Top-Level Takeaways

- The SECU Foundation focuses on four key areas: education, health care, housing, and human services.

- Members fund the foundation via an opt-in $1 monthly maintenance fee. Membership donations to the foundation surpassed $18.2 million in 2021, and the foundation’s total assets were up to more than $53 million.

The world today bears little resemblance to 2004. Cell phones were only for calls and texting, social media was in its infancy, apps weren’t even on the horizon, and major world events that would shape the decades to come the election of Barack Obama, the Great Recession, the pandemic, and more were still unknown.

But 2004 witnessed the birth of a philanthropic organization that has had a profound impact on the lives of millions: the SECU Foundation from State Employees’ Credit Union ($51.7B, Raleigh, NC). And while the foundation and its impact have grown over the past 18 years, it has remained laser-focused on four key areas: education, health care, housing, and human services.

“Credit unions have historically been the ones that are boots on the ground and making a positive difference in our communities in a big way,” says Leigh Brady, SECU’s chief operating officer. “Our foundation formalizes our philanthropic efforts and our ability to make those big differences.”

Brady should know. Despite the recent retirements of several long-time SECU leaders, Brady has been with the credit union for more than three decades and was on hand for the foundation’s launch and formative years.

Early in the 2000s before the foundation’s inception, SECU frequently received funding requests from different organizations across the state. Although those requests came in fast and furious, recalls Brady, they were often small-dollar requests without a significant impact. The idea behind the foundation, launched under longtime CEO Jim Blaine (now retired), was to find a way for the credit union to make a significant impact in all corners of the state.

