Jennifer Platt has seen her own role evolve as she’s helped lead the evolution of leading-edge products and services at Suncoast Credit Union ($9.9B, Tampa, FL) in the past several years.

Platt joined Suncoast in September 2011 as a consumer loan development manager specializing in indirect lending. She became vice president of member experience in October 2016 and then vice president of digital transformation in October 2017.

In her new role, Platt has spent the past 18 months helping to integrate strategy and execution between the business and technical sides of the big Florida credit union.

Here, she describes what the vice president for digital transformation does at a credit union with a long record of innovation and collaboration.

Is vice president of digital transformation a new role and title at Suncoast?

Jennifer Platt: The title is new, but our organization has long focused on technological integration and development. In this case, our executive team envisioned consolidating our laser focus on member experience with our technical excellence. We felt the need to be more creative with the role and title, considering business processes would be reimagined.

Also, our CIO, Ted Hassenfelt, has been a leader for continuous improvement in our SDLC (software development life cycle), and recognized the need to combine the business side of our organization with the technical side so we could solve needs in a very innovative way.

That’s essentially the genesis of the title. It was a great way to break down silos and reimagine business processes along the way. Our leadership is empowered to experiment and introduce technology that will allow us to serve our members more effectively. Getting the business engaged throughout the SDLC was one way to solve this challenge.

What are your areas of responsibility and how have they evolved?

JP: When I first assumed the role, I oversaw all internal development, our new robotic process automation (RPA) initiatives, our process design area, and our business analysts. We also support our digital banking support group in the call center.

Being that I was completely green to application development, we quickly recognized that strategy and execution are two different roles. I was able absorb the principles of Agile Scrum, quickly study and learn the value of integrations across systems, and better understand the inner workings of our SDLC.

We were also lucky enough to bring on another VP who took over application development and RPA execution teams, and I have since evolved to be the strategic product owner of our digital ecosystem. We also support our digital banking support group in the call center.

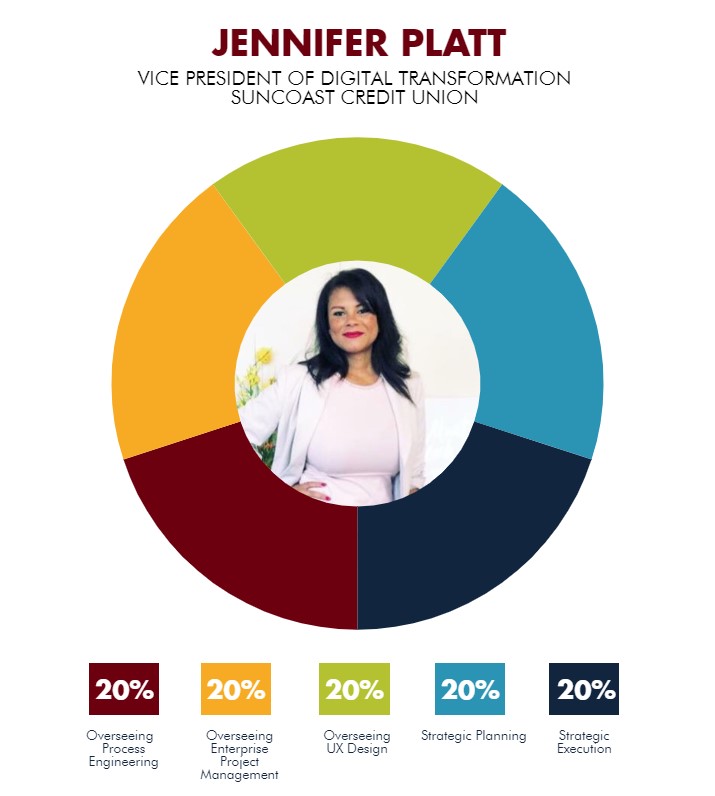

I still oversee our process engineering and business analysis teams, and now also oversee our enterprise project management office and our latest value add ― user experience designer. See, we continue to evolve!

Digital transformation IS NOT digital only. It’s really about people. How can we continue to connect with our members the way they expect so that we can continue to focus on improving their financial lives?

Who do you report to? Who reports to you?

JP: I report to Ted Hassenfelt, our CIO. I have three direct reports: process engineering manager, project management office director, and UX designer

What is digital transformation at Suncoast?

JP: Digital transformation IS NOT digital only. It’s really about people. How can we continue to connect with our members the way they expect so that we can continue to focus on improving their financial lives?

Digital transformation IS the profound renovation of business and organizational activities, processes, competencies, and models to fully leverage the changes and opportunities of a mix of digital technologies and their accelerating impact across society (our member market primarily) in a strategic and prioritized way, with present and future shifts in mind.

We also feel that our internal talent is the conduit of our success. So a cultural evolution is prudent. We will honor our values and the foundation of our 84-plus-year-old company and maintain our focus on serving our members and meeting their needs, and we will also ensure that means that we look forward so that we can continue to be part of our community.

What role do robotics, automation, artificial intelligence, and machine learning play in your strategies?

JP: They enable us to accomplish our strategies. We consider them tools; very important tools. We must leverage a mix of technologies to continue to meet consumer expectation.

When we engaged with RPA (robotics process automation), we quickly recognized how this tool could improve organizational efficiencies that we could better serve our members. Within the first year of our robotics journey, we automated over 25,000 FTE hours. And it has been a snowball effect since.

