Top-Level Takeaways

-

Desert Financial has invested $5.2 million in its community so far this year.

-

The response has been overwhelmingly positive, with articles and social media garnering attention.

Desert Financial Credit Union ($4.3B, Phoenix, AZ) is investing $7 million in its community in 2018 as part of its Year of Giving initiative.

That’s putting its money where its mission is.

Desert Financial Credit Union is investing $7 million in its community in 2018 as part of its Year of Giving initiative.

To date,the Grand Canyon State credit union has funneled more than $5.2 million toward community sponsorships and donations, cash-back rewards to members, and individual drawings for cash and experiences as well as earmarked nearly $50,000 for educational support.

Where did the year of giving start?

As the team at Desert Financial worked through the cooperatives recent re-brand leaders looked for ways to tie thecelebration into the credit unions already strong community giving program.

We wanted to do something more than advertise,says Cathy Graham, senior vice president and chief marketing officer for Desert Financial Credit Union.

The credit union did invest in ads, including this Super Bowl commercial featuring Alice Cooper, but it is also focusing on its community and celebrating their long-standingrelationship.

We do a lot in our community,Graham says.This year, we’ve incorporated even more ways to benefit members and non-members alike.

4 Ways To Give Back

Four main efforts comprise Desert Financial’s Year of Giving: Exceptional Experiences, Community Connections, Member Giveback, and Pledge to Education.

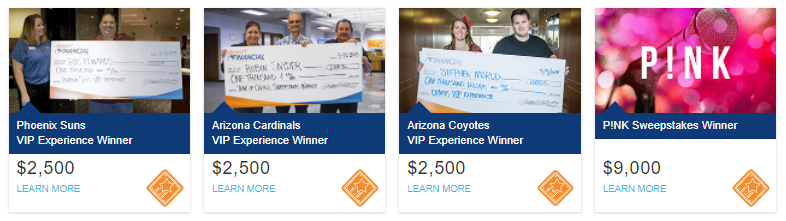

The experience component is helping the credit union underscore its new brand with a bang. From a trip to see the opening night of Hamilton to a catered suite at a Pink concert, the credit union has given away more than $30,000 in exceptional experiences so far this year and that number continues to grow.

To date, Desert Financial has funneled more than $5.2 million toward community sponsorships and donations, cash-back rewards to members, and individual drawings for cash and experiences as well as earmarked nearly $50,000 for educational support.

With its long history of community involvement and member giveback, these two components were relatively easy to budget for, according to Graham.

We had already budgeted to give back $5 million to our members based on their relationships with us,the SVP/CMO says,And we took our history of community giving to charitable organizations into account with the idea that we wanted to do even more.

The fourth category, Pledge to Education, includes a large sponsorship to the Arizona Educational Foundation and a grant to the Anti-Defamation League. However, this category also includes a much simpler way to show teachers that the credit union valuesthem: buying them lunch.

A Tasty Tactic For Consideration

Desert Financial dropped Schools from its name in late 2017, but that doesn’t mean the credit union cares any less about its educators. One of the ways it is demonstrating its continued support of the education community is by sponsoring teacher appreciation lunches at individual schools.

Cathy Graham, SVP/CMO, Desert Financial Credit Union

The response to this has been above and beyond what we expected, Graham says.

And best of all for other credit unions, Graham says appreciation lunches for any SEG or field of membership are something any credit union of any size can replicate in their own communities.

All credit unions give back to their communities, and this can be so simple, Graham says.It can be as easy as bringing in sandwiches to the teachers break room. It is something any credit union of any size can do that has a huge impact.

Teacher appreciation lunches are simple and straightforward because Desert Financial leaves it to branch staff to coordinate with local school principals. The credit union has thousands of schools within its three-county field of membership and buyinglunch for teachers at every one of them is a big goal. Yet that’s just what Desert Financial intendeds to do in the next five years through its network of nearly 50 branches.

Lunches are a way for us to say we appreciate what teachers do every day, Graham says.We started as a credit union for teachers, and this is an easy way to show them a bit of love and support.

53 $1,000 Random Acts Of Kindness

Desert Financial is the largest local financial institution in its market and is plugged into its community. As a community leader, it wants to make it easy for others to make 2018 their year of giving, too.

At an event where it announced its rebrand, Desert Financial gave attendees mostly press and community partners $1,000 to donate to a charity of their choice, no strings attached.

ContentMiddleAd

We kicked off the Year of Giving with 53 $1,000 random acts of kindness,Graham says.People were super excited. A lot of them picked organizations that were in the room, but others had their own charities in mind.

Each attendee filled out a slip of paper with their name and the name of the organization they wanted to support, and the credit union cut and mailed 53 checks.

This was a way to demonstrate that were not just talking, were supporting community and bringing others along with us, Graham says.

No Fake News Here

CU QUICK FACTS

Desert Financial Credit Union

Data as of 12.31.17

HQ:Phoenix,AZ

ASSETS:$4.3B

MEMBERS:320,284

BRANCHES:45

12-MO SHARE GROWTH:6.0%

12-MO LOAN GROWTH:8.4%

ROA: 1.71%

So far, Desert Financial reports a notable uptick in press coverage. In the first quarter alone, more than 100 stories were published about the credit unions re-brand and Year of Giving efforts. Plus, people are sharing the credit union’s story on social media.

We closely monitor sentiment, and what we’ve seen specifically for the Year of Giving is 100% positive, Graham says.Thats incredible. Even if the credit union posts about something positive, typically someone will chimein with an unrelated issue like my check didn’t clear. That hasn’t been the case with the Year of Giving at all.

Marketing played a significant role in Desert Financial’s re-brand, but the Year of Giving is not solely a marketing thing. It involves employees throughout the entire organization and harnesses their excitement about giving back to the community.Graham advises other credit unions to involve vendors and community partners in similar efforts at their own shop.

If you come up with an idea, invite others to come along with you in the name of giving back to the community, the SVP says.You’ll be surprised at the size of the response.