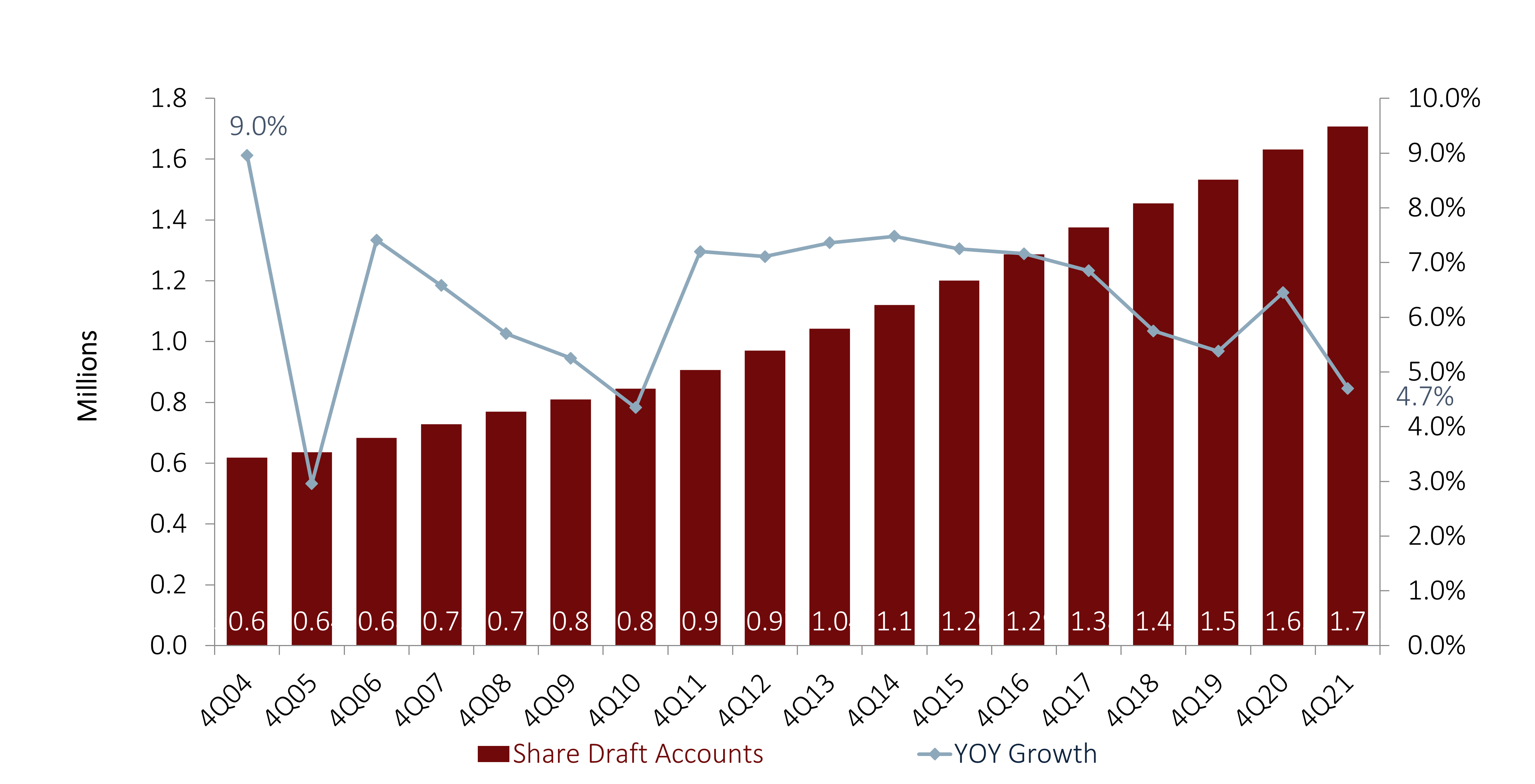

A key component of the foundation’s success was involving members from the outset. The credit union already required a $1 monthly maintenance fee for all checking accounts, but when the foundation launched, members had the opportunity to redirect that dollar toward the foundation. Today roughly 99% of all SECU checking account holders elect to fund the foundation. Membership donations to the foundation surpassed $18.2 million last year, a 5% increase over 2020. The foundation’s total assets were up 2.3% to more than $53 million.

TOTAL SHARE DRAFT ACCOUNTS AND ANNUAL GROWTH

STATE EMPLOYEES’ CREDIT UNION | DATA AS OF 12.31.21

The foundation does work in all 100 North Carolina counties, but some of its most widespread impact comes in the form of scholarships. Thanks in part to member contributions, more than 430 graduating seniors at public high schools in the state each receive a $10,000 scholarship. At the end of the academic year, advisory board members representing local branches present the awards to the recipients.

“Members are our advocates statewide,” says Jamie Applequist, SECU’s executive vice president and chief property officer, who spent more than two decades in the branch network, interacting with branches and advisory boards. “When you get them to participate and award those scholarships, [it’s clear] this is not solely from the foundation. It’s from the membership.”

Many projects the foundation has funded began as ideas generated by advisory board members, who come from a wide array of backgrounds and professions. These volunteers are a vital conduit to nonprofits throughout the state, and because they are connected with local agencies, they can help those groups understand some of the thinking that goes into the foundation’s grant-making decisions.

That kind of local guidance allows the foundation to be more impactful in its giving, says Applequist, since advisory board members in each market are more likely to understand a region’s specific needs than decision-makers further afield.

The advisory board strategy enables SECU to have a broader reach and better understanding of needs outside of North Carolina’s larger metropolitan areas. That’s beneficial because nonprofits in some communities outside of areas like the Triad or the Research Triangle often struggle with fundraising.

“We have members in all 100 counties who are funding the foundation, so it’s imperative that we look for creative ways to support folks in all regions,” says Jama Campbell, the foundation’s executive director.

It’s important to the foundation leaders that it’s doing delicate, maybe more complicated work and providing the same assistance to rural and remote communities.

“The advisory boards give us honest feedback, and there may be times when there might be some red flags,” Applequist says. “The worst thing we could have is a project that’s marred with controversy. I give our foundation staff a ton of credit because I can’t think of a time when there’s been any controversy over any of the projects that have come forward.”

