in 2013 and 2014. Since then, and with its newfound focus on consumer loans and expanded underwriting, loan growth has jumped into the double-digits.

TOTAL NET CHARGE-OFFS

TOTAL NET CHARGE-OFFS

For Credit Unions $250M-$500M | Data as of 09.30.18

Net charge-offs have increased since Infinity has assumed more risk, but the credit union still ranks well below the average of asset-based peers.

TOTAL DELINQUENCY

TOTAL DELINQUENCY

For Credit Unions $250M-$500M | Data as of 09.30.18

Infinity’s delinquency ratio has remained at or below peer performance for the past several years.

$(‘.collapse’).collapse()

Education For Staff And Board

Approving the plan was one thing, making loan decisions in the moment was another.

In the past, we were taught if you could turn down a loan and the member said Thank You,’ then you’ve done a good job, Cloutier says.

That’s no longer the case. Infinity trains lending staff to make complex underwriting decisions and, if they must say no, to work with the member to improve their credit score.

The credit union looked to the University of Lending as one way to train staff on how to make difficult underwriting decisions. Representatives from the program went on-site at the credit union to thoroughly educate staff in how to read a credit report.

Also, CEO Hayes introduced the MOE concept early in her tenure. Standing for Members-Organization-Employee, MOE is a decision-making tool by which all staff can justify decisions. By applying MOE to loan applications, staff are assured they are doing the right thing.

In looking at the credit union’s financials, assuming more risk has benefited the credit union overall. Loan growth, driven by credit cards and autos, has picked up mightily from the -3.7% it reported in the fourth quarter of 2014. And whereas delinquencies and net charge-offs have both increased, the credit union’s performance in these metrics is still lower than its asset-based peer group average.

Still, accepting this new normal is an ongoing challenge, Cloutier says.

When the charge-offs first started coming in, the board was concerned, the chief risk officer says. They were used to charging off $3,000 a month. When that jumped to $20,000, the new reality hit. They weren’t used to that.

Infinity will continue to use its monthly board meeting to assuage concerns that it is taking on an undue amount of risk. The credit union is in a business of taking risk, and the proof of the success of its new philosophy is in the financials. Infinity’s net interest income ratio has grown 53 basis points since the first quarter of 2013. Over the same period, the credit union has added 3,000 members or 17% of its total memberships. These aren’t empty relationships, either. Infinity’s members have, on average, 3.18 products with the credit union, compared with the 2.38 average for credit unions with $250 million to $500 million in assets.

Infinity has more work to do to fulfill its grander plans namely, serve more members than any other credit union in the state but its leaders believe changing its internal risk tolerances was the place to start.

It’s a big transition to say yes when for a while we’ve said no, Cloutier says. And we knew things would change in this process. What’s important is communicating and getting everyone to understand that this is what we planned for.

Need Help Taking The First Steps?

Callahan Associates is here to help. Using industry data, a network of leading executives, and more than 30 years of experience in the credit union industry, Callahan helps leadership teams think differently about framing challenges and developing answers for the new year.