CEFCU ($7.1B, Peoria, IL) found the right person to meld the qualitative and quantitative aspects of running a credit union. Jennifer Flexer has been on the leading edge of internet technologies and even hand-entered HTML code back in the day.

She’s been with CEFCU for 24 years, and today in her role as assistant vice president of marketing and analytics, she leads the credit union’s integration of human understanding with cold, hard numbers.

Here’s how.

Is the assistant vice president of market strategy and analytics a new role at CEFCU?

Jennifer Flexer: Yes, it is a new role. It grew out of marketing and its expanding use of analytics to accomplish that function efficiently and effectively. My role is to advance the maturity of analytics throughout the organization, which has been both exciting and challenging.

Why did CEFCU create that title and role? Did it create the role for you?

JF: My vice president’s predecessor retired just under four years ago, and with that crossroads came an opportunity to consider how CEFCU wanted to expand the marketing, branding, research, and corporate social responsibility functions.

I also had the blessing of working with a longstanding colleague, who is now my VP, who shared my desire to expand our division’s role across the enterprise and within these areas. Her chief officer also saw the possibilities.

Given the expanding use of data within CEFCU’s marketing program, this was a great opportunity to lay the groundwork for an enterprise data program.

I don’t think the challenges of analytics are unique to CEFCU. I think every credit union out there is looking for ways to squeeze value out of data and workflows.

The biggest kick for me is when I see members of my team tackle a problem that would have been a black box just five years ago.

What challenges and opportunities does your new role address?

JF: The biggest challenge I see is what I call magical thinking. There are so many awesome case studies that show the potential for analytics to advance decision-making, member intimacy, operational efficiency, and the member experience. However, it’s critical not to underestimate the extent to which those successes build on, and are driven by, solid data fundamentals: governance, clean data, and clear documentation of workflows, decisions, and more.

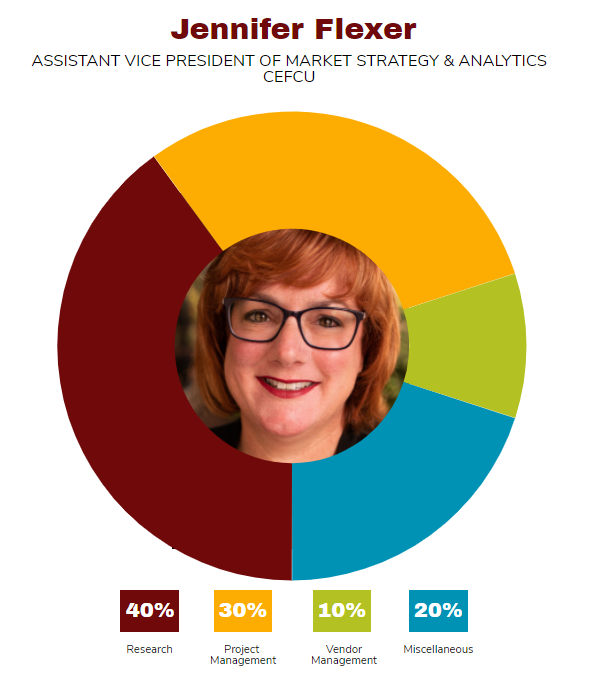

What are your areas of responsibility?

JF: My team is responsible for conducting primary research on members’ and non-members’ opinions, perceptions, and experiences. We use both qualitative and quantitative methods, and we work on in-house and outsourced projects. We conduct analyses and create models using CEFCU data and also third-party data. And, we are responsible for CEFCU’s direct marketing, digital marketing, traditional media, and brand asset maintenance.

CU QUICK FACTS

CEFCU

DATA AS OF 12.31.20

HQ: Peoria, IL

ASSETS: $7.1B

MEMBERS: 356,407

BRANCHES: 29

12-MO SHARE GROWTH: 14.2%

12-MO LOAN GROWTH: 4.5%

ROA: 0.74%

How does your core technology play into your current and future work?

JF: Our core system is one that in-house engineers strategically developed, so we own our data. My team’s challenge, and our opportunity, is to curate this wealth of data to make it a more valuable enterprise asset.

This year, CEFCU will be working to develop and curate a common data store for reporting and analysis, with increased visibility into what is happening day-to-day within our business across its different facets.

Who do you report to and who reports to you?

JF: I report to Jana Stevens, the vice president of marketing. I have two managers who report to me. The product marketing manager handles acquisition and retention offers, including a robust digital and direct marketing program. The research and analytics manager, or RNA, handles primary research and analysis of secondary data.

What makes you a great fit for this job?

JF: My best qualification is that I’m ravenously curious and always want to know why things are the way they are. I have a general education a BA in English as well as a specific education MS in business analytics. These disparate educational experiences have cultivated an appreciation for both the human element and the technical skills it takes to enable analytics.

You’ve been involved in web design and then marketing analytics from the beginning of those solutions’ availability. How have you kept up and how has their advancement helped you do your job more effectively?

JF: Well, I don’t miss hand-coding HTML, that’s for sure. However, I wouldn’t trade that experience because it enabled a deep appreciation for the level of skill that our engineering teams bring to the table.

I also believe that, if necessity is the mother of invention, then impatience may well be its favorite aunt. I always want to find a better, faster way to do things. That systems perspective and design sensibility helps me add value to my job. An elegant solution to a problem goes beyond any particular solution.

What makes the combination of market strategy and analytics so effective and powerful?

JF: It’s a virtuous loop. The things we do work because of the strategy. At the same time, we learn from every project because of the analytics so next time can be better. It’s inherently empowering. The biggest kick for me is when I see members of my team tackle a problem that would have been a black box just five years ago.

What’s your daily routine?

JF: Probably not that interesting! Check emails, attend meetings, read.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How has the COVID-19 pandemic changed strategies and tactics at CEFCU? What has been your role in that response?

JF: Crises bring out who companies truly are, and that was true for CEFCU with COVID. Rather than backing away from messaging during the initial stages of the pandemic, CEFCU chose to refocus.

Our messaging both for staff and consumers emphasized CEFCU’s commitment to being a steady, secure financial partner that members could count on, even during challenging times. CEFCU took steps to connect more closely with staff and to highlight the day-to-day efforts that allowed our business to continue to grow and thrive.

My team helped measure the impact of that messaging through our annual survey. The results showed our brand awareness continued to grow, our Net Promoter Scores increased, and consumers had a positive perception of how CEFCU had handled the pandemic, to date.

With regard to analytics, COVID caused the CEFCU team to ask different questions from what we would have under more normal business circumstances. We were able to take a closer look at things like attrition patterns, which were lower in some cases, dramatically lower.

If necessity is the mother of invention, then impatience may well be its favorite aunt.

How do you track success in your job?

JF: Success, to me, is seeing growth and being able to measure it. In my current role, it’s such a pleasure to see the growth in capabilities and strengths of the managers with whom I work. It’s even better to be able to work with them to tell the stories of those successes using data.

How do you stay current with topics that fall under your role?

JF: The CULytics analytics community for credit unions is one I and other members of my team participate. The Financial Brand and Gonzo Banker offer good perspectives that I value.

My general reading is pretty omnivorous and has ramped up since I finished my degree last summer. Behavioral economics has a lot to offer for marketers, so I’ve read quite a bit of that over the past couple of years. I loved Customer Centricity by Fader, although the customer lifetime value nut is a hard one to crack!

This interview has been edited and condensed.