Former President Harry S Truman is famous for, among other things, keeping a sign on his desk that read The Buck Stops Here. A similar notion prevails at Langley Federal Credit Union($1.9B,Newport News, VA), where all employees regardless of rank, department, or degree own and share the institution’s wins and losses.

But this culture didn’t evolve overnight. As a multi-occupation, SEG-based credit union with more than 400 employees, a full-service contact center, and a branch footprint that will soon stretch from Williamsburg to Virginia Beach, this mega operationhas had its struggles with departmental silos, narrow priorities, and differing approaches to success.

Randy Saltzman, vice president of marketing, Langley Federal Credit Union

That all changed two years ago, when a new strategic plan and success sharing bonus program were adopted. These approaches helped to focus efforts across the organization, caused increased collaboration between all departments (especially marketing andthe front-line staff), andset off a new wave of best practices that continue to break down institutional barriers one block at a time.

Recognizing Your Limitations

Growing pains are to be expected in any thriving institution, particularly one that doubles its asset size in less than a 10-year period, as Langley nearly did from 2004 to 2014, according to Peer-to-Peer analytics from Callahan & Associates.

Changes in size and scope prompted the credit union’s branch and call center team to transition from a transaction model to a sales and service model driven by individual and location-level goals such as members acquired and products sold, saysDeb Vollmer,senior vice president of branch services. At the same time, growth in remote interactions required Langley’s marketing unit to undertake its own transition, with leadersrefining and rewriting job descriptions and creating new roles, such as an in-house graphic and web designer.

Deb Vollmer, senior vice president of branch services, Langley Federal Credit Union

Our marketing department learned early on that it needed to focus on specialization, play to people’s individual strengths, and create ownership of blind spots, such as social media, says Randy Saltzman, Langley’s vice presidentof marketing, who joined the credit union in 2012.

Those branch and call center departmental benchmarks remain important today, particularly for weighing the value of specific branches and regions within the credit union’s footprint, as do the marketing department’s efforts to specialize andcover gaps. However, when both departments focused solely on their own definitions of success, they lacked the full understanding of how sub-tasks and ripple effects to and from other departments influenced their fate as well as the fate of the largercredit union. Without that broader context, no investment was going to provide optimal returns.

We’d been making some important investments in the future, but we also came to realize we weren’t going to reach our full potential by tackling big issues one department at a time,Saltzman says.

Sharing The Burden Through Communication

Given their frequent and critical contact with nearly every facet of the organization, the marketing department and the front line become two points of focus for collaboration.

A marketing department tends to have the most visible ways to affect members and identify options to save them money, Saltzman says. But that also means it’s up to us to share that information with front-line staff and otherdepartments.

To facilitate these efforts, Langley created an in-house CRM tool called iSELL that pushes key marketing information to the terminals of every member-facing employee.

Staff can see when and what campaigns and outreach have been sent to a member,Vollmer says.Because members typically have a much higher response rate to products that the marketing team has communicated about with them previously,this system helps staff focus on product sales with a greater likelihood of success.

As of first quarter 2014, loans are up 34.5% annually at Langley, and the average member relationship is up 1.22% over the same timeframe. By comparison, the member relationship at credit unions of a similar asset size dropped 1.1%.

Langley’s results are partly due to its enhanced relationship management resources, but success isn’t all about technological investments. The marketing team is required to physically visit the front line at least once every quarter. Accordingto Saltzman, this allows the team to appraise branch collateral and materials to see what should or shouldn’t be there as well as to engage with the credit union’s roughly 250 front-line employees. Many of these employees have a wealthof business intelligence about the team’s target audience and the effectiveness of the resources previously provided.

There’s always things we could do better, Saltzman says. The front line sees more members in a day than I might in a year, so why wouldn’t we ask them for their feedback?

Fueled by success in these early collaborative efforts, everystaff membernow has the ability to submit ideas directly to the CEO and the executive team via a company intranet feature calledcalled Ask The Senior Team.Thecredit union then publically shares the answers to all questions and suggestions.

These cross-organization conversations have produced results such as a soon-to-be-opened branch with a design that funnels visiting members through a staffed and message-laden retail sales area before they reach the teller line. A video display that branchescan easily update and tailor to their strengths or opportunities is another result of cross-organization collaboration.

Want More?

Read firsthand insights from Deb Vollmer in the column On Leadership.

Growing Up Together

As an organization, we previously defined success in terms of our ROA and member satisfaction rating, Vollmer says. But over the past two years we have transitioned away from that in favor of a success-sharing program.

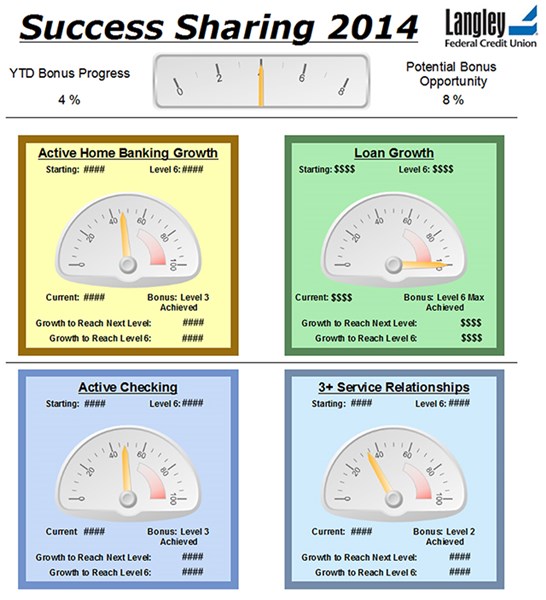

This four-part calculation involves certain percentage thresholds for active home banking use, loan growth, and checking activity factors that indicate likely primary financial institution status as well as the number of members usingthree or more products and services.

All employees work toward these same four goals, Vollmer says. Every department thinks about and communicates what it needs from the others to help get us there.

And depending on the progress made toward goals in each of the four quadrants, Langley employees can receive up to 8% of their annual earning as an annual bonus.

That’s almost one extra month’s paycheck, Saltzman says. It has proven an effective rallying cry.

The company intranet, which also includes visual, odometer-style representations of how close the company is to each goal every month, has become not only the primary tool for tracking these benchmarks but also a sounding board for influencing their performance.

Image Courtesy of Langley Federal Credit Union

If there’s an area that’s falling behind, employees will communicate about the issue with other departments and seek out ways to address it, Vollmer says. They’ll also share accolades when they receive great servicefrom one another or celebrate wins together whenever we do something particularly well.