When Heather McKissick joined University Federal Credit Union ($2.6B, Austin, TX) in 2013 as vice president of human resources, she brought a deep knowledge of not-for-profitleadership and community affairs. For the past five years, she had been CEO of Leadership Austin, a nonprofit dedicated to civic engagement and community leadership. Before taking on the chief executive role, McKissick had been a volunteer there formore than a decade and became an honored community leader in her own right.

When UFCU created a new role to focus on the cooperative’s community impact, McKissick was a natural fit. That role has grown into a senior vice president position with a broad scope and long-term goals geared toward making a positive and significant impact on the communities UFCU serves.

Here, McKissick talks about marrying business with service, developing the perfect skill set for the role, and measuring long-term success.

What is the focus of UFCU’s senior vice president of community impact? What are your responsibilities?

HM: I’m responsible for everything that is external facing but is not direct member service. For example, our retail, lending, and contact center fall under our member experience team.

Community impact focuses on external functions and has four teams that fall under the business unit. They are marketing and communications; relationship management, which others might refer to as business development; financial health; and social impact.

Each one contributes to UFCU’s overall community impact. Whether it’s working with our SEGs in relationship management, designing financial health programs, or building community partnerships, all of that combined is what we consider community impact.

It’s not just working with nonprofits or employee volunteerism it’s all-encompassing.

What goals do you have for this role? How do those goals fit into the larger organization?

HM: In April of last year, the board signed a motion that pivoted us to become a social purpose credit union. Over time, everything we do will be in service to three impact areas intended to lift our members and broader communities. Each area falls under the general umbrella of financial health, but we’re focusing on them to help the communities we serve become more prosperous. They are:

- Education Specifically, encouraging more residents to graduate with a four-year degree.

- Employment This includes both workforce development and job generation.

- Housing Affordability This is an important need in our area.

Eventually, all our operations will be geared toward helping serve the community in these ways and creating financial health through these vehicles.

Another way to look at it is through our four areas of strategic focus on which we regularly report to the board. They include social purpose, financial health, organizational health, and member experience. Community impact comprises two out of four of those strategic focus areas, or 50% of our corporate scorecard, so it is clear how our team’s efforts fit within the larger organization.

What made you the right person for this position?

HM: Prior to joining the credit union, most of my professional experience was working for nonprofit organizations. Most recently, I led a large, local nonprofit that has trained thousands of community leaders. Credit unions are just another flavor of not-for-profit organization, so my experience in those leadership roles qualified me to help UFCU in this capacity.

I love that I have one foot in the business side, considering what we need to be a safe and sound financial institution, and the other foot in my long-standing career path of serving mission-driven organizations. My previous experience in fundraising, for example, gives me insight into how to truly partner with a nonprofit to make a difference. It’s more than writing a check or giving a donation it’s about engaging all the resources the credit union has to benefit our communities. I’m fortunate to have found a role that allows me to bring my business skills and my not-for-profit heart to the job.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

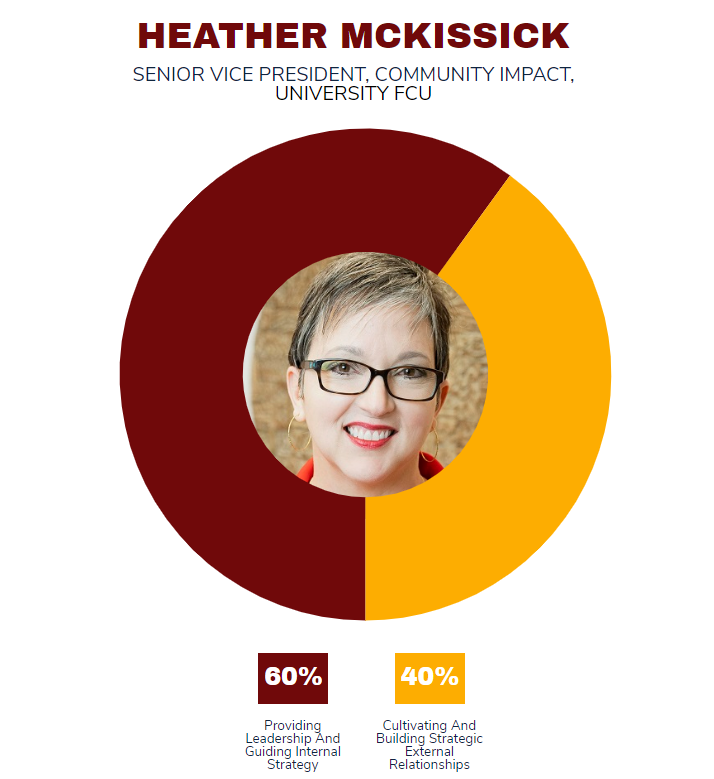

What does your job description look like?

HM: This job is largely based on partnerships both internal and external. I can build external partnerships all day, but I need internal support to ensure those initiatives are successful. Effective internal partnerships create the excitement needed to support external partnerships.

I also make sure we are using the credit union’s strengths to meet the community’s needs, which also requires partnering with the right people internally and externally.

Who do you report to? Who reports to you?

HM:I report to the CEO. I have four direct reports, one for each of the areas I oversee. There are senior managers responsible for the financial health and relationship management teams. Marketing has a director for its much larger team. And, a social impact manager oversees that focus area.

What’s your daily routine?

HM: I spend approximately 50% of my time internally and 50% externally building relationships with community leaders. There are a lot of nonprofits in Austin, and we actively participate in the local chamber of commerce, speaking engagements, and employee volunteer opportunities. It’s a wide variety of things, but it’s all about connecting the credit union to the communities we serve.

We consider the number of scholarships we’ve given, but our real goal is to increase first generation college graduation rates in Texas.

How do you track success in your job?

HM: We have a lot of programmatic metrics that we track around financial health. For example, how many scholarships have we given, how many members have enrolled in our savings habit program, etc.

However, our real community impact is not measured over the short term. We’re going to measure that over a long period of time. Today, we consider the number of scholarships we’ve given, but our real goal is to increase first generation college graduation rates in Texas. We’ll have to wait to see that those scholarship recipients do graduate and evaluate how our participation has helped move the needle in the community overall.

What do you do to stay current with topics that fall under your role?

HM: Beyond keeping up with the latest news, direct engagement and active partnerships with our SEGs and community nonprofits keeps us up to date.

For example, we serve all the universities including our founder University of Texas in our market. One of the first things I did after moving to the community impact role was to interview every president at each of the universities to learn about their strategic priorities and how we could help them. We got a great picture of what was meaningful and looked for common themes to help us set our priorities.

Now that it’s been two years, I’m preparing to go on another listening tour to learn what’s changed. By maintaining direct, professional relationships with leaders and members, we’re able to stay in tune with exactly what they need and understand where we can have the greatest impact.

This article has been edited and condensed.