We also know that security can be a roadblock to convenient and seamless service, and that is the beauty of AI and other authentication technologies like biometrics. We are committed to protecting our members, so exploring and implementing more ways to ensure we are doing that is a primary focus. As an example, we have several strategies on the cusp of implementation that will directly impact the way we interact with members who call us through our Member Care Center.

The use of AI is critical to ensuring our members feel like we know them and value them and avoid bombarding them with out-of-wallet questions or requiring them to recall details that may feel invasive or intrusive. This is where AI will give us a major advantage. We have several strategies to leverage voice biometrics.

We’re partnering with CULedger to explore how blockchain can be an enabler for our improved service with identity verification as our primary use case. When we pick up the call, we’ll be able to know exactly who we’re talking to. That will ease a lot of pressure on our call center reps and enable them to focus on serving our members.

We’re also utilizing automation in our lending department to get our members quicker decisions, improve our processing efforts, and even to optimize the application process.

Data analytics and science sit at the center of our strategies. We definitely take targeted measures to prioritize what will have the greatest impact. We are continuing to evolve this area of our business.

The greatest opportunity for us is the ability to leverage technologies to consolidate the necessary data that will aid in our strategic objectives. We’re using data analytics and science in conjunction with a mix of technologies to be more prescriptive.

As you can see, we’re penetrating various aspects of our business with the use of these enablers. Conversations around organizational strategies start with our executive team having robust discussions on where we can leverage a mix of technologies to redesign our experiences. That is what makes being part of Suncoast so amazing, inspiring, and exciting!

You were previously vice president of member experience. What was that role about and how did it fit into Suncoast’s leading-edge strategies?

JP: One of our executive leaders had a vision to capture and understand how our members interacted with us. She was able to build a program that not only tapped into the mindset of our members, but then allowed for our team members to react and connect, which elevated our member engagement. I was extremely fortunate to be able to step into this role as she took on greater things in the credit union.

During my time in that role, our primary purpose was to support our front line in serving our members in various ways. We facilitated and maintained our member feedback program to obtain a Net Promoter rating and identify friction points perceived by our members and then leverage the process improvement area (which I was overseeing in this role as well) to analyze and make recommendations.

We also spent time in the branches with the reps and worked with them on our service culture. We were invited in by our service centers to work with certain team members or the entire center to reimagine and co-create our service culture. We feel this is an evolving skill at Suncoast, and must continue to focus on this as part of the changes in consumer demand. It was a great way to connect our support business units to our front office representatives.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What made you a great fit for your new role?

JP: I have a bachelor’s degree in applied communication with a focus on organizational development and a minor in women’s studies. I have a master’s degree in management and leadership and a graduate certificate in project management. I’m also CX and Net Promoter certified, have my yellow belt in Lean Six Sigma and my CUDE designation.

I also have experience in Agile Scrum and Kanban and journey mapping. Prior to Suncoast, I worked for a publicly traded company ― KAR Holdings Inc. ― where I was an executive sales director who maintained our relationships with over 150 credit unions, while simultaneously working as a fleet auction representative where I vetted and floor-priced vehicles for resale during auction days. That was the most unique job that I have ever had, but it also shows my growth mindset.

I had a major learning curve coming over to IT. I have had some fantastic mentors in my peers and also our executive team that gave the latitude for me learn. So, I did just that. I absorbed what I could academically and then learned from the experience of others. I ask a lot of questions. I made it my job to know Suncoast!

What’s your daily routine?

JP: This varies. From day to day, I participate in our Scrum ceremonies with our development team to prioritize strategies and align our approach with member and business unit needs as we collaborate with stakeholders.

I also sponsor enterprise projects. That includes analysis and decision-making and staying engaged with the core project teams to remove roadblocks or provide any necessary guidance.

I usually dedicate the first 10 to 15 minutes of the morning reading an article or researching a topic that I am curious to understand the various perspectives on.

How do you track success in your job?

JP: We really focus on contributing to the four strategic pillars of the credit union. They are talent, infrastructure, digital transformation, and member engagement and growth. Each pillar has an annual focus along with a three- to five-year vision.

As an example, our one-year goal for infrastructure is to automate 40,000 hours with intelligent automation. We took that goal and made that a success metric for our area since we have the resources to do this while supporting the other business units that utilize our teams to achieve their goals.

I also track success in our ability to match our vision to the end product. There are so many variables that contribute to the start of an idea to the end product. It’s very important for us to be that link for our stakeholders and business units that request work from us. Realizing the vision leads to greater satisfaction and greater ideas. Downstream impacts are trust in our ability to execute.

What do you do/read/attend/etc. to stay current with topics that fall under your role?

JP: I actually really enjoy reading. Some of the latest books I have read that are relevant to my role are The Phoenix Project (a GREAT book) and The Digital Innovation Playbook. I just started CU 2.0: A Guide for Credit Unions Competing in the Digital Age.

I’ve also read numerous case studies on the transformation of the hotel industry, which also is facing digital disruption from the likes of Airbnb. I consume Harvard Business Review articles on Agile and user experience. We stay connected with community organizations as well as meet up groups to learn about what others are facing.

I also have enjoyed some great collaboration at conferences such as CO-OP’s THINK, Finovate, and Hacking HR, which is about understanding the future of work and where HR can position themselves to support the digital revolution.

This interview has been edited and condensed.