Washington State Employees Credit Union ($5.1B) turned to a veteran of the Seattle housing network for its newly created position of director of community homeownership development.

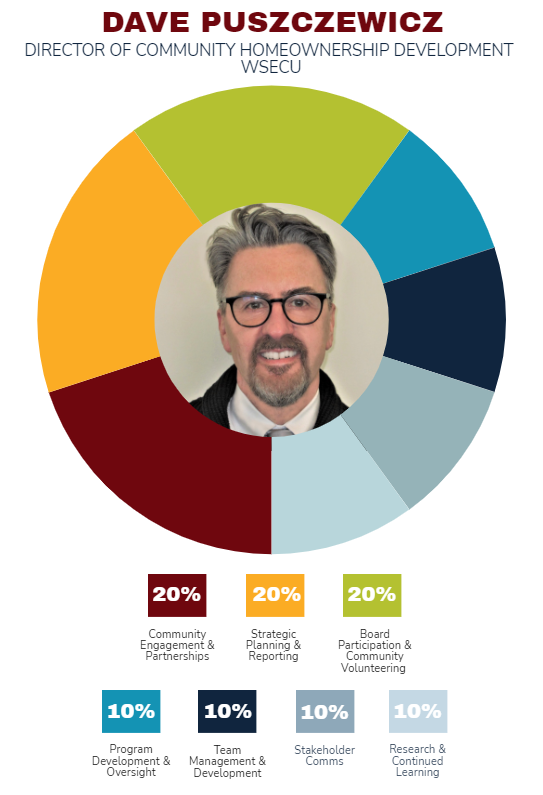

Dave Puszczewicz (pronounced Push-chev-its) had been director of the Homeownership Center Northwest Tacoma for the past three years when he took on his new role at WSECU in January 2022. Prior to that, he spent nearly a decade with the Salvation Army as its director of operations for its three-state Northwest Division.

Now, Puszczewicz oversees initiatives like trauma-informed counseling, partnerships to develop affordable housing, and favorable loan products for target demographics in one of the nation’s more expensive markets.

When and why did WSECU create this role?

Dave Pusczczewicz: In 2021, the WSECU board of directors articulated a desire to create a new homeownership initiative that reflects our commitment to member service, community engagement, and advancing financial inclusion in the diverse communities of Washington State. This role was created knowing that to make meaningful progress, it couldn’t simply be added to an existing job description. It was going to take dedicated resources.

Did WSECU create the role for you, specifically?

DP: No. The role was crafted with clear expectations to strategize, oversee, and implement initiatives that promote affordable homeownership opportunities for, LMI (low-to-moderate income), first-time, and BIPOC (Black, Indigenous, People of Color) homebuyers.

The position was posted broadly, and I was just one of many applicants. My background immediately prior to coming to WSECU was running a housing-focused, non-profit organization. I was new to the credit union world.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

5 Ways WSECU Promotes Homeownership

- Trauma-Informed Homeownership Counseling And Financial Therapy. Counseling programs sensitive to the lived experiences of potential homebuyers with integrated financial “therapy” sessions to address deep-seated financial anxieties, beliefs, and

- Partnerships Focused On Affordable Homeownership: Collaborations with Washington State Housing Finance Commission, Department of Commerce, Department of Financial Institutions, Washington Homeownership Resource Center, and the Black Home Initiative on workshops, access to resources, and community events promoting affordable homeownership.

- Underwriting For Social Justice Development: Two-year pilot program to understand potential methods to reform the underwriting processes and guidelines to eliminate biases and barriers, promoting fairness and equity.

- Grants And Loans: Financial products and assistance programs that offer favorable terms such as lower down payments and reduced interest rates to LMI, first-time, and BIPOC homebuyers.

- Networking: Engaging the community and collecting feedback to understand specific community needs and challenges.

What challenges and opportunities does your role address? How do you plan to address them?

DP: We work collaboratively to create programs and products that support the homeownership needs of our community, especially for those potential homebuyers who have historically been excluded. There’s well-documented data on the differences in homeownership statistics and generational wealth by race and other dimensions. Through community engagement and partnerships, we listen to the community and work to respond with support that directly addresses the challenges or obstacles identified.

