No one involved with credit unions from Congress to the press, from the trade associations to credit unions is satisfied with the current state affairs between credit unions and NCUA. At the center of many of these issues is one continuing theme: the lack of transparency in the agency’s actions.

NCUA’s lack of candor, from its failure to comply with statutory reporting requirements laid out by Congress to its arbitrary supervisory actions, has led to a steady accretion of damaging audit reports and regulatory missteps. The agency’s credibility issue is morphing from a question of trust into one of competence and mis-governance. There is an accelerating erosion of not only credit union but also public and political confidence.

A solution to these concerns, one that would enhance the cooperative system’s reputation, is readily available. Moreover, there are recent, powerful examples that demonstrate how this solution works.

But first, to see the advantages of this solution, we must examine what has happened in North Carolina and how the events there relate to the national concerns with NCUA’s actions?

North Carolina State Charters And NCUA’s Regulatory Imperialism

Last week, NCUA ended its blanket examinations of North Carolina’s state chartered credit unions. The examinations began because NCUA disagreed with the state regulator’s decision to authorize State Employees Credit Union ($23.7B, Raleigh, NC) to publish its state CAMEL rating.

In this case, NCUA followed its own worst instincts and is being disingenuous about its reasons for acting. NCUA’s real concern is not about SECU publishing its 2 rating but about their attempt to impose a different one. In this effort, NCUA is undercutting one of the vital foundations of the cooperative system’s strength, the diversity of judgments fostered by an active dual chartering system.

A review of the correspondence among the North Carolina regulator, NCUA, and SECU shows that NCUA has made numerous misstatements of the facts. But the deeper issue involves NCUA’s use of its examination authority in an arbitrary manner. Like other examination findings, NCUA’s review of SECU contains a number of conjectures that are speculative and contrary to actual experience. NCUA, through its examiners, is trying to impose decisions and considerations of policy that are clearly within the scope of responsibility of SECU’s Board of Directors. Moreover, NCUA’s recommendations would hurt current and future members.

NCUA is attempting to keep its judgments (CAMEL) secret so it will not have to defend its interpretations or respond to other stakeholders points of view. NCUA wants its exam narrative to be the only interpretation. That position is the antithesis of the way the cooperative system is designed and how its resources are collectively governed. Exercising arbitrary authority rarely leads to the best course of action in any economic, political, or regulatory dispute.

Transparency Is At The Heart Of Credit Unions

Democratic governance is the core of the credit union model. Credit unions are financial institutions created by, for, and of the people. They exemplify America’s economic ingenuity and enable citizens to freely manage their own finances.

Transparency is a critical condition for the success of the cooperative model. Members need to know what is happening in their credit union. This need is so vital it has been incorporated into the standard bylaws of every credit union as follows:

Within 20 days after the close of each month, ensure that a financial statement showing the condition of this credit union as of the end of the month, including a summary of delinquent loans is prepared and submitted to the board and post a copy of the statement in a conspicuous place in the office of the credit union where it will remain until replaced by the financial statement of the next succeeding month.

Disclosure is built into the cooperative structure. The fact members have the same access to financial information as the volunteer board is a distinct advantage to credit union membership. Transparency allows member-owners to take informed action based on their knowledge of the state of their organization.

Data almost always has a context, and disclosing data without this supporting information is often insufficient. Interpretations of what the data means is important. Cooperatives benefit from different eyes looking at the information be they the eyes of the members, examiners, the press, analysts, or the community at large. Unlike for-profit, publicly traded companies, credit unions benefit from the multiple perspectives of the many stakeholders affected by their successes and shortcomings. Embracing multiple views of a credit union’s circumstances, along with the ability to take the long view, is a key credit union advantage.

When any responsible party in the cooperative system a state or federal government regulator, a trade association, a CUSO, or a credit union hides behind a veil of secrecy, it puts the entire system’s soundness at risk.

The cooperative, democratic system places a critical responsibility on volunteer directors. To meet their fiduciary responsibilities, they must listen to and evaluate multiple constituencies viewpoints. To rely on one set of narratives whether from regulators, management, consultants, sponsors, or members is to default in their leadership role.

Transparency Reveals Good News, Not Solely Mistakes

The situation in North Carolina is the latest example of NCUA offering an incomplete or opaque explanation for its actions. Its underlying logic often seems to be: We are doing this because we can.

But this lack of transparency creates other difficulties. It suppresses good news and overlooks the significant contributions of the credit union system. Two recent examples of credit union good news that have not been widely published include:

In a December 2011 speech in Las Vegas at the CUES Directors Conference, NCUA Chairman Debbie Matz announced credit union losses to the NCUSIF would amount to less than $50 million in 2011. The speech is not posted. Moreover, the NCUA board in its January meeting stopped its customary practice of releasing the monthly financial statements for all the funds it manages, so there is no way to verify this positive news.