Statewide Impact

The foundation has also raised awareness for the credit union. According to Brady, SECU did little to no marketing prior to the foundation’s launch. That began to change in 2005, with the opening of the first SECU Family House. The facility, located near UNC hospital in Chapel Hill, provides lodging, meals, support services, and more for families with loved ones in the hospital, allowing them to focus on caring for family members rather than worrying about the cost of a hotel when traveling for medical care. The building like its sister facilities is emblazoned with the credit union’s name and logo on the outside wall.

“This kind of replaced the marketing piece and filled that void,” Brady says.

Showcasing its name and charitable works in a high-profile way not only served to attract prospective members, it also established a common point of pride among existing members.

“Our members are able to see the impact in a large way that they themselves are making,” Brady adds.

Although the foundation’s work has always fallen within its four designated focus areas, it has made a greater effort in recent years to ensure funding is going toward projects that have the widest reach.

We’re not going to be funding the local high school’s scoreboard, Brady says. But we are making a huge impact in North Carolina.

Beginning around 2017, the foundation shifted its focus toward more programmatic funding with a direct impact on specific projects. Those efforts kicked into high gear as the pandemic began, when the foundation approved funding requests for everything from personal protective equipment to improving online access for physicians to meet virtually with patients, and more.

Another area the foundation’s board has focused on in recent years is understanding the need for organizational capacity building, and it has developed two different programs with that in mind. In many cases, explains Scott Southern, a vice president, director of grants administration with the foundation, organizations might seek foundation funding but may not be ready for it because of issues with their own sustainability, leadership, or other factors.

To address that, the foundation has worked with regional universities to help nonprofits build capacity so they can not only improve their performance but also prime themselves for eventual funding from the foundation or other sources. Those mission development grants have become a big part of the foundation’s work since they were launched four years ago. In one instance, the foundation provided a $40,000 capacity-building grant to a small nonprofit and paired it with a consultant who could help identify other potential opportunities. Within six months, that organization was able to tap into $8 million in government funds to support its work, Southern says.

“When your $40,000 investment creates an $8 million opportunity, that’s a powerful story to tell,” he says. “It really makes a significant impact for our members to see that.”

Touching More Lives Than Ever

As the foundation approaches its 20th anniversary and explores what additional impact it can make with its statewide reach, management is also looking back at the number of lives that have been changed since its launch.

“Part of the work at the foundation is to continue to engage with partners we’ve worked with to see how our dollars from two years ago or 10 years ago are still making an impact,” Campbell says. “How many folks are they serving? How many lives are they touching? That’s something we continue to look back at how has this organization been able to sustain that impact over time?”

One of the biggest changes has been a shift in how the foundation finds projects to fund. Rather than simply receiving letters of interest, we’re now going out and through the advice of our advisory boards and our board of directors our staff is searching for those most impactful projects. That’s been a major evolution in 20 years, she says.

Not every project the foundation takes on has been a home run, but even those less successful ventures have served as teachable moments. In-depth analysis of applicants’ financials are par for the course, along with ensuring the organization and its projects are operating sustainably. Brady says organizers have become particularly good at spotting red flags in the application process, and, overall, the group takes a more comprehensive approach to its vetting now than it did in the early years.

“This is not in any way a foundation where we’re just saying ‘yes’ and writing it on the back of a napkin,” she quips.

Part of what makes the foundation and its success so remarkable is the buy-in from members and the sense of having skin in the game. That likely wouldn’t be possible without the small monthly fee most members are happy to contribute.

“The $1 monthly maintenance fee is so representative of the cooperative movement because a dollar from you or me doesn’t mean much,” Brady says. “It’s $12 a year, and $12 a year from any one person is not going to fund anything. But when you do it as a cooperative, you can make an impact in a big way.”

This is part of the “Anatomy Of A Credit Union” series, presented every quarter by Callahan & Associates. Read more about the SECU Foundation or dive into a decade of archives. Contact Callahan to learn about gaining access today.