How do you work across the enterprise to create and execute on those strategies?

DP: At first, I got in “trouble.” I had transitioned from a nonprofit organization where, as executive director, I wore many hats. I wasn’t accustomed to the level of support and expertise available to support our homeownership initiative. Inadvertently, I started doing everything from running ads for a counselor to designing marketing materials and outlining an aggressive program.

What I quickly learned was that all of WSECU had the commitment and understanding to support the success of the initiative. From the board to senior management, the organization had already clearly articulated throughout WSECU the purpose, intent, and goals for the initiative.

Tremendous talent and experience by seasoned team members have guided and enabled execution from regulatory and compliance navigation to public relations. I don’t have to fight for support or first, prove value. This perspective and strategy have made it easier to move with urgency, focus, and vision to achieve purpose-driven results. And, I didn’t have to do it all by myself.

How do you work with other credit unions and other organizations?

DP: I have found the philosophy “and, not or” to be commonplace. One example is the Evergreen Impact Housing Fund (EIHF), a consortium of Washington credit unions pooling resources to support the development of affordable housing. EIHF is first-of-its-kind financing that closes a critical gap in affordable housing developments and increases the production of housing for working families and promotes health, wellbeing, and equity throughout the state.

What makes you a great fit for the job?

DP: I’ve been fortunate throughout my career to work in a wide variety of service fields and professions. The work has been diverse and, sometimes, seemingly unrelated. Yet, those combined experiences have contributed to a lifetime of personal and professional exploration that offers insight and perspective that has shaped my ability to lead, listen, and continue growing.

I’ve been involved in multiple aspects of supporting affordable housing from Chicago to Karachi to closer to home in Montana, Idaho, and Washington state. Truth be told, not every endeavor has been successful or without painful lessons to be learned. Yet, this has strengthened my resolve and brought perspective to challenges we face regularly.

How did your previous work prepare you for this new role?

DP: I’ve overseen staff ranging in size from six to more than 700. A common thread has been the collaborative development of products, services, and programs focused on making homeownership more accessible to LMI households. My responsibilities included outreach, community collaboration, education, and access, as well as private and public grant awards and oversight from city, county, state, and federal jurisdictions.

CU QUICK FACTS

WSECU

DATA AS OF 06.30.22

HQ: Olympia, WA

ASSETS: $5.1B

MEMBERS: 302,432

BRANCHES: 24

EMPLOYEES: 765

NET WORTH: 9.2%

ROA: 1.60%

I’ve also been involved with expanding affordable workforce housing in the greater Seattle/King County region through providing subordinated loans to multifamily development projects that have received approval through the State of Washington’s bond/tax credit program with housing bonds and 4% Low Income Housing Tax Credit.

My past work also includes direct assistance and case management for low-income individuals and families in need, veteran services, utility assistance for seniors, food banks, homeless and warming/cooling shelters, human trafficking victim services, and emergency disaster work.

Who do you report to at WSECU? Who reports to you?

DP: I report to Julie Lind, our senior vice president and chief lending officer. I have one direct report right now, Tina LaBouve, our homeownership financial counselor.

What’s your daily routine at the credit union?

DP: No two days are alike. Every day is an adventure.

Check out Dave Puszczewicz’s job description at WSECU. Then browse hundreds of other policies, strategy statements, job descriptions, and more in the Callahan Policy Exchange.

How do you track success in your job?

DP: We have multiple methods that allow for data-driven metrics. One example is the Welcome Home grant progress. We’ve identified goals for that and we’re tracking members in the pipeline. Other goals include an increase in LMI borrowers, BIPOC borrowers, and lowering the average borrower age. Counseling appointments are also tracked, as are referrals to a loan officer when the member is ready to progress from workplan to application status.

How do you stay current with topics that fall under your role?

DP: I serve on several housing-related boards and committees and keep up with many other professional associations and organizations. There’s also continuing education, networking, listening to podcasts, and attending government and private sector webinars as well as participation on panels and roundtable industry discussions. There’s no shortage of inspiration and ideas out there.

This interview has been edited and condensed.

Big Problems Require New Thinking

Learn More Today