The insurance loss expense as of November 2011 (the last statements released) appears to be a positive reversal of reserves of $287 million year-to-date. However, the balance sheet still shows more than $892 million in the reserve for losses. That reserve is approximately 18 times Matz’s announced total for the 2011 losses. Surely this means there are hundreds of millions of dollars in over-reserved funds to return to credit union members. Shouldn’t this good news be broadcast to all credit unions?

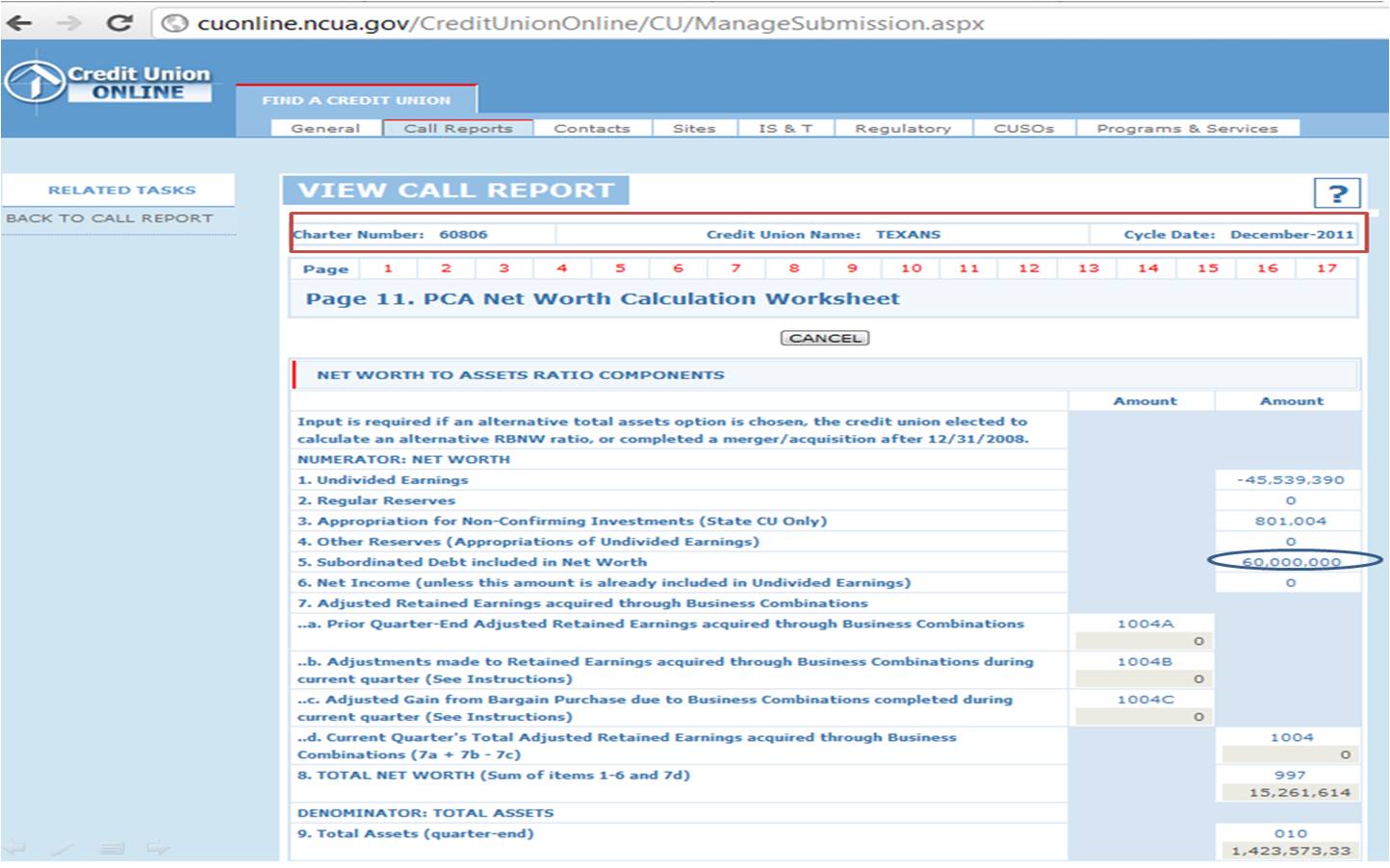

A second example of suppressed good news is the apparent loan of $60 million from the NCUSIF to Texans Credit Union, in conservatorship since April 2011, as shown in the December 5300 filing.

|

| Click image to view larger. |

Why is this good news? Because it shows the agency’s willingness to use the collective capital in the NCUSIF to recapitalize a problem credit union. This action enables the credit union to work through the uncertainties of asset valuations and minimize any potential loss to the credit union system.

