Preferred Credit Union ($154.0M Grand Rapids, MI) knows big data doesn’t always come with a big price tag. That’s why it’s combining old school marketing with existing data resources to help drive card usage to impressive new levels.

For example, in 2014, the 24,000-member credit union began using sophisticated segmenting services from its card processor to identify debit card holders who might boost their usage if they were to receive some type of reward in return, says Rhonda Harrington, vice president of card services.

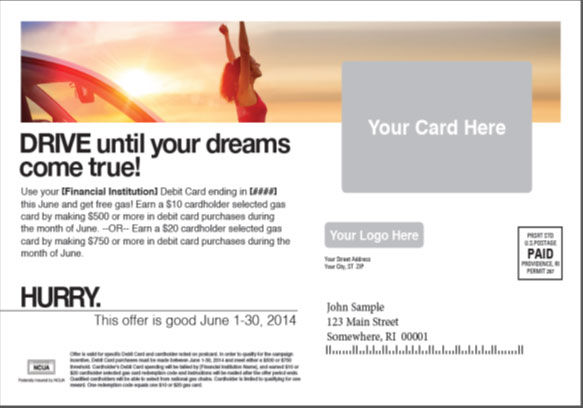

This research resulted in the credit union’s Drive On trial campaign. Drive On gave members either a $10 gas card for making $500 to $750 in debit card purchases in June 2014 or a $20 gas card for making more than $750 in debit card purchases during the same month.

|

|

Sample versions of PCU’s Drive On Mailer.

Although the program kicked off in the summer, PCU identified its target members anyone with a point-of-sale PIN and signature spend of less than $250 two months earlier. From there, the credit union used traditional marketing, such as a direct mail piece, to spread the word.

The outreach worked.

The group’s purchase transactions per card increased from an average of less than six in April to nearly 24 in June. The average spend also increased, from $136 to $1,002 during the same timeframe. More than 11% of the targeted members qualified for a reward.

The effect also proved sticky, Harrington says, with a 122% average spend sustained through the entire summer. Even those members who didn’t qualify for the reward used their cards more, with the overall spend up 61%.

Drive On also supplemented share draft penetration, which was 53.58% in fourth quarter 2014 compared with 48.49% among comparable credit unions with $100 million to $250 million in assets.

Calling In The Reinforcements

Harrington says her three-person team could have done much of this big data work on their own, but they also had other priorities to manage.

CU QUICK FACTS

PREFERREDCredit Union

data as of 12.31.14

- HQ: Grand Rapids, MI

- ASSETS: $154M

- MEMBERS: 23,930

- BRANCHES: 6

- 12-MO SHARE GROWTH: 1.46%

- 12-MO LOAN GROWTH: 4.3%

- ROA: 0.89%

- Credit Card Processor: Vantiv

- Credit Card Processor (3rd Party Managed): FIS

- Debit Card Signature Processor: CO-OP

- Debit Card PIN Processor: CO-OP

PCU had created its card services department in mid-2013 after merging with the $96 million Grand Valley Co-op Credit Union and $52 million Preferred Credit Union and was still developing that operation at the time of these data-driven experiments.

It wasn’t a matter of the credit union’s ability to access the information or resources we needed or used, Harrington explains of the choice to tap a third party for some of these efforts. We just viewed it as an opportunity to begin the process of marketing to our cardholders sooner than later.

By turning to its cards processor, CO-OP, and the Revelation service, which uses Saylent’s data analytics software to create target offers and related marketing materials, PCU could get our foot in the door quickly, Harrington says.

Success In All Seasons

After its initial success in June, PCU and its partners launched two more campaigns throughout 2014.

Last August’s Dinner and a Movie campaign rewarded members who made one to seven transactions a month with a $10 gift card for dinner if they bumped that monthly activity to 15 through 25 transactions. If they exceeded 25, the credit union also threw in a $10 movie voucher.

The second promotion, Season of Gifting, offered those who spent $250 or less on their debit card in August a $20 gift card if they increased that spend to $600 or more in November.

In both cases, more than 12% of targeted members qualified for the rewards. Dinner and a Movie members increased their dollar spend by 477%, whereas Season of Gifting members increased dollar spend by 789%, Harrington says.

This was a steppingstone for us. We’ll learn from these campaigns and move forward within our department.

In total, each of the two campaigns cost approximately $7,000 but brought in about $21,000 respectively, giving them an ROI of about 200% after one year.

The members that have received these marketing pieces continue to use their plastic, Harrington says. In fact, we’ve seen a steady increase since the first campaign in actual settlement of interchange.

Harrington says her credit union plans to continue with these campaigns this year, especially given their turnkey nature. So far, PCU has only had to scrub the mailing lists and approve the final product while leaving the rest of the work to CO-OP.

PCU is also considering extending the strategy to credit cards and incenting local merchants who participate.

This was a steppingstone for us, Harrington says. We’ll learn from these campaigns and move forward within our department.