As winter digs in along the shores of Lake Michigan, Shoreline Credit Union ($127.8M, Manitowoc, WI) is bracing for a financial season of transformation, one driven by changing rates and shifting member behaviors.

Indeed, members who paid little attention a few years ago are now looking to lock in rates and secure their financial future.

“We’re seeing members lock in longer-term certificates more than ever,” says Nathan Grossenbach, who has served as president and CEO of the cooperative since 2017. “This reflects growing confidence that rates will decline. Members don’t want to miss out on what they see as favorable terms.”

This shift coincides with broader economic trends. The Federal Reserve began cutting rates in 2024, including a 25-basis-point cut on Dec. 18. Forecasts indicate a drop of another percentage point or so to 3.3% by late 2025. Meanwhile, TruStage forecasts 6% growth in credit union deposits and loans in that period.

A Delicate Balance

Grossenbach emphasizes the delicate balance required to manage growth in such a dynamic environment. He says his team is focusing on the stability of the rate market, where loan rates have fallen faster than deposit rates.

“Auto loan rates have dropped 200 basis points in the past six weeks in our market compared to a 50 to 100 basis-point decrease in certificate specials,” Grossenbach says. “We expect this to stabilize to a spread of somewhere between 100 and 150 basis points, excluding any promotional rates.

In Shoreline’s market, some small credit unions are challenging the yield curve. According to Grossenbach, one local credit union recently ran a 3.99% special on auto loans and a 4.99%, nine-month certificate special.

CU QUICK FACTS

SHORELINE CREDIT UNION

HQ: Manitowoc, WI

ASSETS: $127.8M

MEMBERS: 7,687

BRANCHES: 3

EMPLOYEES: 35

NET WORTH: 8.4%

ROA: 0.63%

Grossenbach says more sophisticated credit unions can manage such spreads, but there is concern about larger institutions leveraging loss leaders to gain market share. That’s not the approach at his shop.

“We’ve typically stayed pretty true to analyzing cost of funds from an alternative pricing strategy,” Grossenbach says. “We want to remain competitive but also are open to leveraging debt if it makes more fiscal sense.”

That includes pricing in roughly 25 basis points of premium over the cost of comparable debt to raise interest in and for certificates. Grossenbach says the credit union views non-member deposits as emergency cash due to the premium required to issue them. But significant swings in the yield curve might impact that deposit strategy as well, prompting changes in the funding mix.

Ultimately, though, Grossenbach says the challenge is in maintaining a competitive edge without compromising financial sustainability.

Member-first strategies come to the forefront in a changing rate environment. Learn more in “How 5 Credit Unions Are Approaching Deposits In 2025.”

Better Deposit Strategies

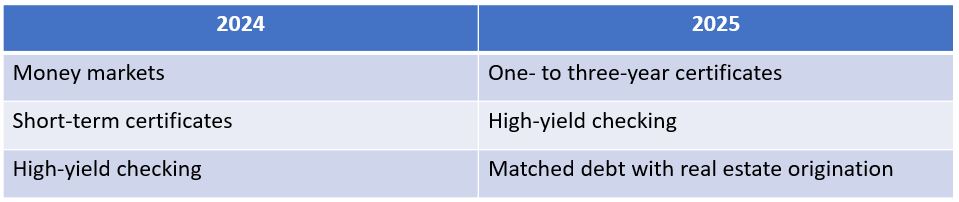

Shoreline is taking other steps to align deposit strategies with evolving member needs. Although money markets were the go-to option earlier in 2024, its focus has shifted to term deposits as members look to hedge against future rate decreases.

“We’re not yet pushing four- or five-year certificates,” Grossenbach says. “We’re actively promoting those one- to three-year options that match our members’ expectations and needs.”

Those certificates accounted for 22% of new issuances at the credit union at the end of 2024, he notes, a sharp rise from just 3% earlier in the year.

Grossenbach adds that he and Shoreline’s management team expect rates to fall by 50 to 100 basis points during the next few years, giving them ample time to wait before promoting longer-term certificates.

As for the other side of the balance sheet, Shoreline plans a sale-leaseback in January that will infuse 33% growth of capital.

“From that, we’ll be able to originate an extra $24 million of real estate loans, which is approximately 20% of our total assets,” Grossenbach says. “We intend to grow substantially in 2025-2026 through real estate originations and will do so on the back of debt and aggressive deposit growth. Underpinning that strategy is the need to manage the growth to a 1.50% spread to hit our targets, so that is highly influencing our deposit/funding strategy.”

Unlock Smarter Deposit Strategies With Peer Suite. Compare your credit union’s deposits and savings performance against industry peers to uncover trends, identify opportunities, and elevate your strategy. Peer Suite gives you the data-driven insights you need to stay ahead. Request a performance analysis session today.