This was a standard option in prior years, but NCUA did not use the NCUSIF during the worst part of the recent financial crisis to assist credit unions struggling with externally imposed events. Consequently, the $10 billion in the cooperative system’s collective capital for emergencies has remained idle with the U.S. Department of Treasury. While examiners right-sized credit unions, credit unions were not able to help hundreds of thousands of members and were not able to benefit from their many years of contributions to the system’s collective resources. The loan to Texans Credit Union indicates NCUA has hopefully corrected that policy omission for using the system’s collective capital.

Two Better Ways For NCUA To Respond

Six months ago, a Freedom of Information Act (FOIA) request by Bloomberg News prompted the Federal Reserve to release a list of the emergency loans it made during the peak of the financial crisis. The central banks of numerous countries, large domestic banks, financial firms, and credit unions were all among the borrowers of billions of dollars in Federal Reserve emergency loans. The list shows the scope and critical role the Fed played in both domestic and global financial markets. It provides valuable, albeit after-the-fact, insight on how serious the panic was among the seemingly strongest, best-capitalized, and well-run firms in the world.

Two weeks ago, the Federal Reserve released the transcripts of its 2006 closed-door meetings. The headlines were instant Fed Missed Home Crisis Threat and Little Alarm Shown at Fed at Dawn of Housing Bust and news stories highlighted board members statements. These previously confidential minutes show that even the experts in positions of authority failed to foresee the housing bubble and how it might burst.

In an effort to make its policy intent more transparent, the Federal Reserve recently initiated the practice of releasing a consensus interest rate forecast of 14 of its senior staff. This new openness provides businesses and consumers a clear view of the Fed’s intentions in this case to keep interest rates at their current low level well into 2014 to promote the economic recovery.

Why is the Fed publicizing previously secret activity? To regain Congressional and public confidence as it wields enormous power in directing America’s economy. By publishing previous judgments, even when in error, the Fed enables candid assessment of its actions to better inform future decisions.

Allan Meltzer who is credited with coining the aphorism capitalism without failure is like religion without sin; it doesn’t work describes the change in his book A History of the Federal Reserveas follows: The Fed has moved reluctantly from a tradition of central banking which was, it’s none of your business what we do. This is incompatible with a modern democratic political arrangement and so they’ve slowly been pulled into telling people what they do.

Isn’t this example a better way for NCUA?

Freddie Mac’s Double-Sided Bet On Housing Refinancing

Three years ago Congress and the press publicly castigated several major Wall Street firms for underwriting and selling mortgage securities offerings while, at the same time, taking the opposite positions on their trading desks and betting that such securities would fall in value.

Last week, an NPR-ProPublica Investigation documented Freddie Mac taking trading positions that bet against homeowners refinancing outstanding mortgages, an action that could accelerate prepayments of existing GSE securities. Although Freddie Mac is under government control, this practice illustrates that a governmentally managed agency can act contrary to a critical public policy. How can Freddie Mac, which directly influences the underwriting and pricing factors driving refinancing of loans, be purchasing inverse floaters that are premised on the fact such an effort would fail?

When the story broke, Freddie announced it would stop the practice.

An eternal rule of government is that bureaucracies are loath to correct mistakes, especially when careers are at stake. The best antidote is open records and public discussion. The NCUA board needs multiple views of the system’s choices, just as the volunteer board of a credit union must listen to all the stakeholders.

Today every major bank, every country, and most publicly traded firms rate their financials, their strategies, and their risk assessments, and newspapers around the world report the full analysis. Credit union cooperative owners deserve the same opportunity as any public citizen or company shareholder; in fact, they need such detail to be diligent cooperative member-owners.

The Future Of The Cooperative Charter

Cooperatives were formed to be different from the established financial system. They were created outside the traditional chartering and regulatory framework as it existed in 1934. Their purpose was, and is, to provide an alternative to a system that was not meeting the needs of underserved consumers. Ordinary citizens, not the elite, were given the opportunity and the responsibility of organizing a financial firm with their own funds. Cooperation replaced self-interest, or greed, as the centerpiece in this example of American entrepreneurial enterprise and ingenuity.

The cooperative dual chartering regulatory system that evolved in the 1980s reflects a distinctly cooperative design for collective capital and internally mobilized liquidity. NCUA’s new rules and examination practices increasingly force conformity on a system that was designed to be different.

It is the diversity of the cooperative experience that creates the unique power to meet local circumstances and more responsively serve members. The credit union system’s record from 2009-2011 which was during the worst financial crisis since WWII, a time that brought the largest financial firms to the breaking point dramatically documents this capability.

Credit unions unique success in the 2008-2009 crises is a matter of public record. NCUA’s public reporting of its actions has been late, incomplete, or non-existent. The solution to this growing confidence gap, as in the case of the Federal Reserve, Freddie Mac, and numerous other events affecting public office holders, is to shed light onto events and decisions. Until that occurs, trust will be difficult to regain.